- The ECB increased its bond-buying initiative by 22.7% in March 2021.

- Europe’s services and composite PMI surged in Q1 2021.

- The UK economy may reach pre-pandemic levels in 2022.

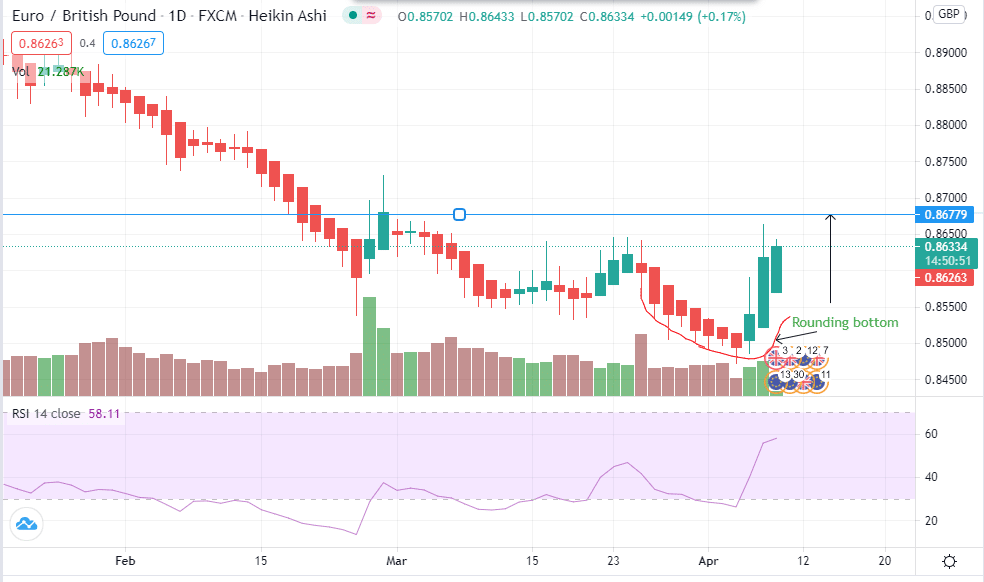

The EUR/GBP pair recorded a +0.61% price change from the previous day’s close on April 7, 2021, after hitting a high of 0.86634. The euro’s gain was attributed to an increase in the French Markit Composite PMI for March 2021 at 50.0 from a previous reading of 47.0. Services PMI for France also inched up to 48.2 for the same month from 45.6, although it remained within the contraction zone. The German composite PMI for March 2021 also gained 57.3 points from 45.7 (exceeding forecast by 0.54 points). Services PMI for Germany also increased to 51.5 in March 2021 from the previous reading of 45.7.

Investment plan

There has been a slow implementation of the ECB’s recovery plan under the €750 billion ($890 billion) stimulus package agreed upon in July 2020. The increase in investments and innovation will help to steer the region back to growth. IMF predicted that the euro area will swell 4.4% in 2021. March 2021 saw the ECB speed up bond-buying by 22.7%, purchasing bonds worth up to €73.5 billion.

The summer of 2021 is likely to see the first payout of the recovery fund, with the main challenge being delayed ratification by national parliaments. Germany may also pose legal contests that may postpone the implementation of the fund’s agenda in the EU. This delay may negatively impact the euro seeing the US is already rolling out the $1.9 trillion stimulus package.

The UK’s economic forecast for 2021 was raised by the IMF from 4.5% in January to 5.3% in April 2021. Britain’s economy shrank 10% in 2020, after recording the highest death toll in Europe from COVID-19. As of Q2 2021, up to 50% of the UK’s population has been vaccinated compared to only 15% in Germany and France.

The forecast of 5.3% in the UK and 4.4% in the eurozone by the IMF has not taken into consideration new lockdowns that may affect output levels. However, the British economy may return to its pre-pandemic levels in 2022, according to the IMF.

Vaccine concerns

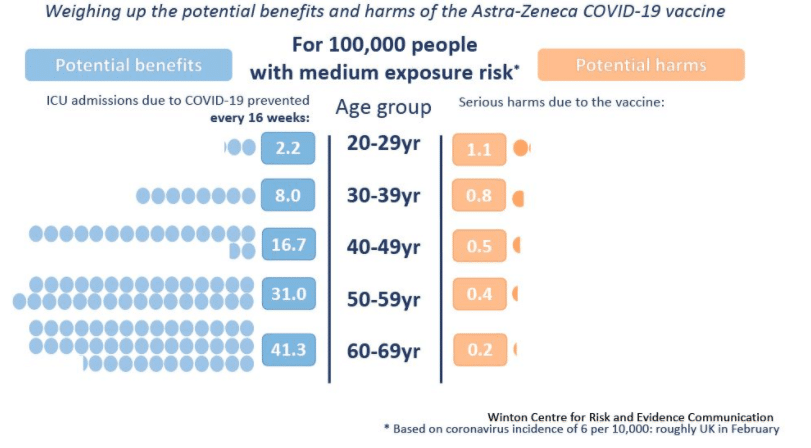

Rising concerns over blood clots in the administration of the Oxford-AstraZeneca vaccine have seen an alternative vaccine recommended for people under ’30s in the UK. While various regulators are in support of the vaccine, these reports could delay the vaccine’s rollout in many countries. ICU admissions have mostly affected those above 60 years.

The potential harm of the vaccine is less than its benefits, with more people saved from ICU admissions. By March 24, 2021, a total of 30 people out of the 18 million vaccinated with the vaccine were reported dead. Regulators are of the view that underlying conditions are to blame and not the vaccine itself.

Economic recovery

The UK’s economic recovery is likely to outstrip that of the US and Europe as a whole. February 2021 saw retail sales gain 2.1% after falling 1.9% in 2020. The sale of clothing contracted 21.5%, while fuel lowered 22% in volume sales.

UK residents are, however, expected to increase their online sales due to the rise in card transactions into the third lockdown. Online sales in 2021 rose by a record high of 33.9%, creating a surge in retail spending.

Technical analysis

EUR/GBP

A rounding bottom has been formed after prices hit a low of 0.84722. We expect the bullish reversal to continue with the trend likely to hit psychological resistance at 0.86779. There was increased buying opportunity among investors after the 14-day RSI hit 58.11 by April 8, 2021. Trading volume is also seen to increase, with traders preparing for an upside in the EUR/GBP pair.