Disclaimer: The information provided here does not constitute any form of financial advice. Readers are fully responsible for conducting their due diligence before making any investment decisions.

Aave: Market sentiment

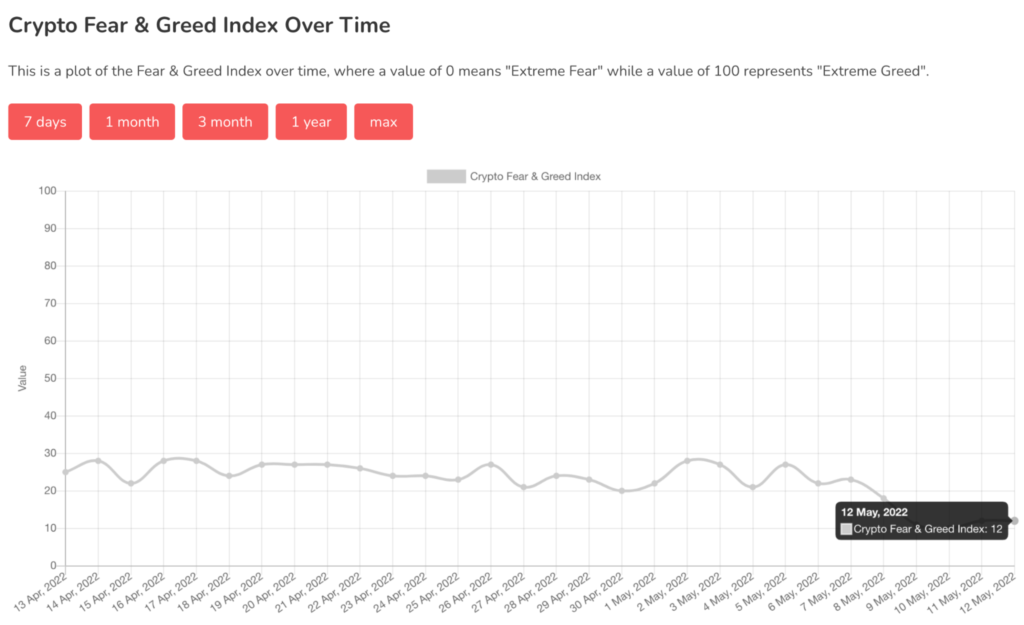

The Crypto Fear & Greed Index (FGI) is the leading indicator we’ll use for Aave’s market sentiment. While this multifactorial tool is based on Bitcoin, it’s impactful across many popular coins like Aave.

The index’s current reading is 12, the lowest it has been for quite a few months. 12 means fear, which, in normal conditions, generally represents buying opportunities.

While this is positive news, it doesn’t consider that the overall crypto market is falling. The decline is caused by numerous factors, such as a loss of confidence in digital currencies (for several reasons) and other geopolitical things.

Although most people are calling this a ‘crash,’ such a decrease in crypto has happened before. However, we don’t know how long it will last. Therefore, while the FGI (which is usually reliable) shows a fear sentiment, broader fundamentals may be more significant for some time.

Technical analysis

Because the crypto market is bearish, it’s no surprise that AAVE has also been tanking. Its value is about $73, a price level the market has not visited for several years. We’ve applied the 50-day (orange) and 200-day (blue) moving averages on the chart above.

Aside from the slope, we can see the price is well below the two, and the 50 is under the 200. We believe that a buying opportunity may present itself if AAVE reaches the $260 region, which could be in several months if the overall crypto market continues moving down.

Luckily, the long-term fundamentals for Aave are mostly positive. Therefore, investors will hope the bearishness of the token is short-lived.

Fundamental analysis

For this section, we’ll observe recent news and the long-term fundamentals for Aave.

Recent news

The most important news for Aave is the V3 or version 3 upgrade to its platform. Some of the improvements include limits to how much can be borrowed and, more crucially, the support of additional blockchains (where V2 was only compatible with Ethereum, Polygon, and Avalanche).

This broader support is understandably positive for Aave’s increased adoption as interoperability continues to be necessary for cryptocurrencies.

Long-term value proposition

Despite competition in the DeFi (decentralized finance) realm from services like Uniswap, MakerDAO, Compound, and Curve, Aave remains a dominant force. According to Defi Llama, the network has the highest TVL or total value locked, roughly $15.66 billion (about 10.5% of the entire market).

Another attractive element of Aave is its deflationary tokenomics. Investors prefer tokens with a finite distribution as they are perceived more valuably due to the concept of low supply and high demand.

Aave has a hard cap of 16 million, of which approximately 86% or 13,715,293 presently circulates the market. Overall, Aave is based on solid fundamentals considering its DeFi dominance and limited circulating supply.

Aave (AAVE) price prediction: 2023-2025

It’s good to know that many prediction sites show investors may get a potential net return on Aave in the coming years. These resources tend to use relative algorithms to offer their estimates, which are usually conservative.

