Investing in cryptocurrencies may feel like juggling many balls simultaneously for the above-average investor. There are more than 18 000 cryptocurrencies to trade presently, a number that’s consistently growing.

Tracking the gains and losses of your investments becomes something you have to endure. Most people are invested in several coins simultaneously and find it demanding to manage them one by one across multiple unrelated platforms.

Well, fortunately, a crypto portfolio tracker is the solution to all these burdens, as many investors aim to be well-diversified. Their personal wealth will constantly fluctuate owing to the ever-changing and highly volatile nature of cryptocurrencies.

A portfolio management tool exists to observe this action so you can see what happens, make any changes, improve where necessary, and more. This article will explore the significance of such tools and how to choose them.

What is a crypto portfolio tracker?

A portfolio tracker in cryptocurrency is a web or mobile-based software application allowing investors to manage and track a broad selection of coins on a single dashboard. These may be integrated into a service offering other facilities aside from tracking or could be standalone trackers.

Such tools use external application programming interfaces (APIs) to aggregate data from a range of wallets, blockchains, and exchanges, permitting the user to observe the total value of their holdings across these numerous platforms in real-time.

Some of the data any respectable portfolio tracking application should include historical transactions, overall balance, open orders, live charts, and valuable insights on areas where the investor could improve performance.

Why a tracker in the first place?

When you’re building a crypto portfolio, you’re often buying from different locations. Although you wouldn’t want to micro-manage your investments, you will inevitably need a condensed approach to monitor the performance of your coins.

Imagine buying crypto from five different exchanges and having to log into the account of each one every time to know your overall net worth. Well, a crypto portfolio effortlessly solves this problem, saving you much-needed time.

We should also remember digital currencies are the most volatile financial instruments where prices can sometimes change in a flash. It becomes imperative for investors to make any crucial decisions promptly.

A portfolio tracker allows one to do just that since you get a glimpse of your overall market performance, so you know where to make changes.

Lastly, tracking apps can present your crypto investments more neatly to yourself or a financial advisor-type person (and even for compiling tax reports in some countries) without a complicated Excel spreadsheet.

How to choose the best crypto portfolio tracker

Here are the main factors to consider with a crypto portfolio.

- Security: Safety is of the utmost importance in the somewhat ‘Wild West’ that is cryptocurrencies, with hackers galore eyeing your money. Thus, a top tracker will adhere to the best security practices by employing two-factor authentication and robust data encryption mechanisms.

- Range of supported coins and exchanges: The more exchanges a tracker can connect to, the more convenient, preventing one from using a separate service to compensate for the lack.

Moreover, some applications cover more than crypto and may include other assets like forex, stocks, and even ordinary bank accounts. This may be preferable for some investors.

- Analytics: Here, we’re referring to the features, with emphasis on high data richness and tools offering numerous personalized insights on bettering your portfolio. Moreover, look for trackers with a stripped-down user interface while not compromising on being analytical.

- Integration with other tools: Here, some investors may want to integrate the data derived from the tracker with other tools. For instance, one may desire to create custom reports on Excel or Google Sheets.

Therefore, an excellent tracker should have the broadest integration with third-party software to meet your specific needs.

- Mobile app availability: As expected, most web applications nowadays will have smartphone versions for on-the-go convenience.

- Price: Last but not least is the cost. Most advanced trackers come with a monthly or yearly subscription. Although there are many free ones, they would understandably be limited in features.

Regardless of your choice, you should ensure it meets your affordability needs.

A list of some popular crypto portfolio trackers

Below are a few crypto portfolio trackers you should check out.

