Volatility is the measure of how frequently the market moves in any direction. When we say that an instrument is volatile, it means the asset’s respective motion is considerable. The volatility of an instrument is created due to hundreds and thousands of buyers/sellers’ combined activity. It’s not consistent and may vary according to the time and day of the week.

Usually, the market starts the week slow, picks its pace up midweek, and then cools off during Fridays. Being aware of active days can help you set the proper pip target for your position as you know when the market will move. Our article will cover each trading day of the week where the volatility plays its best role and consider corresponding assets into play.

Trading on different days

Let’s look at the various volatility patterns on different days of the week.

Monday

For currencies, it’s better to avoid trading during Monday morning as the Japanese and Sydney sessions kick off with extremely low volatility and liquidity.

There are hardly any major events during weekends in forex. As the market is closed, you can’t see the price reaction. There is a particular gap at the opening that ranges from a few to 30 pips, depending on the pair.

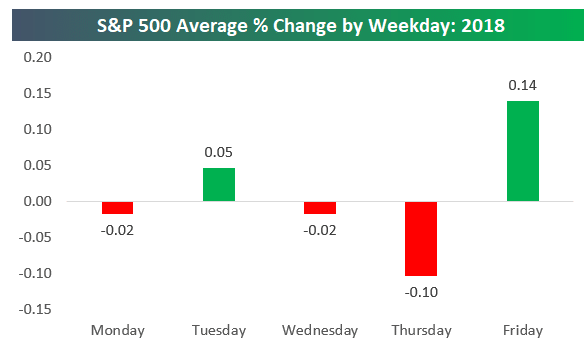

Investors believe that the stock market will generally drop on the first day of the week and refer to it as the Monday effect. The reason for this behavior is claimed to be the negative news which compiles over the weekend. However, the stats show the overall downside is not that bad.

Monday may set the tone for the rest of the week in some cases.

Image 1. The relative change in the S&P 500.

Tuesday

Tuesdays offer one of the best volatility setups in terms of trading days when it comes to forex. By this time, traders usually have a strict opinion on how the market will work out for the rest of the week. They are getting ready to take in their positions and therefore add to price movements.

Stocks follow a much similar approach with the increasing volatility and liquidity as we approach midweek.

Wednesday

Wednesdays are regarded as the second-best option for trading both forex and securities. The majority of institutional traders recommend that you trade during the middle of the week.

Financial institutions release their data into the midweek that drives liquidity, volatility, and momentum.

Thursday

On Thursday, EUR and GBP may depict a difference in volatility due to the European Central Bank and Bank of England’s governing council meetings. For traders, this day can bring a climax as the market tends to trend well.

Some traders argue about volatility between Wednesday and Thursday, regarding the latter as the 2nd best day to trade. In the stocks, the proceedings happen as usual.

Friday

Many interesting things happen on Fridays. Just as humans get tired of consistent work, the market tends to follow the same behavior.

Many investors report the last portion of the week as their significant loss period and refer to it as a stop-loss hunting day. The reason behind this is simple as the majority of participants who have opened their positions during the week close them out, causing the prices to fluctuate back and forth.

You may see a considerable shift in trend as well. If you are looking for opportunities, do so during the initial hours of the day, as a lot of recognizable action happens at this time.

| PAIR | SUNDAY | MONDAY | TUESDAY | WEDNESDAY | THURSDAY | FRIDAY |

| EUR/USD | 69 | 109 | 142 | 136 | 145 | 144 |

| GBP/USD | 73 | 149 | 172 | 152 | 169 | 179 |

| USD/JPY | 41 | 65 | 82 | 91 | 124 | 98 |

| AUD/USD | 58 | 84 | 114 | 99 | 115 | 111 |

| NZD/USD | 28 | 81 | 98 | 87 | 100 | 96 |

| USD/CAD | 43 | 93 | 112 | 106 | 120 | 125 |

| USD/CHF | 55 | 84 | 119 | 107 | 104 | 116 |

| EUR/JPY | 19 | 133 | 178 | 159 | 223 | 192 |

| GBP/JPY | 100 | 169 | 213 | 179 | 270 | 232 |

| EUR/GBP | 35 | 74 | 81 | 79 | 75 | 91 |

| EUR/CHF | 35 | 55 | 55 | 64 | 87 | 76 |

Table 1. You can see the average pip change during each trading day of the week. The significant movement happens on Tuesday, Wednesday, and Thursday.

Fridays are the best for shorting stocks as the incoming weekend may bring some negative news. On Mondays, a trader can then cover all the sell positions that they held over weekends. Buying is relatively risky on Friday evening.

Weekends

You can not trade currencies during the weekend through brokers. Public dealings can take place amongst individuals accourting the last exchange rate on Friday.

It is possible to trade stocks over the Electronic Communication Network even on the weekends. However, the access is mainly limited to big guys.

Other important periods to know

While general information about volatility during certain weekdays can help in making trading decisions, there are some other minor factors that you should know before pressing the button:

- Trading sessions. The market volatility varies during the four sessions making its impact on different pairs. Significant movements are seen during the overlap between London and New York.

- Months. The currency trading sees depreciation in volatility and volume during summers and the end of the year. Investors take vacations on major holidays like Christmas and Easter. In terms of stocks, the market tends to show a negative performance during September. You can go long during this month. The January effect is where investors get in to beat the markets aggressively, buying stocks with a low market cap.