This is the mindset to have considering the current down-trending climate of the crypto markets.

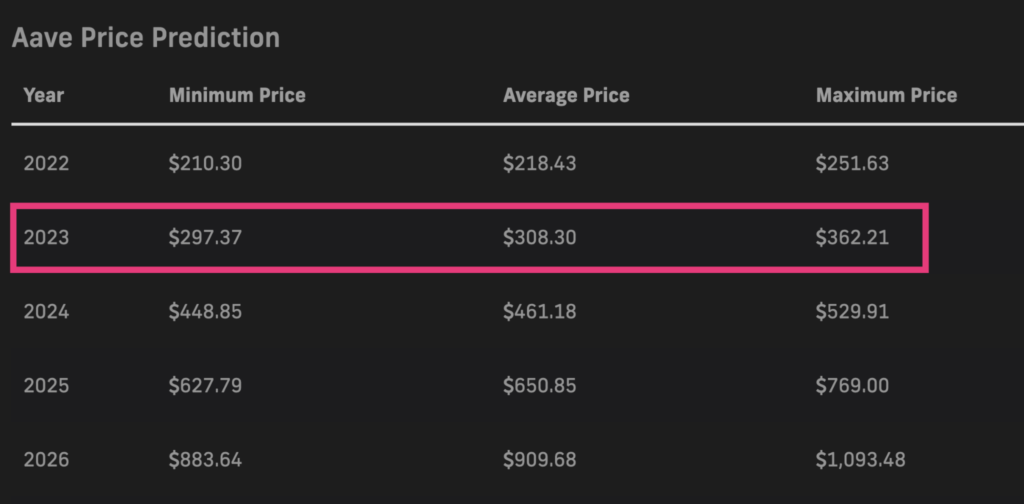

2023 forecasts

$197 is the average prediction for 2023, which is about 2.5 times Aave’s present value. Such an increase by this time is certainly possible. PricePrediction.net offered the most optimistic projections, with a minimum of $297 and a maximum of $362, respectively.

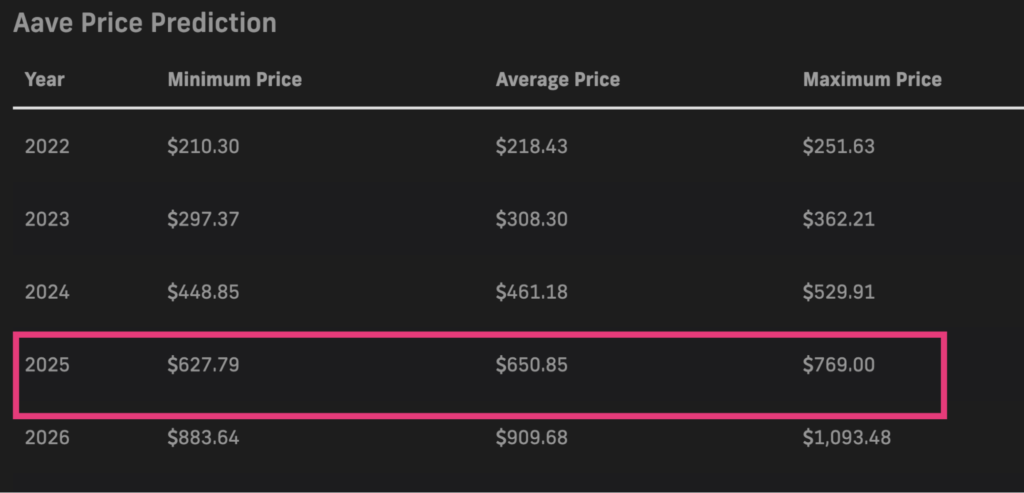

2025 forecasts

The average we derived for this year was $379, noticeably higher than 2023. Again, PricePrediction.net topped the forecasting sites observed, with the site predicting at least $627 up to $769, the latter of which is higher than Aave’s all-time high of $666.

Aave Frequently Asked Questions (FAQs)

Is Aave real?

Yes, Aave is the first crypto lending platform (launched in November 2017) and one of the most popular decentralized finance protocols.

What is the Aave price today?

$71.

Will Aave’s price reach $1000?

Having analyzed numerous forecasting sites, $1000 seems unlikely by 2025. Aave can potentially reach this price some years after, although it would take a substantial value increase.

Should I buy AAVE?

While Aave is one of the most popular DeFi networks with solid fundamentals, it remains a speculative bet. Therefore, you should only buy once you understand the risks involved.

Where do I buy AAVE?

As with most coins, you need to create an account with popular exchanges like Binance, FTX, Coinbase, Gate.io, Kraken, and many other platforms to buy AAVE. You can find a complete list on CoinMarketCap.