Those in the trading industry’s profitable category may have gone through all the stages of our topic. The market demands a trader to visit all learning levels similar to that of a traditional education system. We can contrast losing with school, breakeven to college, and winning alongside university. Consistency in trading is only at hand if a trader decides to work hard to get good grades or gains. For an investor to achieve the top, he must learn what it means to get his risk, mind, and bad habits under control. He can also choose to work with a mentor who will speed up the overall process.

What does losing mean in trading?

Losing can mean several things when it comes to financial markets. Let us take a look at several prospects:

- Quitting. After losing long, traders will finally decide that trading is not for them and decide to leave—most investors quit within 90 days of beginning their journey.

- No cash. Some traders will give up only when they have nothing left in the system to back up their accounts. They have to give up the markets against their choice forcefully.

- No interest. Not everyone finds trading enjoyable. Those who consider it risky and boring flee to the other safer assets, such as property.

- Noise. There is a lot of unnecessary noise where many novices get confused and often get scammed by fraudsters. Potential hurdles and the inability to find proper information marks them amongst the losers.

Traders who fall in the losing category usually experience small or big drawdowns consistently. There are a few winners here and there, and a few might hit a big jackpot. But to their dismay, it is all lost when they cannot control their emotions and end up risking it all on a few single positions.

Tips on moving from losing to breakeven

You can use the following tips to help you get to the breakeven stage:

- Only risk 0.5 to 1% of the total equity of your portfolio.

- Do not change your trading strategies quite often. Stick to one game plan and follow it for at least two months before concluding.

- To solve your psychology issues, read books like trading in the zone and trading psychology 2.0.

- Choose your trading mentor wisely, as it can make a massive difference between success and loss. Make sure that they answer your related questions.

- Only risk what you are prepared to lose.

- Do not put your money in different financial sectors. Deposit in one and learn it thoroughly before proceeding to the next one.

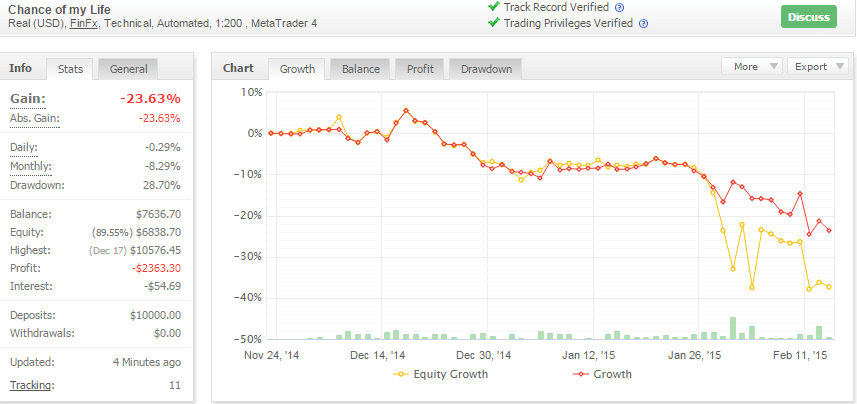

Image 1. Myfxbook record shows the stats of a trader who is losing. He has his drawdown under control and loses a strict amount over a month rather than facing huge upsets.

What does breakeven mean in trading?

Breakeven is the point where the amount of money that a trader makes or loses reaches a standpoint. Let us look at the ongoing processes during this interval:

- Feeling of contentment. No drawdowns on the portfolio may serve as a breather. It will have an overall improvement on an investor’s psychology and boost their results.

- Amateur. Some traders may define this as amateur level trading as there are some hopes of profits, but it is all lost by some bad decisions.

- Future horizon. A trader can see the future horizons as broad. He tries to eliminate his mistakes by aggressive journaling.

The term breakeven is also used when your trade closes at its opening price. We define it as a step in moving to make consistent profits at the winning level for our concern.

Tips on moving from breakeven to winning

- Journal aggressively.

- Do pre and post-market research each day.

- Use expert advisors for managing your positions.

- Re-read the books on trading psychology once again.

- Share out your trades on noted forums and rooms. Having the critique of other top traders is beneficial.

- Determine all your strengths and weaknesses. Plot a chart and remove the demerits one by one.

