It is common for traders to make errors in forex. Some of them come up on a regular basis for beginners and novice traders. But, it isn’t prudent to ignore them. One has to become aware of them so they can be worked upon and eliminated to improve one’s trading capabilities effectively. In this article, we outline the top 8 mistakes that beginners tend to make when trading forex.

Trading without a plan or strategy

Those who don’t have a trading strategy tend to approach trading in a scattered and haphazard way. This leads to inconsistency, which is anathema for forex trading. Strategies provide predefined approaches and guidelines for traders, which prevent them from making blunders in hostile market conditions.

One should be willing to develop a trading strategy, lest one’s trading style can lead to catastrophic mistakes due to unfamiliarity. Furthermore, these strategies should first be tested on a demo account. Only when the strategies pass should they be adopted and used on a live account.

Trading with poor risk-reward

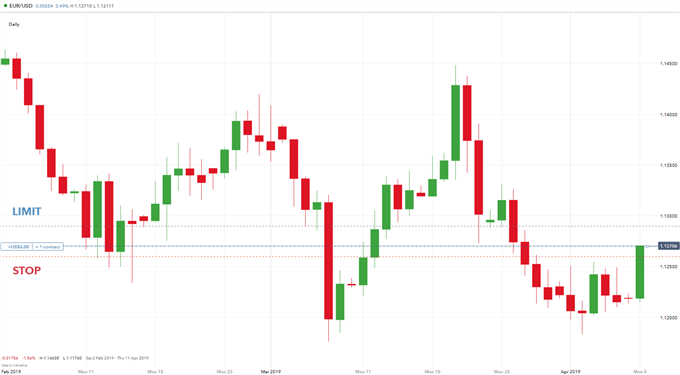

Many beginner traders tend to overlook the risk-to-reward ratio, which invariably leads to poor risk management. A positive risk-to-ratio highlights the potential of profits being higher than potential losses. If the ratio stands at 1:2, such as the one shown below for a long EUR/USD trade, then the rewards are double in size to the risks involved.

A healthy risk-to-reward ratio must be kept in mind to manage expectations since the inability to manage risks is one of the biggest mistakes traders tend to make.

Not using a stop loss

Every trade that you make should have a stop-loss order. Such an order is used to get you out of a trade when price begins to make against you. Beginners often find themselves in murky water when they don’t utilize the simple procedure of placing a stop-loss order and end up losing their gains with a single downturn.

When this order is made on the trades, one effectively takes a huge portion of the risk out of the trade. If you begin to take losses, the stop-loss order will prevent you from losing anything more than you are capable of handling.

Lack of proper position sizing

Beginners are also sometimes unaware of the size of the position that would be suitable for their trade. Having a trading size is important for an effective trading strategy. When one trades unsuitable sizes relative to their account size, the risk increases, which has the potential of wiping out one’s account balance.

Experts suggest risking no more than 2% of one’s account size. For instance, if your account has $10,000, then you should trade no more than $200 per trade. Using this 2% rule will eliminate the risk of overexposure of one’s account.

Holding on to losing trades

This is one of the most dangerous mistakes that a beginner can make. Many traders tend to hold on to their trade even when the price is moving against them, kept afloat by the hope that the trend will reverse. This practice is catastrophic to one’s account since the price can continue to move against you for longer than you think, and you will end up with exponential losses.

The better way to manage a loss is to trade with a stop-loss and a proper position size. This way you won’t expose too much of your account unnecessarily and the trade will close as soon as the price hits the stop-loss. Risking anything more than that is not worth the reward.

Overtrading

Many times, beginners are tempted to ignore all risk management strategies and take trades larger than they usually do. Whatever the reason may be – for they do differ from trader to trader – once a trader begins to think this way, they are setting themselves up for a big failure.

A trader might have had long losing streaks, which might tempt them to get back the losses. A winning streak will definitely get all that back and there is always that one trade that promises high returns and so a trader starts to take unwanted risks and overtrade.

This is a mistake that will only compound. When a trader starts feeling this way, it is better to stick to the 2% rule and resist the temptation at all costs. Stick by the risk management strategies and keep yourself from overtrading.

Having unrealistic expectations

There is a lot that can be said about having unmanaged expectations regarding what one can do in forex trading. Traders, especially beginners, often tend to impose their own biases and expectations on the market. But, the market doesn’t care about individual concerns and biases and must be accepted as volatile, choppy, and unpredictable.

As mentioned before, the only way to stick to some order in the chaos is to have a trading plan. Only as one’s account buffs up should one increase the position size and only as one becomes more competent should one test out new strategies.

Ignoring market news, events, and trends

When trading forex, a trader ignores news and current developments at one’s own peril. In order to succeed, traders have to invest in proper research, which includes:

- Trends (on different time-frames)

- News

- Current events

- Media releases

Studying the market will illuminate the trends, influences, and timing of trades. The more time one spends on researching, the better one’s understanding of the market will be.

The Bottom Line

Beginner traders are guilty of many aforementioned mistakes while trading. However, these can be corrected swiftly as long as one is aware of them and chooses to adopt the strategies needed to overcome them. These are the basics that one has to master in order to move forward and truly succeed as a forex trader. Practice, of course, remains the most crucial thing, which can be done on demo accounts as well.