Are you looking to increase your profits trading in the stock market but feeling overwhelmed with the volume of resources? If you are a novice and want to streamline your analysis in a more efficient manner, you can try setting trading alerts. Trading alerts will help you make quicker trading decisions with more ease. Read further to learn what trading alerts are, how they can help you and how to set them up.

What is a Trading Alert?

As a trader your time will be invested in choosing from thousands of stocks, keeping track of the global news and events, understanding market trends and strategizing to make the best trades. This barrage of information coming at you can be quite overwhelming at first, but there are a variety of tools at your disposal that can ease the process of trading and related analysis. Trading alerts come in as a saviour for any day trader! Setting up alerts can provide an investor with specific alerts for particular changes in the stock market that would eventually lead to a change in share prices. These changes in the market can be influenced by technological developments, changes in the socio-political scenario, reaching a particular price point, etc. Making use of trading alerts can help make you an efficient and a comparatively stress-free trader.

There are a variety of trading alerts that can help you as a trader streamline your strategy in a seamless manner.

Some of them are –

- Technical alerts will inform you when certain technical conditions are met according to your set requirements

- Price alerts will notify you when the market moves by a certain amount in points or a percentage. You can create instant sell or buy alerts on all types of markets.

- Economic alerts will notify you about current or upcoming economic events, including central bank announcements. You can set up alerts on the basis of moving average convergence divergence (MACD), Relative Strength Index (RSI), Exponential Moving Average (EMA), etc.

- News Alerts help you by sifting through the current news and providing you with only the updates relevant to make your trades.

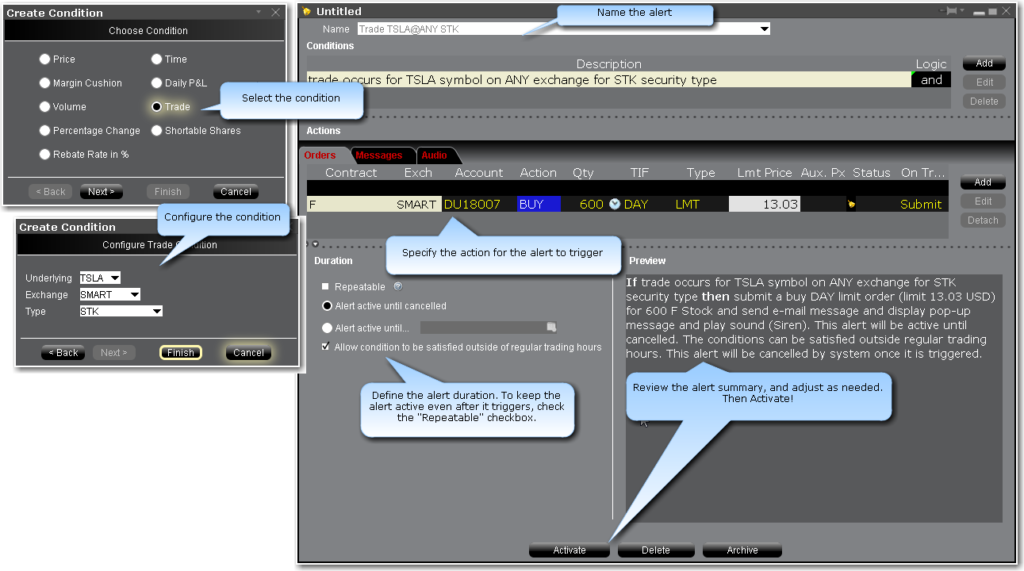

Trading alerts come as a basic component of most brokerage firms and trading applications. The Trade Alerts window in your portfolio consists of two sections. The first one is where the conditions are set up for the alerts to go off and the second one is where the actions are set up. Under the actions section, you can set up the actions to take place when the alerts are activated.

To set up trade alerts, follow the steps below –

- Right-click any one of the instruments from your portfolio and then click on the “Alert” icon.

- Click on “Advanced Settings” in the Configure Price Section.

- Start setting up the alert conditions by selecting the ‘Trade in the Choose Condition’ section of the Create Condition box and then click ‘next’.

- You can modify the underlying, exchange and type values.

- Now click on the Finish button. You should be able to see the alerts in the Preview box.

Allow the alert to remain active even after it has triggered by selecting the “Repeatable” box.

How Can Alerts Help you?

As discussed before, setting alerts can help you streamline your

- Reducing the noise: Trading alert software minimizes market noise. This is very useful, especially for beginners who can feel overwhelmed with tuning in to a lot of sources like news sites, market scanners, etc. By programming alerts to your specific needs, they will only alert you when certain conditions are met, allowing you to stay focused on sharpening our trading strategy rather than scavenging for information.

- Figuring out if you were right or wrong: Trading alerts not only tell us about entering or exiting a position but also helps you recognize your errors. By understanding when you reach the stop level at the current time, you can set the alerts to warn you when you’re approaching a stop level in the future. This will give you ample time to react.

- Automatizing your manual trading: On the trading platform, when you use your alerts frequently they become very structured stock scanners. By doing your research and setting up alerts, you can sit back, relax and let your platform help you trade.

How to Receive Chart Trading Alerts?

There are a variety of ways to set alerts according to your trading style and frequency.

- On-Chart Indicators trigger sound to alert the trader in case an event has occurred. These alerts work for traders who are trading full-time and have alerts based on price-action and not on static numbers.

- If you are not an active investor or have another day job that keeps you away from your trading screen, text messages can help you immensely to keep you informed if and when your alerts go off.

- Chat Bots are based on Artificial Intelligence and interact with people (traders in this case) through text or voice. Chat bots are similar to receiving text messages, but here you can ask for information about the alerts which is not quite possible while using text messages.

Conclusion

Due to the uncertainty and dynamic nature of the market, keeping tabs on all the relevant events can easily overwhelm new and seasoned traders alike. Trading alerts help the traders by keeping them up-to-date through text messages, on-chart notifications, etc. Trading Alerts not only help traders to make timely trades by reducing market noise but also in reviewing mistakes and automatizing the trades. You can easily set these alerts according to your trading style and needs.