Aimed at traders who are looking at stable profits with low risk, FxStabilizer is an EA that assures regular profits, low drawdowns, and good durability and reliability. Founded in 2015, the robot makes trading easy for novice traders with the automatic trading system it uses. With installation and choice of preferred mode, the work of the trader is done as per the vendor. Is the robot an effective one to consider for your trading? This FxStabilizer review will help you decide whether this is the right choice for you or not.

Is It The Ideal Trading Robot To Choose?

FxStabilizer is offered in two versions namely Pro and Ultimate. While the Pro model is applicable mainly on AUD USD and EUR USD pairs, it also works on 6 other pairs. The main difference is the two main pairs can work in Turbo and Durable mode, while the remaining pairs do not have these options. For the Ultimate version, 6 currency pairs can be traded on with two main pairs being the same as the Pro version. In the Ultimate version, harder drawdown control is used.

Unclear Strategy

According to the vendor, the software is designed to accurately assess the best open trade situation and close the trades with maximum profit. An absolute trading security method is used by the EA to stop losses. Other than this the vendor does not provide any other explanation regarding the strategy used, which raises suspicion about the reliability of the product.

Insufficient Vendor Information

Based on the information provided on the official site, this EA was launched in 2015. There is no further information regarding the vendor, location, and other relevant information that can increase the credibility of the robot. However, we were able to discover that Forex Store is the company behind this EA and that it owns other similar EAs like FxCharger, Forex Spectre, etc.

How To Start Trading With FxStabilizer

Prize package of this EA differs based on the type of EA you purchase. FxStabilizer Pro version costs $739, while the Ultimate model is priced at $539. Only one real license is provided with the pack along with 24/7 support. The leverage used by the EA is 1:200 and the robot uses MT4 and MT5 platforms.

This EA recommends a minimal deposit of $1400. If a trader loses over 40% of the deposited cash during the trading using the recommended settings, the vendor assures a 30-day money-back assurance.

Regarding the working method used by the EA, the two modes are aimed at maximizing profits and ease of use. However, we could not find any other detail regarding the modes and how they can provide stable or high profits they assure. With the expensive price, we would like more details on how it works so a trader can understand the process and assess its suitability.

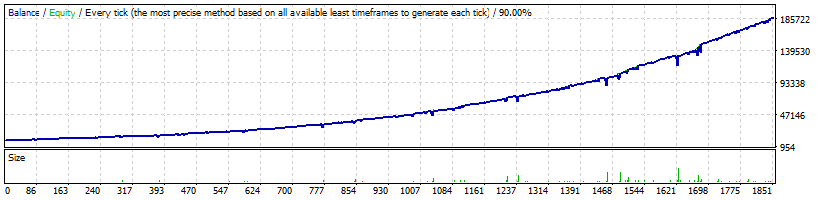

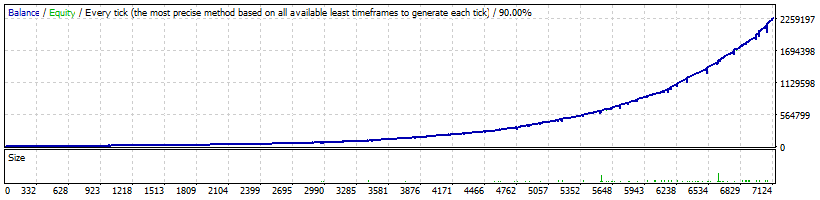

FxStabilizer Backtests

FxStabilizer Durable EURUSD

FxStabilizer Durable AUDUSD

We found several backtests on the official site for different currency pairs and spans. A span of 21 years is the longest backtesting data provided on the AUDUSD pair using durable mode. However, all the backtests were done with 90% modelling quality, which does not give true and reliable results.

