Forex, stocks, commodities, and cryptocurrencies are the most popular assets among day traders. Each class has its pros and cons. For example, in most cases, cryptocurrencies tend to have more volatility than stocks. In this article, we will look at the better trading options between stocks and forex.

Forex and stocks: what are they?

For beginners, forex is the short form for foreign exchange. It refers to the process of buying and selling currencies with the goal of making a profit. In layman’s terms, assume that you are a UK citizen, meaning that you mostly use the British pound. Someone sends you 1,000 pounds today when the GBPUSD exchange rate is 1.42. This means that you will have $1,420.

If the same person sent you the same 1,000 pounds in the following month when the exchange rate has gone to 1.45, you would receive $1,450. In other words, within a month, you get $30 more. This is the basic premise of forex trading. It is facilitated by a forex broker who provides the tools and liquidity to trade.

Stocks, on the other hand, are also known as shares. They refer to companies whose shares are listed in major exchanges like the London Stock Exchange (LSE), Nasdaq, and the New York Stock Exchange (NYSE)in. If you own a share of a company, you simply own a small part of the firm. For example, a company like Shopify has a market capitalization of more than $152 billion. Therefore, if you have shares worth $1 million in the company, it means that you own 0.00065% of the company.

Forex and stocks: what moves them

To trade forex and stocks, you need to know what moves them in the long-term and short term. Some top movers of forex and stocks are usually interrelated.

For example, the actions by the Federal Reserve tend to have an impact on US-listed equities and the US dollar. For example, if the Federal Reserve cuts interest rates and launches a major quantitative easing, it will be a positive thing for stocks but a bad thing for the US dollar. Lower interest rates tend to incentivize people and investors to move from low-yielding safe assets like bonds to stocks.

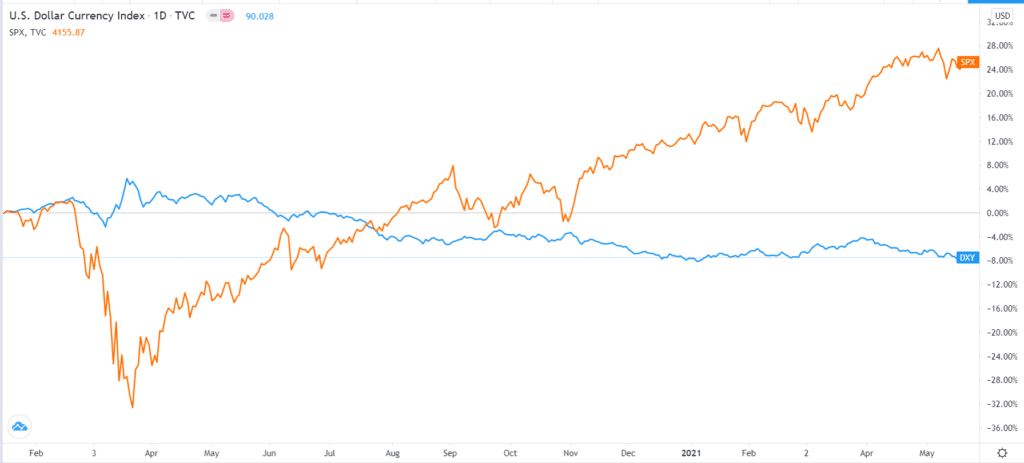

The dollar, on the other hand, tends to weaken because of the so-called risk-on sentiment. A good example is shown in the chart below. We see that the dollar index declined while the S&P 500 index rose after the Fed unveiled its coronavirus pandemic measures.

S&P 500 vs dollar index

Second, macro issues have an impact on currencies and stocks. For example, in the case of a major global conflict, the dollar tends to gain because of its role as a safe haven. Stocks, on the other hand, usually decline because investors are scared about the impact of the geopolitical issue on the companies. Other macro issues that move forex and stocks are employment, manufacturing and services PMIs, and retail sales.

Still, there are other specific issues that move stocks and not currencies. These are:

- Mergers and acquisitions – This is a situation where two companies decide to merge or where a bigger one decides to acquire a smaller one. In this case, shares of the company being acquired tend to do well. Other companies in the industry also react to M&A activity.

- Management change – Shares move when a CEO or a senior official resigns or when a new team is hired. For example, a stock can grow when a company hires a prominent CEO and board member.

- New investor – Shares tend to move when a respected investor buys shares of a company. Some of the best-known investors who move stocks are Warren Buffett, Bill Ackman, and Elliot Management.

- New product – A company’s share price can move when it introduces a new high-quality product. For example, in May 2021, Ford shares jumped when it unveiled an electric version of its popular F-150 truck.

How are forex and stock trading different?

There are pros and cons of trading stocks and forex.

First, there are thousands of stocks that you can trade. In the United States, there are more than 5,000 publicly traded companies of all industries that you can trade. Some of the most popular names are companies like Facebook, Twitter, and Google. On the other hand, there are a few hundreds of currency pairs that you can trade. Among the most popular are EUR/USD and USD/JPY.

Second, because of the impact of Robinhood, trading stocks in the United States is mostly free. All popular brokers like Schwab, Fidelity, and Interactive Brokers allow people today to trade for free. There are no hidden charges since these firms make money through order flow.

On the other hand, forex trading is not free. While most brokers don’t charge a commission, they charge a fee indirectly. They make money through the difference between the bid and ask prices. They also charge swap fees for trades left open overnight. Therefore, from a cost perspective, trading stocks is relatively cheaper.

Third, there is a difference on when you can trade stocks and forex. The forex market opens every Sunday night when the Asian markets open and go on through Friday evening when US markets close. At the same time, the market does not close during public holidays. This is different for stocks, which can only be traded at a small window during the day. The stock market is also closed during public holidays.

Fourth, the stock market can be compromised while the forex market is difficult to manipulate. For example, a company’s insiders can make some announcements that can move the market. Similarly, especially in penny stocks, many investors can easily pump and dump stocks. It is not possible to do this in the forex market.

Finally, the forex trading entry threshold is lower than stocks. You can open a trading account with some brokers for less than $200. With that amount, you can trade all currency pairs. If you have that amount, buying some stocks is not ideal. While you can use fractional shares, you won’t see significant results in the near term.

Summary

Stocks and forex are two of the most popular markets in the world. Many people have succeeded by focusing on forex, while others have succeeded as stocks. Others have succeeded using a hybrid model, where they trade both stocks and currencies. In this article, we have looked at the difference between the two and what moves them most.