Bonds are financial products used when there is needed to raise much-needed financing. Entities that are constantly dealing in foreign money turn to these financial products, cherished by investors, to generate some money to finance various operations.

Foreign currency convertible bonds are a special type of bills synonymous with corporations or other entities constantly dealing in non-native accounts. They stand out in that they are issued in bills different from the issuing entity’s legal tender.

Similarly, they are a mixture of debt and equity and operate as a normal bond. In this case, they come with a provision for regular principal remittances and coupons. Unlike other products for acquiring capital, they come with a provision that allows owners to convert their holdings into stock holdings.

They are primarily used to generate money in overseas bills but retain all the features of convertible bills. The quasi money-raising tools allow issuers and holders to share risk-reward. In this case, holders assume the risk of investing in an entity doing well, which in return gets the opportunity to acquire funds in external legal tenders to meet underlying obligations.

Any amount borrowed through this security appears on the left-hand side of a balance sheet as it is a liability.

What you should know

As is the case with other bonds, FCCBs are investment products in which people invest money for regular remittances in the form of interest. In return, entities get to raise money that can be used to finance various projects or operations.

In addition to regularly scheduled dividend remittances, bearers are also entitled to reimbursement of what they invested at maturity. However, some issue bills whereby owners are usually given the option of converting their holdings into stocks instead of being repaid the face value at maturity.

With convertible bills, there is a conversion rate at which they are converted into holdings in companies. Conversion mostly occurs whenever issuers’ share price increases significantly. Investors jump to the opportunity of profiting from further share price gains.

However, share prices remaining below the conversion price would often result in FCCB holders shying eye from converting their holdings. In this case, the issuer must pay the regular dividend and return the face value upon maturity.

Example

Sighting economic stability and low benchmark interest in Switzerland, a US company could acquire capital by issuing an FCCB pegged in Swiss francs. The entity will, in this case, receive proceeds in francs and make regular payments in francs.

While these types of capital-raising financial products are synonymous with corporations doing business on an international scale, they also attract hedge fund arbitrators and institutional investors.

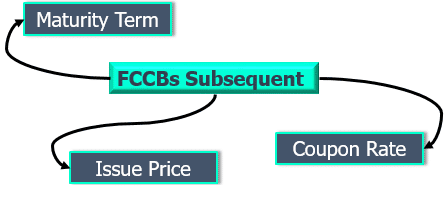

Features

FCCB comes with regular interest payments, as is the case with other typical convertible bonds. Holders are always assured of remittances and a provision through which they can own stocks through the holdings. The fact that they are traded in exchanges makes it possible to profit from price appreciation.

They are also issued by entities seeking access to new markets or those planning to expand their footprints. The focus is usually on countries with much lower benchmark rates as a way of keeping borrowing costs affordable.

Why FCCB Stand Out

For starters, they enable the capital acquisition outside the home country. Conversely, they allow the tapping of opportunities in international markets.

Their coupon rates tend to be much lower than raising money from traditional channels that charge much higher interest. Therefore, they are ideal tools for keeping the cost of account financing low.

They are often issued in countries where interest rates are much lower than in the home country, making it easy to take advantage of affordable costs through reduced interest remittances.

Besides, their coupon payments tend to be much lower, which helps reduce the overall borrowing cost. Exchange rate fluctuation in favor of the issuer can also reduce the cost of financing. Similarly, they are issued in countries with stable economies, thus averting the risk of exchange fluctuations.

Investors cherish these capital-raising securities as it is possible to convert them into equity, therefore, profit from equity price appreciation. Also, they come with the guarantee of fixed payments over an extended period.

Conversion of these capital-raising products allows entities to reduce settlements significantly; conversely, they gain much-needed equity capital.

Drawbacks

FCCB issuers are always at a high risk of incurring more conversion rates moving against them since all repayments have to be made in the borrowing country’s legal tender. Should it change significantly to maturity, outflows on refunds could be much higher.

Bearers often refrain from any form of conversion whenever share prices fail to appreciate. If this were to happen, issuing entities are often bombarded with increased interest remittances and principal payments.

Foreign Currency convertible bonds dampen debt to equity ratio until bearers agree to a conversion or everything is paid off.

The demand for FCCB tends to be much lower whenever the stock market is in a negative cycle. Such cycles are associated with underperformance, reducing the possibility of share price increases highly needed for holders to agree to conversions.

Bottom line

Foreign Currency Convertible bonds are ideal tools for raising money and allowing enhancing access to international markets. They come with some of the lowest coupons, much lower than traditional borrowing streams. Conversely, they are ideal for raising affordable capital on the international scene.

Favorable exchange rate allows issuers to benefit from low cost borrowing. On the other hand, Holders are usually guaranteed fixed-rate returns while also standing a chance to convert into equity should share price increase significantly.