Keeping It Simple Stupid (KISS) in Forex

At face value, the forex industry for any novice initially requires a substantial investment of study and financial resources. After this challenging stage, the execution in the live trading environment should be simple. Forex, like most endeavors, is simple, but it’s not easy. While the technical and fundamental analysis can take years to master, at the end of the day, the price either goes up or down. That’s the simple part of understanding. The part that is not easy and requires a ton of effort is mastering not just the analytical aspects but also yourself.

In this digital and information age that we live in, traders tend to have an information overload that is not fruitful for their careers. This challenge is one of the main ones that most newcomers face. This overflow ranges from the hundreds of different strategies and indicators that exist on the internet, to various financial news outlets, to analyst opinions in different media platforms. With all this information at hand, they can, unfortunately, engage in analysis paralysis when faced with a trade idea. A trader needs to have the ability to objectively reason by themselves without the distraction of opinions, which may say otherwise.

Another troubling aspect of the forex industry is the value of education. Some novice traders believe that paying lots of money for a trading course will give them a better start than someone who doesn’t. Most of the information one needs already exists on the internet for free. Of course, not all the information is worthwhile, but there is enough to form a solid foundation without spending a lot of money. What is vital is simplifying the data.

Ultimately, what it really entails to are your individual preferences, what resonates with you the most, and sticking to that. No method is 100% correct. Right off the bat, any trader, including newbies, should understand that there’s more than one way to skin a cat. Whichever way that is, it must be simple.

How do the pros keep it simple?

Simplicity all starts in the trader’s mind, for it is often their biggest enemy. Trading the markets profitably does not take a rocket scientist. Professional forex traders first appreciate that no ‘Holy Grail’ exists. This realization alone can put any trader ahead of the curve. Once one realizes there is no perfect trading system that never loses, the simplicity battle is already half won since you’d now be stepping into what really matters.

Professional traders can define with a high amount of confidence what they are looking for when scanning the markets through a stringent set of rules. They know what their ideal trade set-up should look like without hesitation. Professional traders have a purposeful routine of conducting themselves for every single trading day by remaining calm, taking notes of what they see, anticipating certain news events, keeping a watch-list, setting price alerts, and keeping a trading journal, to name a few things.

Every action is devoid of complication because it only leads to a purpose and a benefit. Forex is complicated in the beginning, but as a trader gains more experience, it becomes a lot simpler. The hard part is gaining the experience; living the experience should be simple.

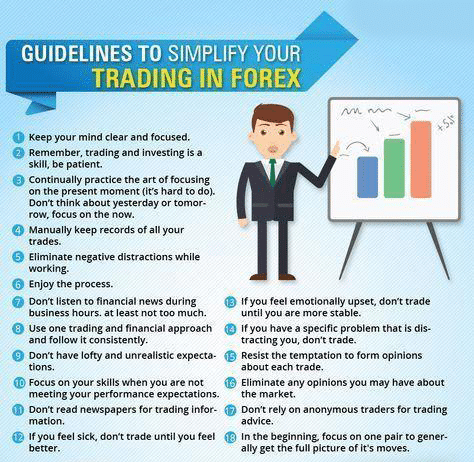

Methods to simplify your trading

There are ways traders can simplify everything in their trading technically, fundamentally, and psychologically. These are just a few of plenty:

Technical analysis:

- For traders that trade patterns, they may consider sticking to just one pattern, especially with more complex patterns like harmonics and Elliot waves.

- Instead of using more than one indicator, a trader may attempt to stick with one, which they feel is the most significant. Having more than one indicator could lead to a conflict in trading ideas and over-analysis. Hence, some traders are huge proponents of using no indicators whatsoever in their charts. Of course, this approach is not necessarily superior, though it is much simpler.

Fundamental analysis:

- Traders must define which fundamentals they believe are the most important to follow. This type of analysis itself is as tricky as technical analysis, and different fundamentals matter to specific types of traders. For example, traders who trade news releases such as scalpers and day traders should ideally stick to high impact news such as interest rate, GDP, and NFP releases for liquidity reasons. These news events are considered high impact due to the huge amount of interest they garner. Other news releases are not so impactful and do not provide as much liquidity, which is the driving force for any shot at profit.

- Overall, there are several fundamental indicators that all merit extensive study on their own. In keeping it simple, one should define a few which they believe are the most important. Swing traders and position size traders should mainly focus on the interest rates, GDP, and employment figures as their primary indicators since these are partly responsible for the more prominent market trends.

Psychological aspects:

- Traders have to control their emotions by trading in a stress-free mind and a minimalist environment. Also, it’s paramount to always be neutral regardless of the trade outcome. So, you should not be overconfident and excited during a winning period and be fearful or even revengeful during a losing period. Traders should also never assume anything about the potential trade outcome no matter how much the evidence suggests.

- Keeping track of your performance and journaling is also crucial. A trader needs to know where they are going and how they can rectify any mistakes.

Conclusion

Albert Einstein once said, “If you can’t explain to a six-year-old, you don’t understand it yourself.” Indeed, decades later, these words still hold a lot of value in the world of forex. This realization should not take away the work that is required upfront and on an ongoing basis. However, simplicity is needed in the moment of execution since this is where it ultimately matters. Could you keep it simple stupid?