Have you ever found yourself having a hard time making a trading decision, even though you seem to have everything you need for that? Or maybe when you see your setup, and it’s time to place a trade, something stops you from pulling a trigger? These are the signs of analysis-paralysis or performance anxiety.

Performance anxiety occurs when our thinking about our performance gets in the way of our actual performance. It happens to rookies just as often as to experienced traders, so nobody is safe!

New traders

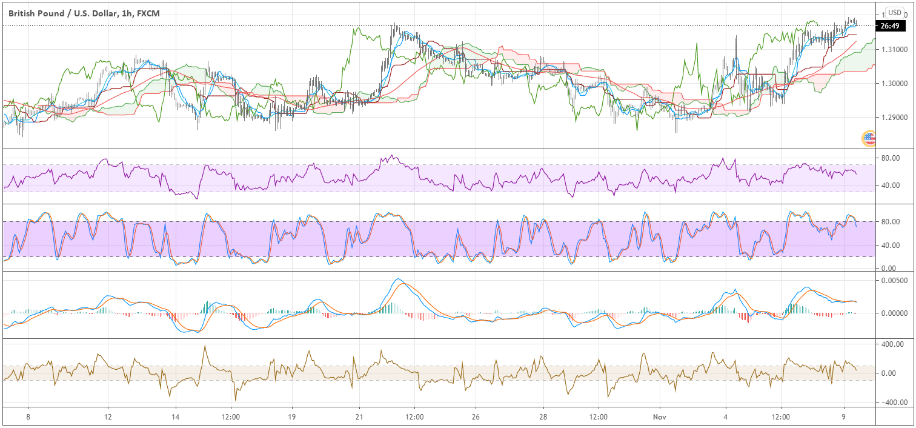

Rookies worry about doing everything, and because of that, they can do nothing correctly. For new traders, for example, the common reason for anxiety is using too many indicators when analyzing the market. Often those indicators contradict each other, making a trader confused about which one to follow.

Look at the screenshot on the left. If it looks anything like your screen, the chances are you may suffer from performance anxiety.

To avoid being overwhelmed by the overflow of information, have a clear strategy with the defined entry and exit rules. Make sure about your risk management rules, so even if you take numerous losses, you will still be able to trade and recover from the drawdown.

Experienced traders

Experienced traders typically worry about their losses and make their losing streaks longer by cherry-picking trades.

Pay close attention to your losing streaks. Think about how you could overcome losing streaks before? There is a great motivation in the thought like “If I could overcome that streak in the past, I can overcome this one too.” The trading journal would come in handy here. Check your notes from the times of your most significant drawdowns. Is there anything common in the kinds of emotions you experienced, the trades you took? Internal peace in trading comes down to knowing what to expect from yourself and the performance of your strategy.

Dealing with losses

Learn from your losing trades. How can I cut the loss faster, so my gains become relatively larger? “Cut the loss” can mean different things: the distance of the protective stop order from the entry, profit-taking tactics, timeout between losing trades, etc.

If you’re actively trading intraday, you must recognize when it’s “your” day and when it’s not. We all know these kinds of days: maybe you’re dizzy, or there is something in the back of your mind, the market acts weirdly, etc. When there is something off about the day, know when to stop risking or, in other words, cut it down fast!

Make sure you can participate in the good days when you’re at your best and cut off those challenging days before they take your money. Whatever the losses, use them as the opportunity to be a better trader, so document your work and keep improving!

Focus on the right things

Most of the traders suffer from performance anxiety simply because they are afraid of losses. The losses are the byproduct of either not managing risk properly or a lack of experience trading that strategy. In either way, what causes the inability to make a good decision is the disrupted focus.

In any performance-based industry, what makes some professionals stand out among similarly skillful rivals is the exceptional winning mindset, which is highly dependent on their ability to focus. What kind of focus are we talking about?

Imagine Lebron James worrying about every shot that he takes. Imagine famous singers trying to guess what the audience is thinking of them while they are singing. It’s impossible to perform at your best if you are not focused on the actual performance, not the result of the performance. Professionals cannot worry about the result, because it can eventually even cost them their jobs! Instead, they must focus on executing their skills correctly.

If you focus on the process, you will get good results. If you focus on the results, you will get bad execution, which leads to poor results.

The time to judge your performance is after a sufficient sample of trades. There is no point in thinking much about the result of every individual trade. Focus on your weekly or monthly performance. The NBA players do analyze their performance with coaches after the game, not after each particular shot or foul during the game!

Final tips

The great performance doesn’t only include skills but also depends on the ability to maintain your focus well and the professional attitude to losses.

Here are some tricks to deal with performance anxiety:

- Use visualizations – Just like professional athletes visualize their best shots before the practices or games, take time to imagine your best setups and how you’ll treat them tactically and emotionally.

- Listen to your body – Know when to take a step back if something feels off about the trading day or you have a strong emotion about a particular trade. Do breathing exercises, calm down, and allow that feeling to pass.

- Focus on the present – Remember to focus on the process of executions, not the results!

- Reduce your position size when you have a losing streak – It will protect your account and help you to regain your confidence to trade better. You won’t be concerned about the losses much as they are smaller than before.

- Use market replay to automate your skillset – There are various market replays available. By replaying history, you’ll prepare yourself for any possible outcomes of your strategy. It will “link” your brain with the market and help you to spend less mental energy on the execution of your system.

- Reframe the situation – You don’t need to be perfect in this business. If you have a trading system with a 55% hit rate, you only have to be right 55 times out of 100! That means it’s perfectly fine to bear losses 45 times!

- Don’t risk money you’re afraid to lose – This is the classic one. It’s tough to have an objective judgment if every loss can cause you a significant change in your lifestyle.