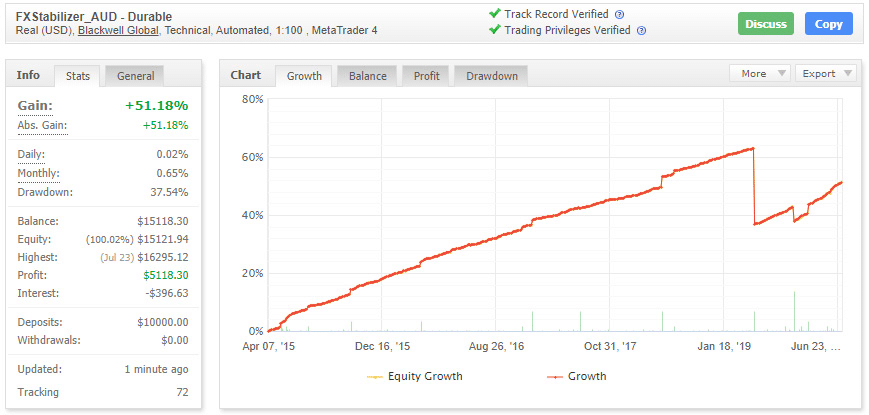

Trading Results

Live trading results of this EA are verified by the MyFxbook site and from the data provided in the site we could see the results are too perfect to be practical. Except for the real account trading in durable mode on USD AUD pair with leverage of 1:100 shown below, which indicates a high drawdown and low profit, all other accounts look too good to be true.

FxStabilizer Unlocked

An additional license is provided by the EA with the Pro version. This license includes a trading system that does not have any restrictions on the currency pairs. As per the vendor information, all parameters for trading can be customized. Since the main objective of using an EA is to make the trading process automatic by setting certain parameters, we could not fathom what is special about the customization the vendor claims.

People Feedback

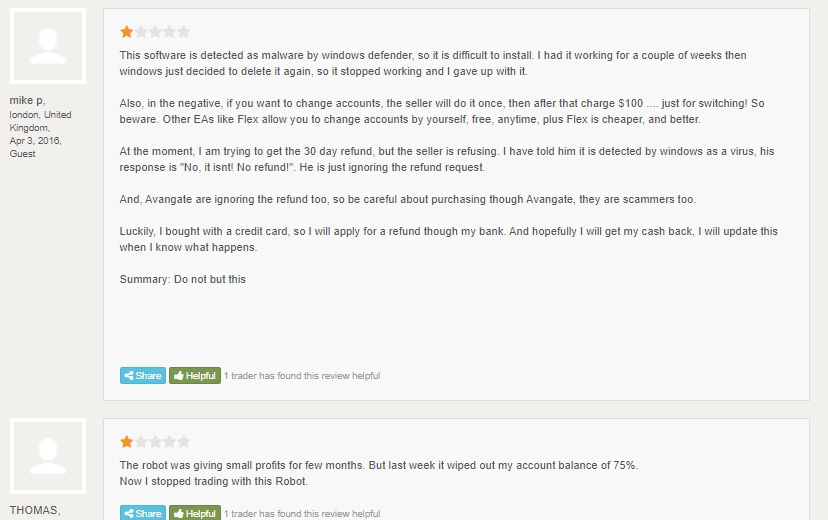

User reviews from the Forex Peace Army site for this EA as found in the above screenshots do not look promising at all. From registering huge losses to not working properly, the EA seems to have several issues to address.

Further, the performance tests show a -3/16% weekly loss for a trading period of 135.3 weeks and a gross loss of 98.698%, which is a big letdown and shows how the real account results are not true proof of the performance of this robot.

Summary

To sum up, this EA gives real account verified results of being profitable but without any clear explanation of how it has achieved the results. And the perfect results make us suspicious about the efficacy and reliability of the Forex robot.

Advantages

- Verified Myfxbook trading accounts

- Plenty of backtests

Disadvantages

- Results and performance test do not match

- Negative user feedback

- Exorbitantly priced

- Unclear strategy

As we come to the end of this review, we could not find any good points to discuss FxStabilizer. Too many drawbacks including low-quality backtests, lack of vendor transparency, unreliable results, and negative user reviews of this Forex robot are reason enough to stay away from this robot. The expensive price tag further caps it all.