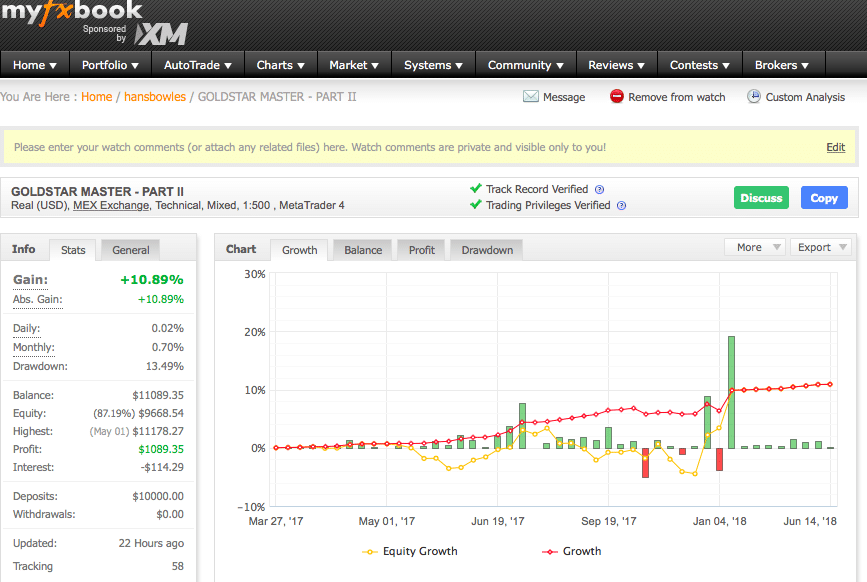

Image 2. A trader breakeven for three consecutive months from dates of March 27 to May 27. He follows all the essential tips to become a professional and finally starts to see some growth afterward.

What does winning mean in trading?

This is where traders make all the money. Almost everyone who begins trading dreams to achieve this point, yet only 10% make it this far. Investors at this level have by far the best qualities of a market participant:

- Discipline. They have the best discipline amongst all traders and follow their written set of rules with a firm belief.

- Patience. At a professional level, traders’ mindset is free of greed, fear, euphoria, sadness, and excitement. These traders take trading as a business and approach it accordingly.

- Hard work. Winners put their everything to prepare for the markets and journal the positions with complete dedication.

- Love. To put it simply, pro traders love what they do by enjoying the overall process of trading.

- Losses. It is impossible not to lose in a game such as trading. Top traders understand the loss is a part of trading, and it is inevitable. They cope with their drawdowns with extreme care.

- Learning process. Professionals are always looking to learn something from their mentors. As they do not have destructive emotions of ego, they keep themselves down to Earth and constantly learn.

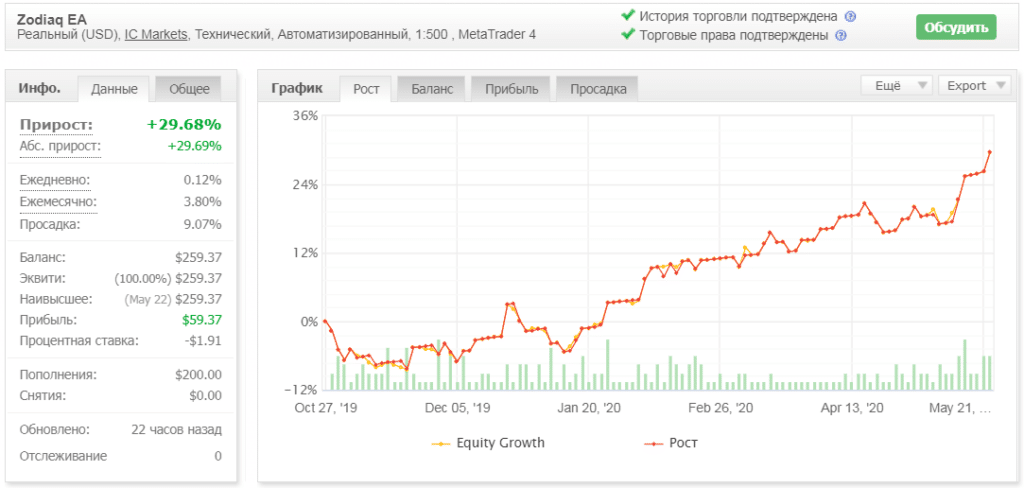

Image 3. A curve of a winning EA.