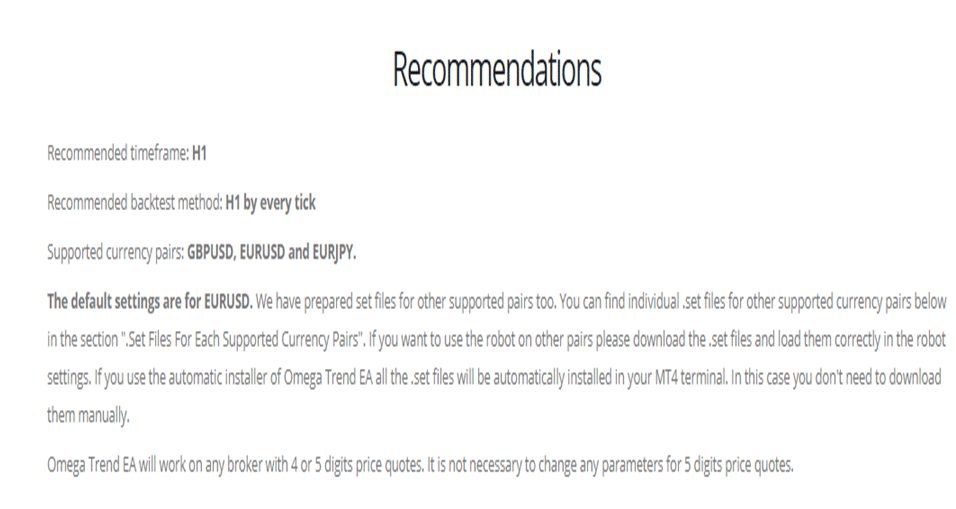

Omega Trend EA promoted by FXAutomater boasts of multiple trading approaches to ensure enhanced performance and high returns. Trend trading is however the main focus as the name of the FX robot implies. The vendor claims to use an advanced trend indicator for following trends effectively and making successful trades. Only three currency pairs can be traded using this MT4 tool namely GBPUSD, EURJPY, and EURUSD.

Is this a good EA to trade?

As one of the products promoted by the FXAutomater group, this FX robot uses three different approaches. One of the strategies used is the trend-spotting approach, which involves identifying all the micro and macro trends that help in boosting profitable trades. Strategy diversity is the second approach which involves the use of two indicators linked to specific strategies. This provides better flexibility which is needed to adapt to changing market conditions. Dynamic trade execution is the third approach used which is independent of volatility. The vendor claims to use the three approaches in a combined manner to counter market volatility.

The vendor does not provide location info and there is no phone contact or live chat feature present. For customer support, an FAQ section and an online contact form are the two options given. This lack of vendor transparency makes us suspect the reliability of the vendor.

How to start trading with Omega Trend EA

You can purchase this FX EA for $97 which is a discounted rate from the earlier price of $147. With the purchase, you have three demo accounts and a single real account for trading. 24/7 support is provided by the vendor and a 60-day money-back guarantee is offered. You also get a user manual for helping with the installation, lifetime free updates, and fully automated trading.

Once you have purchased the EA, you need to download the software which takes just a few minutes after which the setup is done in a couple of minutes. Now you can begin the trading. The vendor recommendations include the H1 timeframe, but there is no mention of the minimum recommended balance to start trading.

Omega Trend EA Backtests

Backtesting results are displayed on the site by the vendor. Here is a screenshot of one of the strategy tester reports done on the GBPUSD pair on the H1 timeframe.

From the above report, we can see that the modeling quality is 90% which is not sufficient enough to know about the slippage, spreads, and commission. We prefer a 99.99% modeling quality. For the above backtest, a total net profit of 21996.38 is presented for an initial deposit of $2000. The total number of trades is 4853 for the backtesting done from 2001 up to 2020. A profit factor value of 1.26 is shown with a maximum drawdown of 11.62%. The lot size used is 0.10.

