Introduction

When speaking about currency markets, many people feel lost because the breadth of knowledge required to understand the market is vast. Currency markets – also called foreign exchange markets – are nothing more than exchanging money between counterparties. If you are a retail currency trader, you will likely know that the market has various tiers.

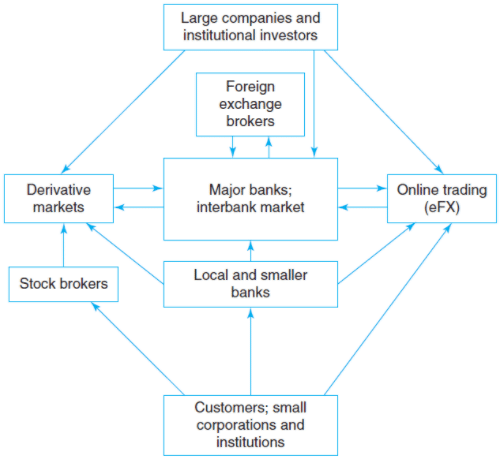

The entire foreign exchange (forex) market revolves around the interbank market. Notice in the structure below, the interbank market appears in the center of all other smaller markets.

Figure 1: Structure of the Foreign Exchange Market

It provides liquidity for all participants, whether significant traders like smaller banks and institutional traders or fringe participants such as retail traders like you. The significance of the interbank market in currency markets continues to grow as more participants enter the market.

However, you could be a little at a loss when we talk about this enormously crucial aspect of the forex market, and you wish to gain a good understanding. Worry not, because this guide will explain the concept to you in great detail.

Understanding the Foreign Exchange Interbank Market

An interbank market is a place where big banks converge and lend funds to one another. Because the institutions deal directly with each other, trades are fast and informal. Interbank markets involve participants with deep pockets, and it accounts for most of the liquidity in the foreign exchange market.

The amounts moved in interbank arrangements are significant, with the typical funds on the lower side being about $5 million. Interbank market arrangements mature fast, but how fast? The typical maturity for interbank deals is overnight, although some counterparties might enter deals that mature after six months or even one year. Because the US dollar appears in most international trade deals, the currency also accounts for the largest share of interbank market arrangements.

Often, interbank market participants deal directly with each other. Nevertheless, the market has many brokers who link up banks that would otherwise be unsuccessful in finding a counterparty. To demonstrate the international nature of the foreign exchange interbank market, banks that participate in the market come from all locations in the world. It is not surprising that a few banks from specific locations – such as principal financial centers like London or New York City – dominate the market.

A Historical Perspective of the Interbank Market

Before 1971, most currencies – currencies for the UK, France, Germany, etc. – were convertible to the US dollar, and in turn, the US dollar was convertible to gold. This system became known as Bretton Woods after an agreement forged in a New Hampshire city called Bretton Woods in 1944. However, the United States government terminated the greenback’s gold convertibility in 1971, effectively sounding the Bretton Woods system’s death knell.

Without the Bretton Woods system that had supported an era of fixed exchange rates, most major currencies shifted to a floating exchange rate regime. When we say a currency’s exchange rate is floating, we say the forces of supply and demand of the foreign exchange market determine the given currency’s price. Higher demand translates into positive growth for a currency’s price.

In light of the arising changes, financial institutions and big companies began to face exchange rate risks. The risks arose from the non-fixed exchange rates, meaning exchange rate differentials could lead to unexpected losses, especially when a company earns its income in a foreign country. Therefore, the interbank market started as one of the solutions to the risks of floating exchange rates. Central banks, commercial banks, and big companies found reliable liquidity in the interbank arrangements.

How Does the Interbank Market Work?

For starters, the interbank market operates without a central authority. If we compare the interbank market to the stock market, we are talking about stock trading without relying on the New York Stock Exchange (NYSE) to relay and execute orders. The decentralized nature of the interbank market raises pertinent questions – how does it work, and who makes the rules?

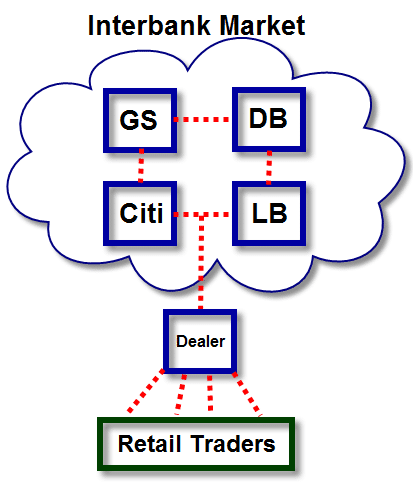

No country has regulations in place to guide the working of the interbank market. Instead, the participants align themselves based on their creditworthiness. For instance, a bank with an immense balance sheet and less constrained by regulatory hurdles commands the market. Such institutions include Goldman Sachs, Deutsche Bank, and JP Morgan.

Instead of a central authority that guides the market, the interbank market relies on market makers. In the interbank market vocabulary, a market maker is a participant who trades both ways; that is, they provide the bid rate and the offer rate. Such participants benefit from the spread between the two rates.

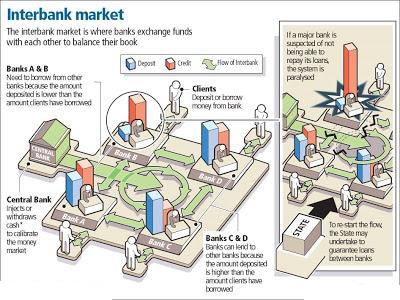

We can boil the seemingly complex activities into the following paragraph. Consider Bank A and B in the figure below, which have more credit on their books than customers’ deposits. To balance their books, the banks approach Bank C and D – with each having more deposits on their books than credit – to borrow funds.

Figure 2: How the interbank market works

Can Retail Traders Access the Interbank Market?

The pricing of orders at the interbank market level is beyond the capability of individual forex investors. Nonetheless, retail traders benefit significantly from the interbank market players’ market-making activities—the more participants at the interbank market level, the more liquidity and volatility. The volatility creates trading opportunities for retail traders.

Since retail traders do not have the financial depth to access the interbank market, they rely on dealers to provide a bridge. A dealer breaks down interbank market lots into smaller units that retail traders can manage.

Some dealers often double up as brokers. Broker-dealers can offer over-the-counter or online trading services. When a retail trader buys a currency pair, the dealer is the selling counterparty. Likewise, the dealer is the buying counterparty when a retail trader sells a currency pair. Therefore, the quotes that a trading platform like MT4 shows you are the bid/ask prices that the dealer accepts/offers.

Conclusion

The interbank market is the reason behind the foreign exchange market vast liquidity. Players in the market lend each other funds to balance their books and cushion themselves against foreign exchange risks. In the process, they make a market that benefits millions of retail traders.