You have a decent trading experience behind your shoulders. You already know what you’re doing in terms of your strategy, and you have the right expectations from trading. Most likely, you’re a consistently profitable trader.

If this short description matches you, I must congratulate you at this point. Only a handful of traders get to the point of consistency in trading. So, you’re doing something right! At the core, keep doing what you’re doing.

The issue here is progress. Maybe you feel that you’re not growing as a trader and even losing momentum in your trading career. The clear sign of it is unchanging or even decreasing profits.

Next, let’s look at the three ways that will help you to improve your trading results.

Position size

You know how much to bet to survive in the long-run. Increasing your average position size can drastically change your trading results. The most obvious step would be to increase each bet proportionally. Say if you previously risked 1% per trade, try to risk 1.3%. Doubling your position size right away can affect your mental state and decision making while trading, so I’d suggest increasing the size gradually.

The topic of position sizing is deeper than you probably think. There are different position sizing strategies that, if used properly, can increase your profits more significantly compared to merely increasing an average bet, as we discussed before.

Getting deeper into position sizing

Let’s look at the position sizing techniques that can help you to tailor your strategy to meet your trading objectives better. Notice, though I previously mentioned that positions sizing could increase your profits, that might be not your ultimate objective. Maybe you’re fine with your current profits, but you would rather decrease the volatility of your equity. You might also arrange the risk-taking in a way that is psychologically more comfortable. Below you can find the ideas to help you with that.

Equity models

Here are the three equity models to help you decide how you will calculate the % of your equity. Choose the one that suits your risk tolerance more:

- Total equity – always use % of your initial equity regardless of the current equity (while the positions aren’t closed yet).

- Core equity – based upon cash and the value of your open positions. (consider an allocation gone until you closed it out and use % of the rest of the equity for other trades. In other words, it has nothing to do with the open positions).

- Reduced total equity – based upon your cash equity plus the money you lock in when you move your stops. (a position is considered gone until you move your stops).

Position sizing models

Here are the ways of how you can regulate the size of your position:

- Two-tier position sizing: risking 1% (or other percentages) until one’s equity reaches a certain level and then risking another percentage at the second level.

- Multiple-tier approach: having more than two tiers.

- Market’s money techniques (thousands of variations): risking a certain percentage of one’s starting equity and a different percentage of one’s Profits.

- Using maximum drawdown to determine position sizing: position sizing to make sure that you do not exceed a certain drawdown that would be too dangerous for your account.

Trade management

Usually, when traders feel like they underprofit from their strategy, the first instinct is to make more trades to improve the results possibly. However, it often leads to opposite – overtrading, distorted judgment, and eventually losing the edge. Instead, think about what you already can do with the trades you make. How can you squeeze out more profits from existing trades? Do you need to adjust the protective stop, entries, or your targets?

You probably heard the powerful saying, “Cut your losses short and let your winners run.” If you look closer into every part of this sentence, it’s all about exits! We can conclude then that trade management comes down to exit management.

By now, you should have access to the statistical data of your trading. I hope you’ve been keeping the records of your trades in an organized manner. One of the first things you can improve is tweaking your exits according to the statistics of your trades.

Calculate Maximum Adverse Excursion (MAE) from all your trades or even for a particular kind of setups. It will help you to minimize the distance to your protective stop objectively so that you can cut your average losses or, if you decide to increase your size, gain more profits with unchanged average losses. For example, after extensive research and backtesting I found that the best protective stop for my system is at 10-20% of daily volatility from the entry point.

You can also analyze whether you’re consistently leaving too much money on the table by calculating the Maximum Favorable Excursion (MFE).

Market specialization

The next step is to know the instruments you’re trading at the intimate level. Stay with your core instruments. Don’t add any more. Learn what the features of each are. You will be amazed at how much more powerful your trading edge will become when you adapt your strategy to the behavior of the specific instruments.

What does the instrument do differently from others? Are there any repetitive patterns that pertain to this particular instrument?