Trading Results

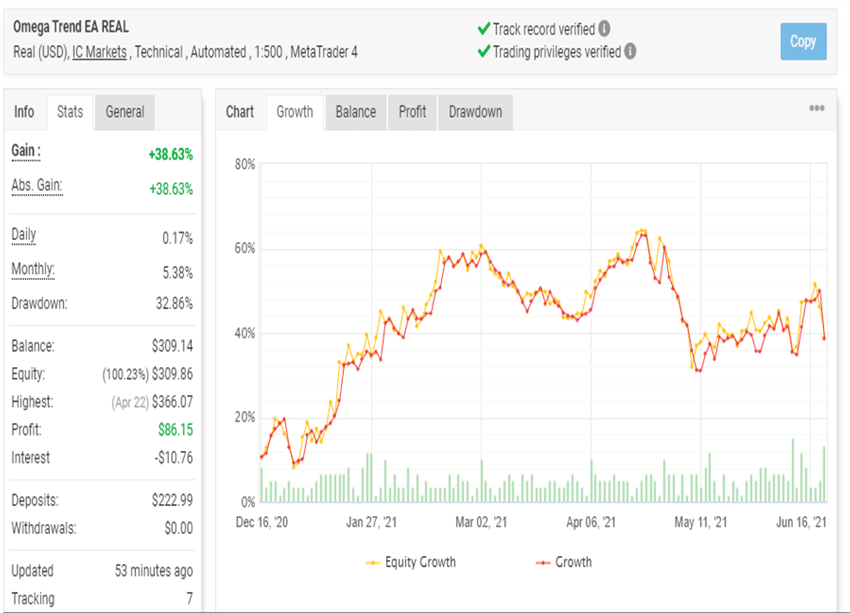

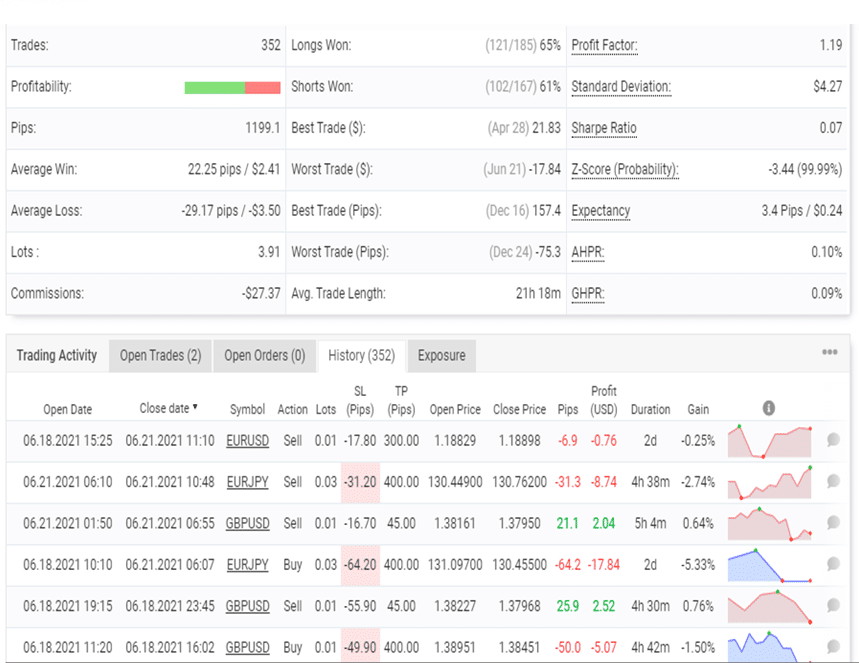

A live real account verified by myfxbook is posted on the official site. Here are a couple of screenshots of the trading stats and history revealed by this account.

The real USD account using IC Markets broker uses the leverage of 1:500. It indicates a total profit of 38.63% and an absolute profit of 38.63%. A drawdown value of 32.86% is shown for deposits of $222.99 and a balance amount of $309. For the trading started in December 2020, up until now, a total of 352 trades have been executed with a profitability of 63% and a profit factor value of 1.19. Lot sizes used range from 0.01 up to 0.03. Compared with the backtests, the drawdown value is higher for the real account and the lot sizes also differ between the two. The high drawdown value and big lot sizes indicate a high-risk approach.

People Feedback

We could not find feedback from users of this FX EA. While the cost appears to be affordable, the lack of reviews on reputed sites like Forexpeacearmy, Trustpilot, etc. indicates this is not a popular expert advisor in the market. Unreliability is another factor behind the lack of feedback.

Summary

Advantages

- Fully automated system

- 60 Day money-back guarantee

Disadvantages

- High drawdown value

- High-risk approach

- Lack of vendor transparency

- No customer reviews

Summary

Omega Trend EA promises profitable trades with its unique combination of trading approaches. However, our analysis exposes the true nature of this FX EA. While the vendor provides verified results, the details indicate the FX robot is not performing effectively. The big lot size and high drawdown are definite signs of a high-risk approach. Further, the lack of vendor transparency and absence of user reviews indicate this is not a system you can rely on.