The U.S. Non-Farm Payroll report is published by the U.S. Bureau of Labor of Statistics. This report is also known as NFP. This is a key economic indicator for forex trading. This Non-Farm Payroll (NFP) report publishes the total number of paid workers in the U.S. excluding farm employees, private household employees, and employees of non-profit organizations.

This report works as an economic indicator which can describe the economic condition of USD. This news can be found in many websites as Non-Farm Employment change.

Effect of NFP in Currencies:

If the NFP increases then the USD will become bullish or strong against the other currencies. Inversely, if NFP decreases then the USD will become bearish or weak against other currencies.

For example, if NFP increases then GBP/USD will be bearish as USD would become stronger than GBP. If NFP decreases, then GBP/USD will be bullish as USD would become weaker than GBP.

Time of Release:

NFP releases at the first Friday of the month at 08:30 EDT.

Major Pair Impact:

NFP has a major impact on the pairs containing USD. Such as, GBP/USD, EUR/USD, AUD/USD etc.

Trading NFP News Release:

Trading the news releases is difficult and carries high risk. During news release, the market becomes highly volatile, and the spread is higher. Trading in this situation is quite risky as most of the times the impact of the news fades away in a short time.

Most of the major economic news have the long-term impact on the currency pairs, but the short-term direction might go against the news. For this reason, using this news for short-term trading can be dangerous. If you can understand the forecasted NFP, then you can take a position just before the news release and wait for the news impact.

Some traders also enter into a position, after 15 or 30 minutes of the news release to check the mass traders’ sentiment on this news using technical analysis.

Trading Strategy:

NFP has a long-term impact on the pairs as it releases once in a month. Most of the cases, its impact stay for a month. NFP report can be very effective in the long-term trading strategies. Here we will discuss a long-term trading strategy using NFP report.

Time Frame:

4 Hours

Trading Pairs:

All major pairs such as AUD/USD, EUR/USD, GBP/USD, USD/CAD, USD/CHF etc.

Entry Conditions:

For the pair which has USD as the base currency (USD/CAD, USD/CHF etc.); Look for a buy signal to take a long position when NFP increases and look for a sell signal to take a short position when NFP decreases.

For the pair which has USD as the counter currency (GBP/USD, EUR/USD, AUD/USD etc); look for a buy signal when NFP decreases and look for a sell signal when NFP increases.

Now, rules for buy and sell signals are given below,

- Enter a long position when Williams’ % R crosses above -20 (buy signal) after NFP releases.

- Enter a short position when Williams’ % R crosses below -80 (sell signal) after NFP releases.

Exit Conditions:

- Exit a long position when Williams’ % R crosses above -50

- Exit a short position when Williams’ % R crosses below -50

Stop Loss:

- Exit signals (as mentioned above) in a losing position.

- Or, a fixed stop loss of 40 pips.

Example:

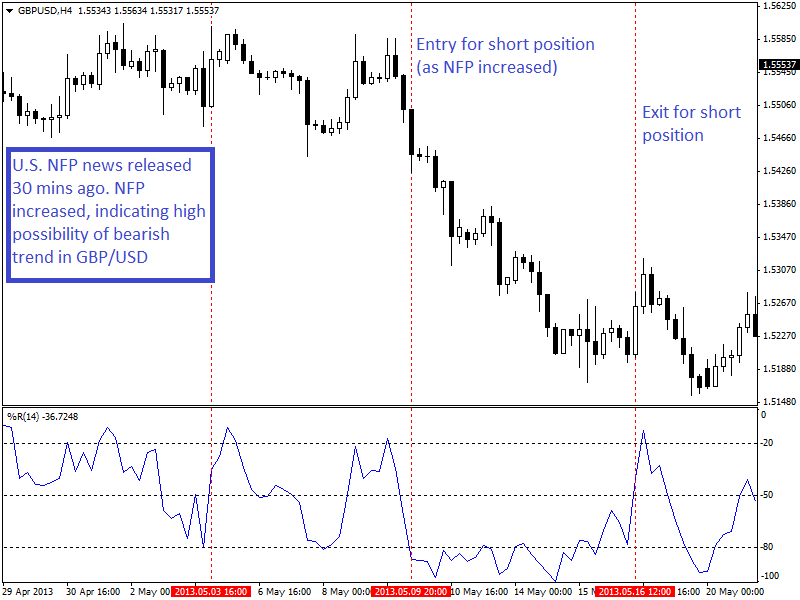

In May 2013, Non-Farm employment change was 1, 65,000 which was higher than the previous one (88,000). This increase in Non-Farm employment change had a bearish impact on GBP/USD as USD is the counter currency here. Entry and exit signal for short position has shown in the 4-hour chart of GBP/USD (given below),

Summary:

Non-Farm Payroll report often found as Non-Farm Employment Change in the number. This report is effective for long term trading as released once in a month.

This news generally has a monthly impact on the pairs which contains USD. Trading the NFP news releases can be risky, so it is better to use this key economic news for long term trading.