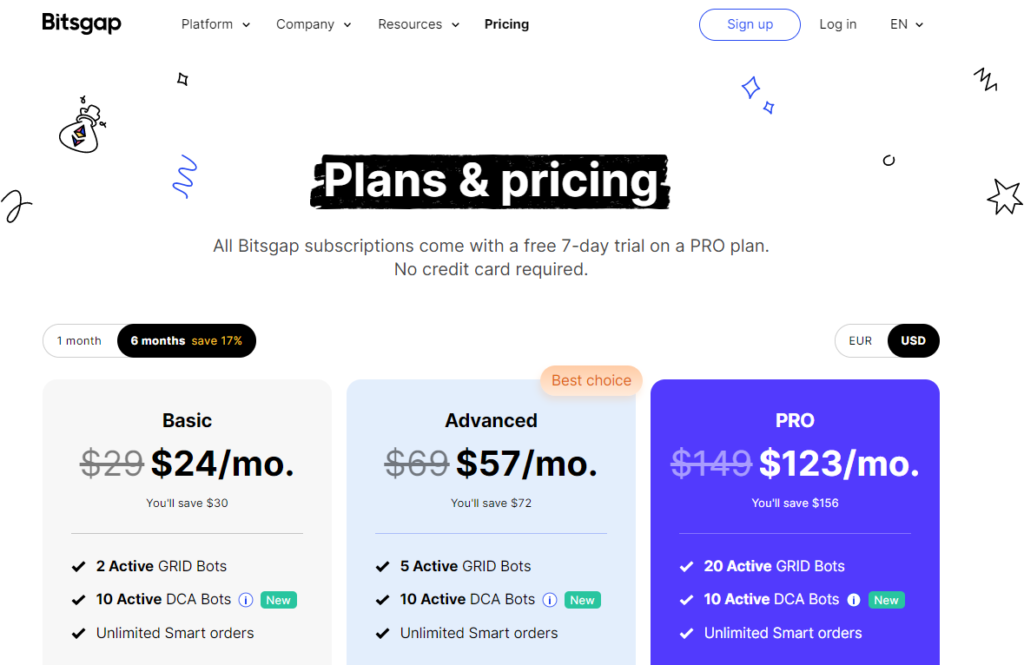

Bitsgap

Bitsgap is an excellent tool for creating and tracking a cryptocurrency portfolio, monitoring past trades and trading results. The user API is straightforward and intuitive. The user interface is designed to make the trading process easier, but its functionality will allow you to give up the exel spreadsheets with complicated formulas forever.

Additionally, you get access to the vast platform that enables everyone, from beginner to profi, to automate their trading process without any knowledge of coding. To start it from scratch, you are given access to a vast and ever growing knowledge base on trading strategies and their automation on the platform.

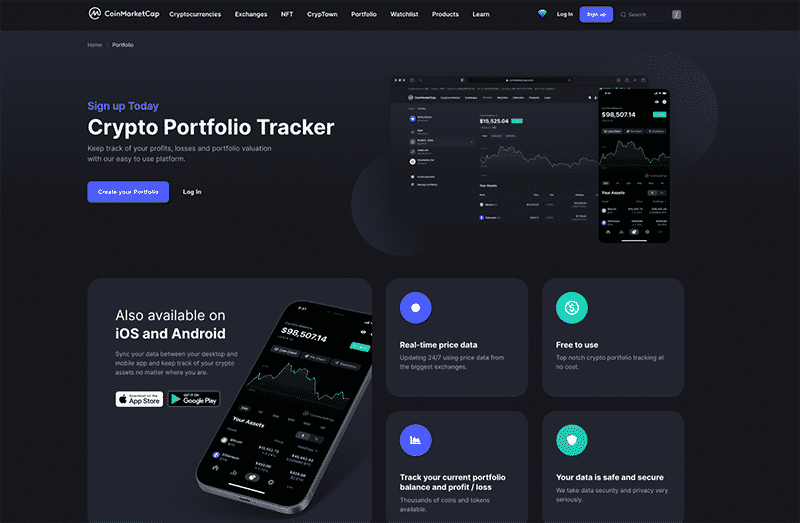

CoinMarketCap

One advantage of this tracker is it doesn’t come at any cost. CoinMarketCap is a very well-known crypto data aggregator established in 2013. Aside from the massive amount of available statistics, you will have cutting-edge charting tools, price notifications, watch list creation, etc.

