The US economy is the most followed of all economies in forex and the world at large as the dollar is considered the world’s reserve currency. The dollar has an overwhelming influence across multiple markets in forex, stocks, indices, cryptocurrencies, commodities, and bonds, to name a few. What makes fundamental analysis tricky is traders are looking at two separate currencies rather than a singular entity. However, when trading US-paired instruments in forex, they tend to put more emphasis on US economic indicators nonetheless.

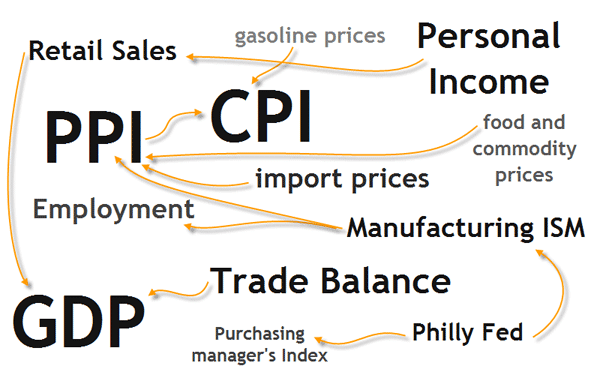

Within the context of economic indicators for fundamental analysis in forex, there are a plethora of different indicators that investors and analysts keep a close eye on when speculating on prices.

We can grade each of these indicators on a scale of low, medium, and high importance. This scale would depend on the perceived implication of the indicator in question.

Below is a list of the leading US economic indicators used in fundamental analysis (and their level of importance in brackets):

- Federal Funds Rate/interest rate (high).

- Non-Farm Payrolls/NFP (high).

- Gross Domestic Product/GDP (high).

- Consumer Price Index/CPI (high).

- Manufacturing Inclusion of Manufacturing ISM (high).

- US trade balance or trade deficit (high).

- Retail sales (high).

- Michigan Consumer Confidence (high).

- National Savings % (medium).

- Institute for Supply Management Index/ISM (medium).

- US unemployment rate (medium).

- Housing Starts (low).

- Employment Cost Index/ECI (low).

- Purchasing Managers Index/PMI (low).

- Residential Building Permits/RBP (low).

- Producer Price Index/PPI (low).

- Weekly Leading Index/WLI (low).

- New Orders for Durable Goods (low).

- Industrial Production (low).

The most significant US economic indicators

While there are debates over other indicators that some would consider significant (making this list not exhaustive), the eight below are the ones that traders pay attention to the most:

- Federal Funds Rate (interest rate): Set and revised by the FOMC (Federal Open Market Committee), the federal funds rate is the interest rate that commercial banks charge each other to borrow cash from their reserves. The data for the interest rate is released eight times a year on a pre-determined Wednesday of a particular month at approximately 14h15 NY time.

- Non-Farm Payrolls: Released on the 1st Friday of every month at 08h30 NY time, the NFP represents the number jobs added to the US economy (excluding farm, non-profit, private household, and government employees).

- Gross Domestic Product/GDP: This indicator represents the output of goods and services produced by the labor and property market. There are two reports for the GDP, the preliminary and final reports, and both are released every last Wednesday or Thursday of the month at 08h30 NY time. The final report would overlap the preliminary, released quarterly.

- Consumer Price Index/CPI: The CPI calculates the difference in the price of a basket of goods and services paid by urban consumers. The data is made available on approximately the 15th of every month at 08h30 NY time.

- Manufacturing Inclusion of Manufacturing ISM: The Institute for Supply Management (ISM) indicates activities in the manufacturing sector. The data is made available on the first business day of every month at 10h00 NY time.

- US trade balance or trade deficit: This indicator calculates the difference between the total number of exports versus imports in goods and services. The data is made available on roughly the 10th of every month at 08h30 NY time.

- Retail Sales: This indicator calculates the monthly differential in sales by retailers to customers. The data is made available on approximately the 15th of every month at 08h30 NY time.

- Michigan Consumer Confidence: This indicator represents consumer confidence in the US economy by surveying 5,000 households every month. For the data releases, there are two reports. The preliminary report is made available on approximately the 15th of every month. On the other hand, the final report is made available on the last Tuesday of every month. Each of these reports is made available at 10h00 NY time.

Low to medium significance US economic indicators

- National Savings %: This percentage reflects the saving of personal disposable income.

- Institute for Supply Management Index/ISM index: This is a composite index on the seasonally adjusted diffusion indexes of five indicators (employment, inventories, supplier deliveries, production, and new orders).

- US unemployment rate: This is the ratio between the number of unemployed citizens and the total labor force, seasonally adjusted.

- Housing Starts: This report calculates the number of residential units on which construction begins each month.

- Employment Cost Index: The ECI is a measure of the number of jobs in more than 500 industries in 255 metropolitan areas.

- Purchasing Managers Index: The PMI is a composite index of national manufacturing conditions.

- Residential Building Permits: The RBP measures the number of owned housing units, both single and multi-unit, authorized by building permits.

- Producer Price Index: The PPI measures inflation at the producer level, excluding services.

- Weekly Leading Index/WLI: The WLI is a composite index based on seven indicators (JOC-ECRI materials price index, mortgage activity, jobless claims, bond yields, stock prices, bond quality, and stock prices).

- New Orders for Durable Goods: This is a measure of new orders placed with domestic manufacturers for current and future delivery of factory goods.

- Industrial Production: This is a chain-weighted calculation of the change in the production of the country’s mines, factories, and utilities, including a measure of their industrial capacity.

Conclusion

As we can see, there is a long list of US economic indicators in forex. The most significant indicators are what we may consider market movers. The interest rate, NFP, and the GDP hold slightly high relevance in the long term since they affect the economy meaningfully more than others.