Polkaswap is a decentralized exchange possessing non-custodial liquidity aggregation. It is a cross-chain AMM DEX designed to work in an interoperable DeFi situation. The DEX is based on the Kusama and Polkadot ecosystems and is built over the SORA network.

Polkaswap background

Other than the mention of the DEX being operated by the community, we could not find info on the company, its founding year, location, team members, etc.

Polkaswap overview

The DEX is a cross-chain liquidity aggregator that aids in swapping tokens on the Kusama and Polkadot networks, parachains, and blockchains connected through bridges. The bridging helps the DEX enable the trading of ETH-based tokens. As per the vendor, the DEX operates at high speed and charges low fees for swapping assets in a non-custodial way on the SORA network.

Pros & cons

Pros

- Common liquidity aggregation

- Lower transaction fees

Cons

- Risk of impermanent loss

- No vendor transparency

- Lack of performance proof

| Funding methods: | Cryptocurrencies |

| Cryptocurrencies supported: | 100+ |

| Countries: | N/A |

Key features of Polkaswap

Some of the important features of the DEX are listed below:

- The DEX can trade on numerous liquidity sources with the liquidity aggregation algorithm.

- It is an open-source project that adds more liquidity sources by forming within the Polkaswap module.

- The DEX is capable of minimizing the risk of impermanent loss and causes less pair fragmentation than the competitor AMMs.

- As it works on a parachain, it is natively interoperable with the Kusama and Polkadot ecosystems.

- Users can trade ETH, ERC-20, DOT, KSM, BTC, and BSC tokens.

- It aggregates liquidity from DEXs and CEXs.

- PSWAP is the native token of the exchange and is used to reward liquidity providers on the DEX.

What wallets does it support?

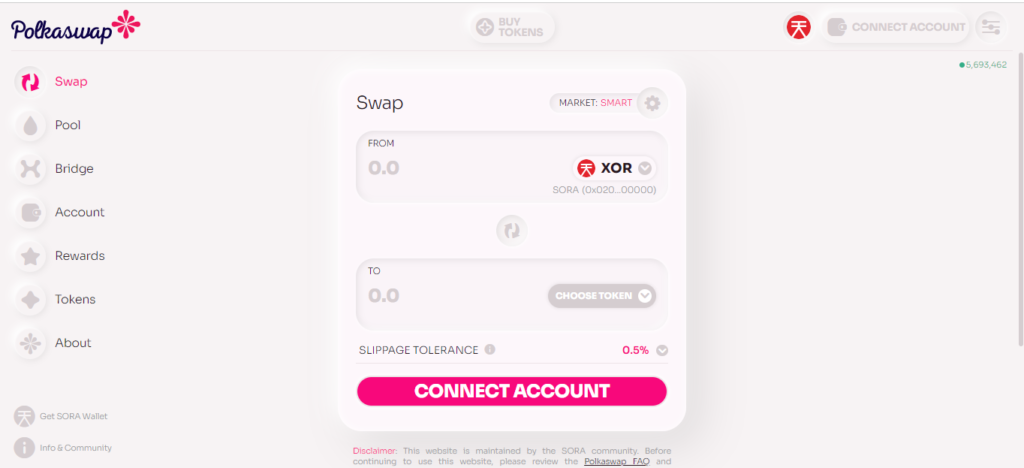

The DEX supports the SORA and the Fearless Wallets. Connecting the DEX to the wallet is done in the following steps:

- Visit the official site and click on connect account

- Connect to the SORA network using the SORA Wallet

- Using the connection, you can transfer tokens on the ETH blockchain to the network

- Click on the ‘choose token’ button to choose the toke you want to transfer between the networks and enter the amount you want to transfer

- Click on the ‘next’ button to confirm the connection

- You can transfer DAI, ETH, XOR, and VAL via the bridge

How does Polkaswap work?

The DEX works by removing trusted intermediaries and enables faster trading. It combines multiple liquidity sources in a common algorithm and operates on the chain totally in a devolved and trustless manner. The DEX can be used in three main ways:

- Swap tokens

- Provide liquidity

- Remove liquidity

All the above ways require an additional fee called the liquidity provider fee. Two liquidity sources are present for the DEX namely:

- XYK Pool

- Token Bonding Curve (TBC)

With the XYK pools, any community member can provide liquidity to any pool. All pools have XOR as the base asset. TBC is used to buy and sell XOR with USDT, PSWAP, and VAL as the initial collateral assets.

What can you buy with Polkaswap?

Numerous tokens are available on the DEX. The main tokens or coins you can buy on the DEX are:

- PSWAP

- VAL

- XOR

- XSTUSD

- AAVE

- ADX

- AGI

- AKRO

- ALCX

- ALEPH

- and many more

Are there any risks with Polkaswap?

As per the vendor info, the DEX has top-quality security and is audited. But the vendor states that the company cannot guarantee that bugs will not occur in the future. The vendor recommends performing research and due diligence while using the DEX. Impermanent loss is the biggest risk for liquidity providers. However, the 0.3% fees paid for each trade reduce the loss.

Polkaswap fees

Each trade on the DEX will fetch a fee of 0.3% fee to be paid in XOR. The fees are converted into PSWAP and burned. The burned amount is reminted and given to liquidity providers, as a strategic bonus vesting to users, and the Parliament.

Deposit methods

You can use ETH tokens, DAI, XOR, DOT, KSM, and PSWAP tokens for swapping. The DEX also allows buying tokens with Moonpay using your credit card.

Should you buy it?

Polkaswap differs from its competitor exchanges due to its low transaction cost and faster transaction. Other than the benefit of liquidity aggregation, the DEX allows trades on many liquidity sources using a special algorithm for customizing the aggregation. Order books, AMM DEXs, and other algorithms can be used as sources.

The Review

Polkaswap provides the benefit of quicker trading and lower fees. Its liquidity aggregation and on-chain operation and the facility to cross-chain trading are benefits unique to the DEX. However much like other DEXs, it has the risk of impermanent loss, which the vendor claims is mitigated to some extent by the trading fees.