You can use this tracker on a supported browser or as an Android/iOS mobile app.

Delta

Delta is one of the best multi-asset tracking apps where you can track and manage numerous non-crypto financial securities such as equities, forex, futures, and indices. The tracker is available on the web and mobile platforms.

With Delta, you get a free and paid version (with additional useful features), the latter of which is reasonably affordable compared to other premium management tools. Depending on your country, you can expect to pay about $8 monthly or $50 yearly.

Kubera

Similar to Delta, Kubera is an all-encompassing investment portfolio net worth tracker. Aside from traded financial markets like crypto, forex and stocks, you can manage bank accounts, credit cards, loans, and even the value of vehicles and real estate with Kubera.

Because of this diversity, Kubera will eat a bit more into the pocket, as it costs $150 annually or $15 per month (with a 14-day free trial). You can use the service’s tracker on your web browser and Android/iOS phones.

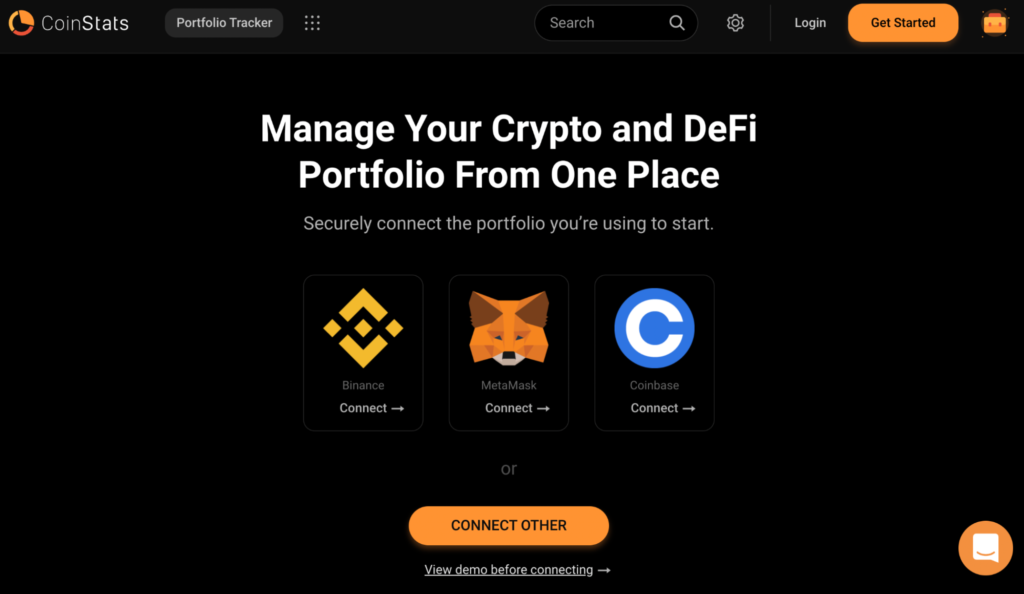

CoinStats

CoinStats is a crypto-only portfolio management service focused on digital currency and DeFi (decentralized finance) assets. The application works on your web browser, desktop, or smartphone.

Furthermore, CoinStats provides an in-built wallet where you can buy and sell different coins as you would with a typical exchange. Plus, you can earn up to 20% in yearly interest through staking.

CoinStats is on the pricier side for their premium plan (a free one does exist, albeit with limited functionality). You can expect to pay either $41.88 yearly (or $4.99 monthly) or $167.88 annually (or $19.99 per month).

Curtain thoughts

Ultimately, what you can track, you can manage (and hopefully manage to grow); this is where a portfolio tracker comes in. The crypto industry has substantially changed in the last few years, with investors having far more investment options than ever before.

Trackers help you not get left behind in the ever-evolving world of digital currencies and stay on top of your investment portfolio.