Exit or limit orders are important as they are related to money management. Money management plays an important role in the success

Some of The frequently used exit orders are,

• Stop Loss Order

• Take Profit Order

• Trailing Stop

Stop Loss order :

Stop loss is used in trading to reduce the risk by cutting the losses in short. This is risk tolerance level for a trader. Stop loss order is placed below the entry price in case of a long position and above entry price in case of short positions.

Thus, when your traded currency pair moves against you and hit the stop loss order, then your trade will be in loss. This prevents the loss from growing further.

Take Profit Order :

Take profit order is to capture a certain amount of profit immediately when the price hits the take profit order. This order is above the buying price in case of a long position and below the selling price in case of short positions.

Examples of Stop Loss and Take Profit Order:

Here are some examples showing stop loss and take profit order in both long position and short position.

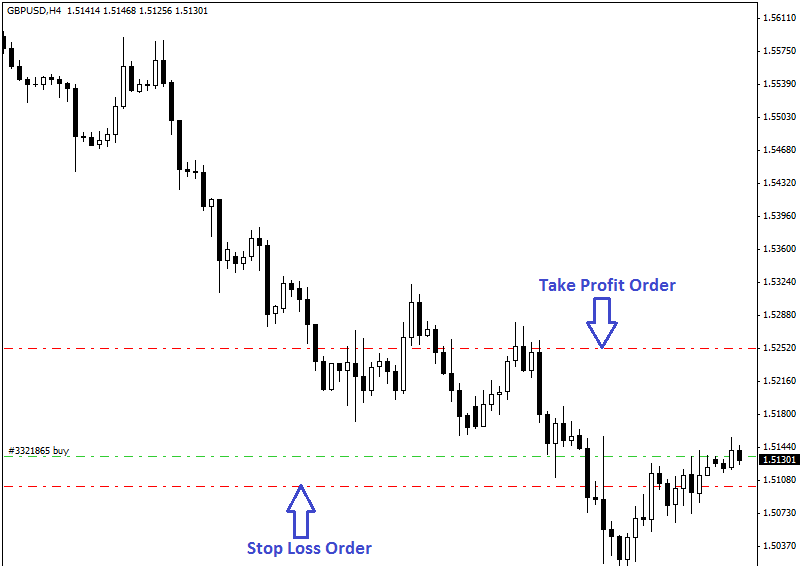

In the 4 hour chart of GBP/USD (given above), buy price (long position) was 1.5132. Stop loss order placed at 1.5102 which is 30 pips lower than buy price. Take profit order placed at 1.5252 which is 120 pips higher than buy price.

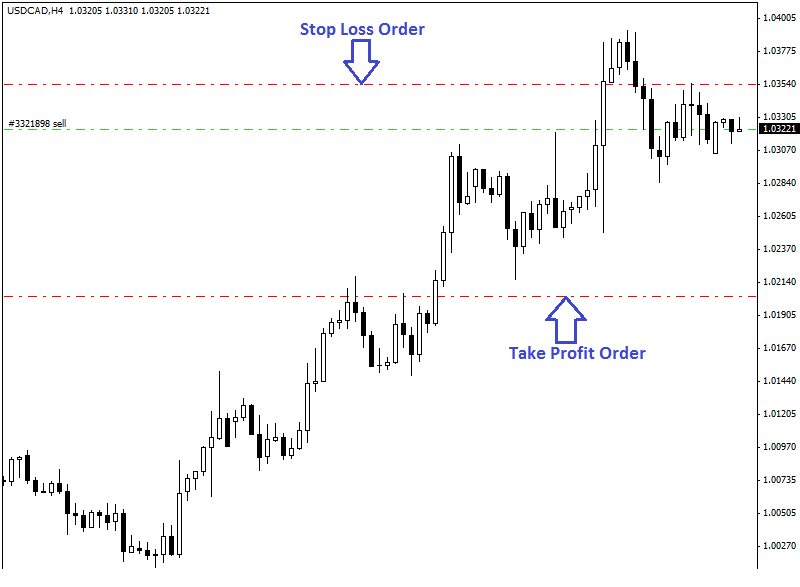

In the 4 hour chart of USD/CAD (given above), sell price (short position) was 1.0324. Stop loss order placed at 1.0354 which is 30 pips higher than sell price. Take profit order placed at 1.0204 which is 120 pips lower than sell price.

Forex Trailing Stop Loss Order :

Trailing stop loss is a dynamic or moving stop loss. This kind of stop loss trails or moves in your favor when price moves in your traded direction. For example, you are in a long position and placed a trailing stop of 50 pips. Now a stop loss order is placed at 20 pips below your buying price.

Now, if the price does not move 50 pips or more, then the stop loss stop loss will not move. In this situation, if the price drops 50 pips and hit the stop loss order then your trade will be closed in the loss.

Now, if the price increases 50 pips then your stop loss will come 50 pips higher at your breakeven price.

After this, your stop loss will remain 50 pips distance from the current highest point of price. For example, if you have entered into a long position and the price is now 150 pips higher than your buy price, then your stop loss will be at 100 pips higher than your buy price keeping 50 pips distance from the highest point.

In the case of short position, stop loss level will be 50 pips above the lowest point.

Summary:

Exit or limit orders are important as they are related to money management. Money management plays an important role in the success.

A trader should decide his/her exit in both profit and loss, before taking a position. A trader must know about the limit or exit orders in forex to execute an exit decision.