Forex trading seems like the hardest concept in the world when you are just starting. Indeed, new traders need plenty of information for proper and profitable navigation of the market. Successful traders get ahead by having their finger on the pulse of the market. This includes identifying patterns that are more than just happenstance. Interestingly, forex market cycles are one of the patterns for which you need to keep an eye out.

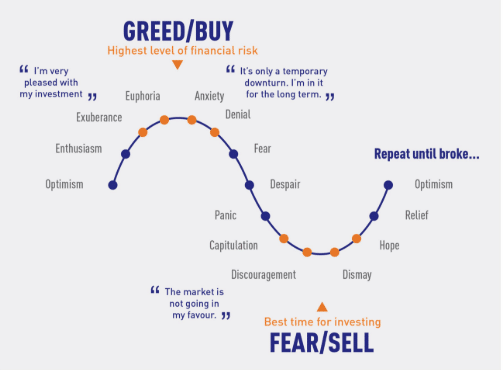

Forex market cycles are the regularity in the fluctuation of trading activity that happens over an extended period. What this means is, traders behave in a certain manner that reflects in the movement of the price chart. Usually, a forex market cycle swings from optimism, through euphoria, down to discouragement, and then back to optimism. Observing such a pattern is not easy and only dedicated traders can crack it. In a sense, the cycle reflects the ebb and flow of trading activity along a certain trend.

How can you identify a forex market cycle?

Granted, the nature of the fluctuations in the forex market is not as clear-cut as the figure above shows. This means, therefore, that you are going to need some kind of skill to put it together. Essentially, the skill facilitates reading of chart patterns with the aim of smoking out some regularity. Before you embark on identification of the cycle, you must acknowledge that humans are the engine of the forex market. Even when talking about forex expert advisors, there is always a human pulling the strings.

From the foregoing, the first step towards identifying forex market cycles is by acknowledging that humans power the forex market. Why is this important? Human traders have a psychological aspect that is common across the board. Specifically, they get carried away by emotions. Though the psychological aspect is diminished in traders implementing automated forex trading, it is still perceivable. It manifests itself when setting the parameters for the forex robot.

Having been clear on this matter, one can implement strategies using fundamental analysis to gauge market sentiment. In a sense, these strategies, kind of, give you a picture of what the market will look like in future given the current occurrences. In addition to some technical analysis and forex charting tools, one can easily identify the rhythmic fluctuation of the market.

Secondly, you need to understand the relationship between the two currencies in a trading pair. This needs to go beyond the mutual relationship to individual characteristics of each currency. For example, assume that you want to trade the USD/JPY pair. As you can see, the pair consists of the US dollar and the Japanese Yen. What you need to know is that financial markets in each of the countries that the currencies belong open and close at different times. When the Japanese market is open, trading activity involving the yen is high. The same is true for the dollar.

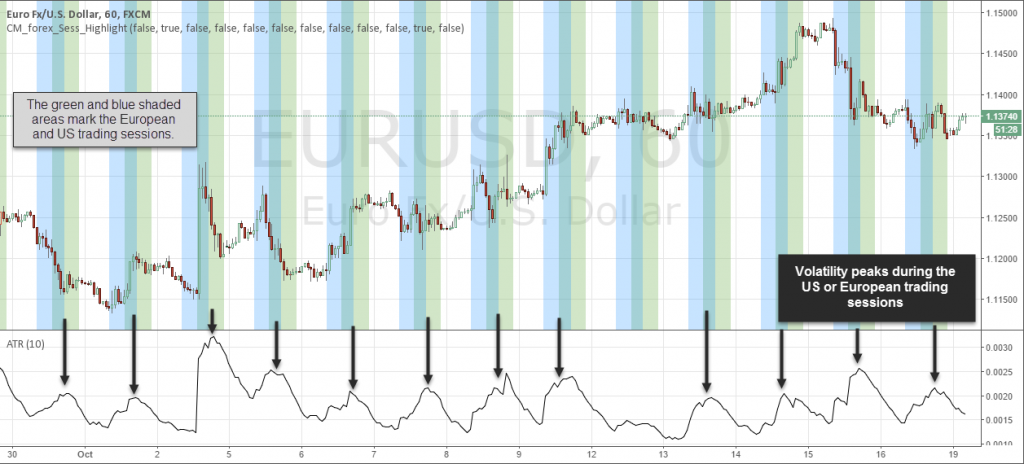

Similarly, you would experience the difference when trading other pairs like EUR/USD. When markets in the US are open, the dollar volatility peaks. If the European market is not open at the time, the volatility for the EUR should be low. The opposite is also true (see the figure below).

Trading the forex market cycle

Besides learning about the repetitive nature of trading activity, great traders can recognize cycles in any period. For example, the traders can recognize daily cycles, weekly cycles, monthly cycles, andmore. Largely, this depends on the overarching trading strategy in use. For example, traders who implement a scalping strategy might need to master the forex market daily cycle. This way, they are in better position to set tight entry and exit points.

- Master the market’s characteristics

Trading the forex market cycle requires two things. In the first place, you need to master every detail of the target market. For example, you should know detailed characteristics of the US financial markets and the European financial markets if you want to trade the EUR/USD pair. This way, you will be able to anticipate fluctuations in the volatility of each of the currencies in the pair. You will be able to set price targets that are realistic and ones that increase the probability of profitable trades.

Further, understanding the characteristics is critical when constructing the trading strategy. If you are one who enters trading positions on the EUR/USD once a week, you might want to master the forex market weekly cycle. To this end, you must have all the details of the information that is pertinent to the behavior of each of the currencies.

- Plan your activities appropriately

In the second place, you need to pick the most appropriate markets. Appropriateness in this sense refers to time zones you can manage. Although all markets open during the day, the issue of time zones makes it vary greatly. For this reason, the forex market is active around the clock. Remember, your trading activities should complement your life to make it enjoyable. If you are on a day job, you need to plan your activities such that you work at night. This means selecting pairs that are active during this time.

The perfect market is the one that is active when you are trading. During this time, the volatility in the market is good enough to apply any strategy, be it news trading or trend trading, and to profit. If you live in the US and you trade only at night, your best choice could be European and Asian markets. That means the probable currency pairs are AUD/JPY, EUR/JPY, GBP/AUD, and so on.