Forex trading, like most jobs, comes with specific requirements that every trader needs to understand. Before choosing the currency exchanges to trade on, it is important to first consider the acquisition of basic trading skills. As a trader, you need to learn more about the challenges, opportunities, features, and characteristics of a successful trader. Most traders that this art entails pouring money into your forex account and predicting price movement, but trading is more than that. However, the most basic aspect of forex trading is to first treat your trading account as a personal business.

Risk management principles in forex

The five basic risk management principles below will help a beginner trader to build a healthy attitude to the most important aspect of trading. Observing them from the beginning of your trading career will save you a lot of time and nerves.

Learn as much as possible

The financial market is constantly evolving, and there is a diverse need to continually educate yourself on emerging trends. A good trading strategy for a full-time trader should incorporate the different trading indicators, patterns, charts, price trends, and analytical tools. The trader should make a financial decision from an informed perspective as opposed to guesswork. As a trader, you might think of working in an exchange, a trading firm, or your private equity. If you are trading using your own money, it will be imperative to learn all the risk models applicable in forex.

Stop loss and take profits

For example, using the stop-loss option is important, especially with the high failure rate among novel traders. This automated tool helps the trader to set predefined closing prices when the market goes against the prediction.

In figure 1, we have planned to sell the USD/TRY pair at 7.44976 on January 20, 2021. We expected the currency to continue falling. To help lower the losses in case the market reverted, we placed the stop loss at 6.90796. True to form, the trade went as predicted, and the market was bearish for the time under analysis. The benefit of the stop loss is that if the market changes, as it did after February 19, 2021, our risk of loss is reduced.

Figure 1: USD/TRY

For a full-time trader, trading in a particular direction may take more than a day or weeks. For example, in figure 1, the position was taken from January 20, 2021, to February 19, 2021. The trader will note that the market was bearish for almost 30 days. In all these days, the trade was gaining in pips – or price movements calculated as a fourth increment, especially in forex.

If we say that one pip is equivalent to 100,000, the profits to be gained in this trade will be calculated as follows. 7.44976-6.90796= 0.5418 * 100,000. The answer is $54,180. This is the amount to be gained by the trader for a successful prediction of the market’s downside (as seen in figure 1).

Application of the stop-loss is dependent upon a trader’s experience and understanding of volatility and margins. Level adjustment is necessary so that you do not place them too close or too far away from the trading position. Move or trail the stop-loss closer to your trading position if you feel you have gained the intended profits and fear that the market may change the trendline.

While a stop loss is common in a bearish market prediction, the take-profit is placed in a bullish market.

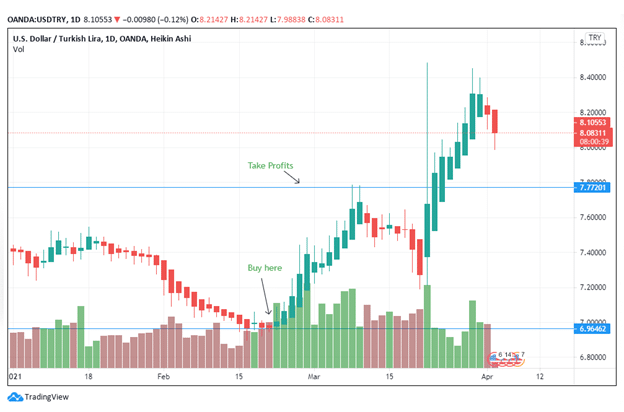

Figure 2: USD/TRY Take profits

In figure 2, we are placing the take profits option above the buy position of the currency pair. Other than the risk, we are thinking about the reward. We have the buy position at 6.96462 while the take profit option is at 7.77201. Most take profits are placed at 40 pips above the trade position. In figure 2, the take profits option has been placed at least 80 pips above the buy position. We made this consideration based on the volume of the candlesticks as seen by the rising green bars.

Risk a portion of your investments

A successful full-time trader will only risk a part of their investments. For example, if your account has $10,000, you should risk between 1.5% and 3%, that’s $150 to $300, in a single trade. Choose the downside if you would like to spend more time in your trading capacity.

The figure of $150 may appear small, but it is appropriate if you do not mind losing it. Remember that the amount risked can be a bad loss. Check the volatility of the currency pair, and the higher the volatility, the lesser the amount to be risked. You should not go past 2% if you feel that you are on a losing streak. If the trade goes according to your plan, maintain your emotional balance so that you do not exceed your stake.

Use a business plan to keep the forex active

Identify the timeframe you intend to keep a trade open and when you will close. Such a plan enables you to have stop loss and take profit options. Maintain a consistent investment amount in your trade with an entry and exit strategy. This option helps the trader to control the psychological pressure that comes with forex trading.

Keep your focus on any market news that may affect the trading pattern on a currency pair. In figure 2, the consistent rise of the USD/TRY pair was due to negative news from Turkey when the central bank chief was replaced.

Portfolio diversity

A full-time trader needs to diversify the currency basket to increase the chances of success. Application of the risk management practices is essential as you manage the trading pairs.

Conclusion

To embark on profitable forex trading, every full-time trader needs to understand the basic principles of performing it as a viable business. Trading is a risky business, and the trader must be ready to evolve with the constantly changing trade patterns. This article has centered on risk management as the core structure of a successful trade business. Learning is vital in this activity in regards to resources, news, and fundamental trade options. Finally, diversity is important to help the trader have a wider investment portfolio, no matter the funds in the forex account.