In this section, we will discuss forex positions, orders and calculation of profit/loss. Before trading in forex, a trader should have a clear understanding of these topics.

Long Position and Short Position:

It is said that there is no bearish market in forex. It does not mean that forex market never goes downward. In forex, you can take trade in any direction.

It may be long or short positions. This allows a trader to make a profit in both bullish and bearish market.

You can make a profit by buying at a low price in a bullish market and selling at a high price in a bullish market. This is called a long position. Long position means buying the base currency by selling the counter currency.

In a bearish market, you will not be able to make a profit by taking a long position.

As short selling is allowed in the forex market, a trader can make a profit by selling in high and buying it at a lower price when the market or pair is falling. This type of trading activity is called short position or short selling.

Forex Orders:

When you execute your decision by trading it is called an “order”. There are different types of orders in the forex market. These orders can be divided into two major parts, entry orders, and exit orders. These are,

Entry Orders:

There are different types of entry orders. We will discuss on some commonly used entry orders in details. These entry orders are as follows,

- Market Order

- Limit Entry Order

- Stop Entry Order.

- Good Till Cancelled Order (GTC)

- Good For the Day Order (GFD)

- One Cancels the Other Order (OCO)

- One Triggers the Other Order (OTO)

Market Order:

When you make a trade directly at the available market price, then it is called a market order. For long position market order would be at the asking price and for short positions market order is at the bid price.

Limit Entry Order:

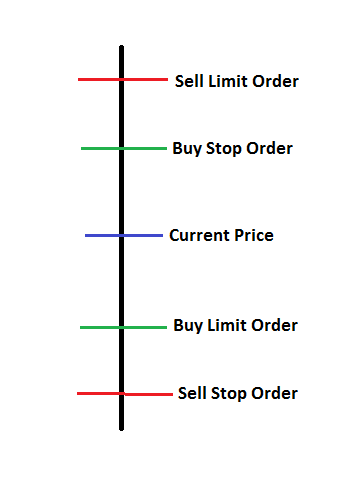

When you place a buy order below the current market price or a sell order above the current market price, then it is called a limit order. Buy order below current market price is also called “buy limit” order and sell order above the current price is also called “sell limit” order.

For example, EUR/USD is trading at 1.2943, and you place a buy order at 1.2903, this is a buy limit order. On the other hand, if EUR/USD is trading at 1.2943 and you place a sell order at 1.2983 then this is a sell limit order.

Stop Entry Order:

When you place a buy order above the current market rate or a sell order below market rate, then this is called a stop entry order. This type of order is particularly useful to trade trendlines and chart patterns.

In this case, an order is placed when there is a possibility of a breakout. Buy order below the current price is also known buy stop order and sell order the above the current price is also known as sell stop order.

For example, if AUD/USD is trading at 0.9654 and you place a buy order at 0.9694, then it is a buy stop order. If EUR/USD is trading at 0.9654 and you place a sell order at 0.9614 then it is a sell stop order.

Good Till Cancelled Order (GTC):

In this type of order, the order will not expire unless you manually cancel it. This type of order may lead a trader to the unusual situation in trading if used carelessly.

Such as you placed a GTC order day back and forgot to cancel it when it is not necessary, then there is a chance that these orders will open unexpected trading positions automatically. Be sure that you have cancelled unnecessary GTC orders.

Good For the Day order (GFD):

A GFD order is valid until the end of the trading day. When the trading day ends, the order expires automatically. The expiry time of GFD orders varies broker to broker due to a country origin, different time sessions etc.

This type order can also lead you to unexpected positions if forget to cancel the order manually and price hit the order several times during the trading day.

One Cancels the Other order (OCO):

In OCO orders, an order is automatically cancelled when the other order is executed. For example, if the price of a pair is in ranging condition and you placed both buy and sell order using this method as you do not know the price will break the support or resistance level.

Now, if price breaks out the resistance then a buy order will be executed and the sell order will expire at the same time. Inversely, if the price hits the sell order then sell order will be executed, and the buy order will expire at the same time.

One Triggers the Other order (OTO):

This type of order is opposite to the OCO order as it will trigger one order while filling another one without cancelling it.

Summary:

A trader should understand these entry orders and choose one of them which work best with his trading styles.