The Euro (EUR) and the US Dollar (USD) are the world’s two most popular currencies as reported by a Central Bank Survey that took place in 2016. The two currencies belong to the European Union and the United States, respectively. Both these currencies play an important part in the Foreign Exchange (Forex) market. The pair of both the currencies, that is, EUR/USD is the most traded pair in the world with the largest trading volume worldwide.

So, if you are a trader you cannot ignore this major forex pair. For this, you must know the various forces and factors that affect the price movement and volatility of the EUR/USD forex pair. However, before that, you should know more about this currency pair, such as its nickname and so on. This way you can effectively trade on the pair and earn profits. In this article, you will get to know the main points that can help you to trade in the EUR/USD pair.

Deeper into EUR/USD pair

The US dollar is the most common and traded currency, followed by the euro, which is the world’s second most popular currency. And, when these two powerful currencies combine, they form a major currency pair that holds over half of the overall trading volume in the global Forex market.

The EUR/USD pair is also known as the Fiber and Euro. The Euro nickname is pretty clear but the Fiber nickname has two stories behind it. Some people claim that the EUR/USD forex pair is called the Fiber because the GBP/USD pair is called Cable. This is because the US and the UK were connected with the old telecommunications cable, which was upgraded to the new fiber cable, as per traders. And, other traders say that the pair got its Fiber name because the Eurozone has the world’s best optical fiber network.

EUR/USD is the part of the ‘majors’ pair, which also includes pairs like GBP/USD, AUD/USD, USD/JPY, USD/CHF, USD/CAD, and NZD/USD. Since it’s a major currency pair that belongs to two significant economies, it holds immense power globally.

In the EUR/USD pair, the euro’s exchange rate is put against the US dollar. This means the amount of the US dollars you need to purchase a euro. So, if the EUR/USD rate is 1.15, then it means you need 1.15 US dollars in order to purchase one euro. You can use this pair for forex trading or as a financial instrument (CFDs) for speculating the exchange rate between the two currencies.

What moves EUR/USD

The volatility and exchange rate of the EUR/USD pair constantly fluctuates due to multiple factors. These factors are as follows:

The US and Eurozone economical data

The economical data is reported through the economic calendar, which comes out every week. This affects the EUR/USD forex pair. Some of the most powerful economic reports that move EUR/USD include:

- The CPI or Consumer Price Index reports the inflation rate, which determines the health of the economies.

- The PMI affects a currency’s strength by determining economic health. This data displays the viewpoint of the purchasing managers on their economy in the medium-term. They can be either positive or negative about it. Central banks also use this data when they are creating their monetary policies.

- The GDP also shows the health of an economy.

- The Balance of Payment is the report that shows the amount of money a country gives to and gets from other economies in the world.

The Federal Reserve Bank and the European Central Bank

These two institutions greatly affect the EUR/USD volatility in the following ways:

- Institutions: The EUR/USD currency pair is mainly affected by the central banks of the US and Europe. The Federal Reserve Bank (US FED) of the US and the European Central Bank (ECB) of Europe and the Eurozone regulate the money supply, monetary policy, interest rates, as well as the strength and weakness of their individual currencies. The Federal Open Market Committee (FOMC) is a division of the US Fed that also determines the US monetary policy.

- Personalities: The forex market pays attention to all meetings of these two central banks and the speeches given by their chairmen and presidents. This governs the volatility of the EUR/USD pair in the Forex market.

- Interest rates: The interest rates decided by the US FED and ECB also affect the EUR/USD exchange rates. As per the interest rates of different economies, there is a rise or fall in their currencies. For instance, when the European Union has high interest rates as compared to the US, then its currency, that is euro, becomes more solid than the US currency, which is a reason for the price move. However, monetary policy is a bit more complicated, so traders also have to pay attention to other factors that affect currency value. And, the same thing happens the other way round.

- Quantitative easing: Quantitative easing (QE) is a monetary policy wherein the central bank buys long-term securities for “cash” from the open market. This affects the EUR/USD as it is the most common way for money emission by central banks.

Political stability

Political issues can also affect the EUR/USD currency pair. These can include any political events, such as Brexit, European crises, elections in the major European Union economies, etc. The EUR/USD currency pair can also be affected by the claims and speeches of politicians. For instance, if the US Treasury Secretary, claimes that the US manufacturers can benefit from a weaker dollar it can cause the direct fall of the US currency.

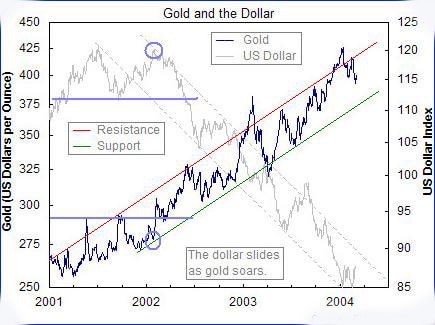

Gold, which is denominated in the USD, has a direct impact on the EUR/USD pair. It has a negative correlation with the EUR/USD currency pair. This means when both gold and EUR/USD are going in the same direction, they will cancel each other. On the other hand, when both of them are going in opposite directions, both will benefit.

Trading sessions matter

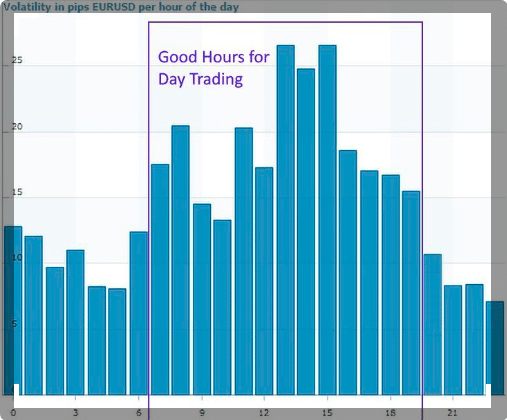

Traders must know when the EUR/USD pair can be the most volatile and when it is not traded much. The pair liquidity is low during an Asian session since the pair is mostly affected by the economic events and data released in the European and US sessions.

The trading activity of EUR/USD diminishes around noon when traders go for lunch and the liquidity falls again around 5:00 GMT since at this time the traders in Europe and the US close their positions. At other times, the liquidity is high for the EUR/USD forex pair.

Both the Euro and the USD are most active from 8 AM to 4 PM EET from Monday to Friday. Moreover, there is a two to three hour overlap period during which both the American and European markets are open. This period offers the most volatility and volume for the EUR/USD forex pair.

The conclusion

The EUR/USD pair is one of the major pairs in the forex market since it belongs to the two biggest economies in the world. So, if you are a trader who wants to trade this currency pair, then you must know about this pair and the factors that move it.

These include sessions that tell you what are the best hours to trade the pair, the comments of personalities and decisions of institutions, political issues, economic reports that show the health and development of an economy, etc. All these factors drive the direction and price movement of the EUR/USD forex pair.