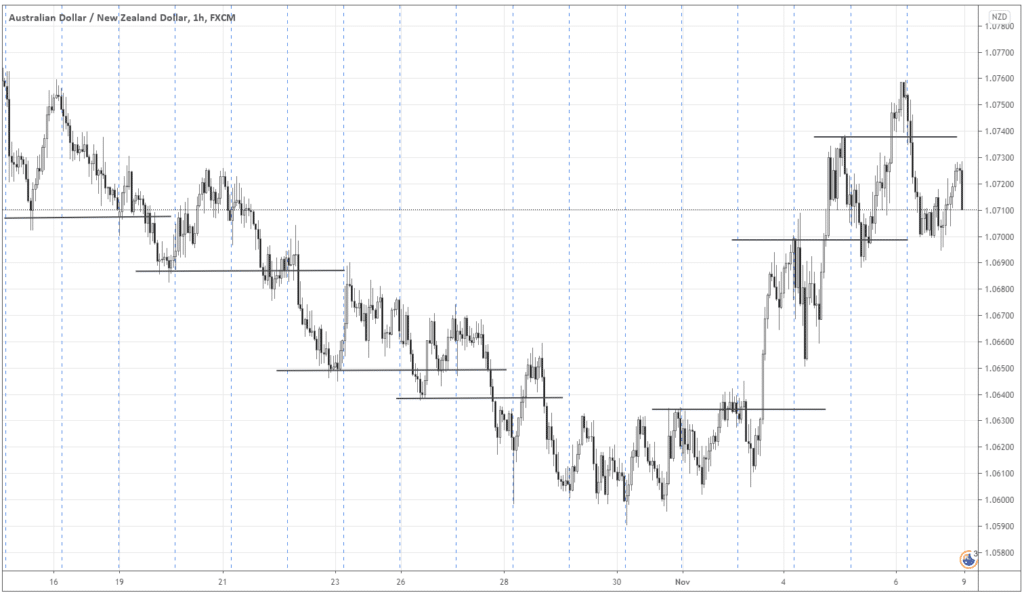

For example, consider AUDNZD, as it usually trends quietly. Every new breakout is short-lived, and the pair has deep pullbacks. It tells us that the best entries would usually be at the pullbacks.

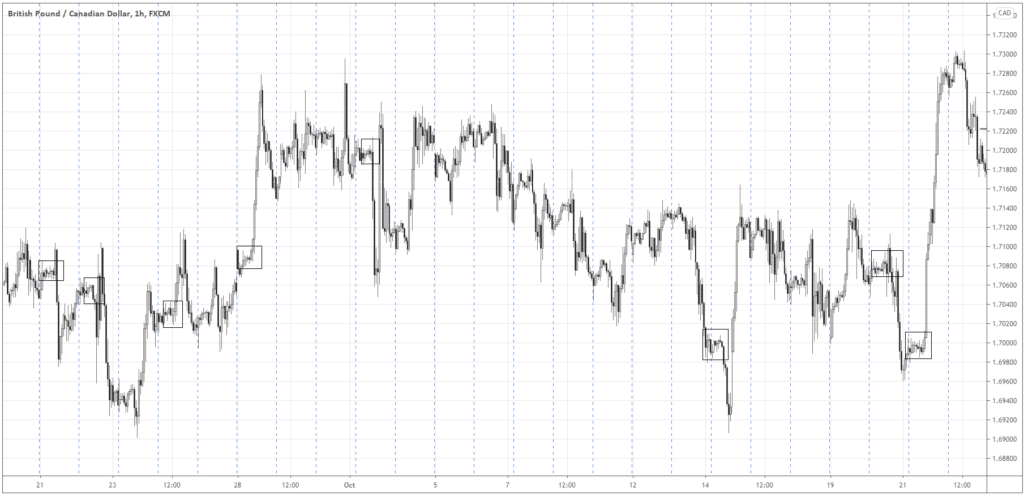

Here is another pair and its feature – GBPCAD. Notice how often there are strong breakouts around 6:00 AM (GMT). Each move makes around 100 pips (marked with rectangles).

Summing up

To start improving again, focus on the quality of your trades, not quantity. Investigate your favorite instruments and get the most out of them

You can experiment with your position sizing models and tweak your exits to exploit your classic setups to the maximum. Knowing your instruments well is another huge step towards efficiency and ultimate trading mastery.