- The euro area’s employment change rose 1.8% (YoY) as Australia’s full employment change for July 2021 declined 4,200 against a prior increase of 51,600

- Australia’s wage price index for Q2 2021 rose 0.4%, failing to beat Wall Street estimates at 0.6%.

- Australia’s manufacturing PMI decreased to 51.7 from a high of 56.9

The EURAUD pair added 2.45% in the week ending August 20, 2021. It closed at 1.6434 on the last trading day after opening at 1.6405. The eurozone recorded a 1.8% increase in the employment change (YoY) in Q2 2021 from a 1.8% decrease in 2020. Employment change (QoQ) rose 0.5% in Q2 against a 0.2% drop.

Wages and employment

Australia’s wage price index for Q2 2021 rose 0.4% against a previous increase of 0.6% in Q1 2021 (QoQ). It failed to beat Wall Street estimates at 0.6%. The index rose 1.7% in Q2 2021 (YoY) from 1.5% in Q2 2020. It, however, failed to beat estimates at 1.9%, hurting the Australian dollar.

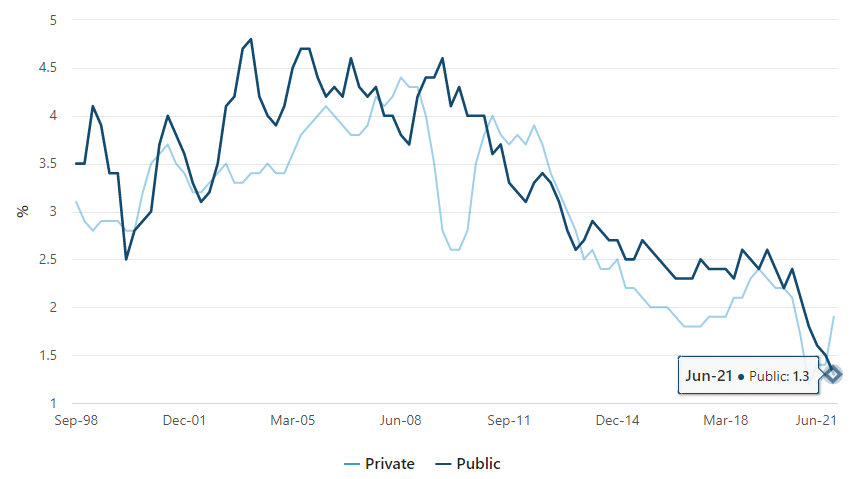

Australia’s wage price index in the public sector declined to 1.3%, as the private sector recorded an increase of 1.9% as of June 2021.

The lowest quarterly increase was witnessed in the energy, transport and water services departments that gained 0.1%. Real estate and rental services grew 0.6%, while wages in arts/ recreation rose 0.9%.

Despite the beckoning lockdown towards the end of July 2021, Australia’s employment change increased by 2,200. It rose against a prior decline of 29,100 in June 2021, beating estimates at -46,200. The Australian dollar was weighed down by the full employment change for July 2021 that declined 4,200 against a prior increase of 51,600 witnessed in the previous month.

July 2021 also saw the unemployment rate fall to 4.6% from consensus estimates of 5.0%. The participation rate also rose 66.0% (-0.2% points) from the prior record of 66.2% in June 2021.

Strong current account in the eurozone

The euro also strengthened after the euro zone’s current account for June 2021 surged 86.32% from €11.7 billion in May 2021 to €21.8 billion in June 2021.

The €21.8 billion surpluses were recorded, amounting from €316 billion balance in June 2021 to €235 billion balance attained in 2020. The former surplus represented 2.8% of the euro area’s 1-year GDP, while the latter represented 2.0% of the annual GDP.

When not seasonally adjusted (n.s.a), the current account balance for June 2021 soared 82.08% from €4.3 billion to €24.0 billion.

Germany’s producer price index (PPI) for July 2021 (YoY) rose 10.4%, up from 8.5%. This increase lifted the euro as it beat estimates at 9.2%. Month-on-month analysis of the PPI (for July 2021) indicated a 1.9% of the index, up from 1.3% recorded in June 2021. This measurement beat projections at 0.8%.

Australia’s manufacturing PMI also decreased to 51.7 from a high of 56.9. It shrank due to the lockdowns imposed to contain the spread of the Delta variant. The services PMI also decreased to 43.3 from 44.2, laying a blow to the Australian dollar into the week.

Technical analysis

The EURAUD has been forming a rounding bottom since December 2, 2020, with the downtrend hitting support at 1.5267.

The recent uptrend took shape after the price consolidated at 1.5905 before rising to 1.6382. A sustained move above this region is expected to pull prices towards 1.6420 and 1.6495.

There is a high buying momentum with the 14-day RSI in the overbought zone at 77.70. The 14-day ATR is also rising at 0.01306, showing an increase in volatility.

In the case of a bearish reversal, sellers may push the price below 1.6371, pointing to 1.5905.