The forex market is home to a number of currency pairings. While some are considered major given the amount of liquidity they command, others are considered minors and exotics. USDCHF is one pair that gives rise to unique trading opportunities.

Understanding USDCHF

It is one of the major currency pairs as it depicts legal tenders of some of the biggest economies in the world. It simply shows the United States of America dollar on one end and Switzerland Swiss franc on the other hand.

The pair simply shows the number of Swiss francs needed to buy one dollar at any given time. For instance, when quoted as USDCHF 1.1300, it simply means one needs 1.13000 Swiss francs to purchase one greenback.

The USDCHF is often considered a safe haven. What this means is that market participants rush to it in times of uncertainty triggered by geopolitical or economic tensions. During such periods, participants often bet on the Swiss francs, given that Switzerland is relatively stable financially and politically. It shares the same attribute as the Japanese yen, also considered as a safe-haven.

Amid the relative stability of the Swiss francs, it tends to fluctuate as market participants react to a number of things. Consequently, the pair’s price action is affected by factors that influence the greenback and the Swiss franc, on the other hand.

Some of the factors that influence the USDCHF exchange rate are listed below.

Monetary policy

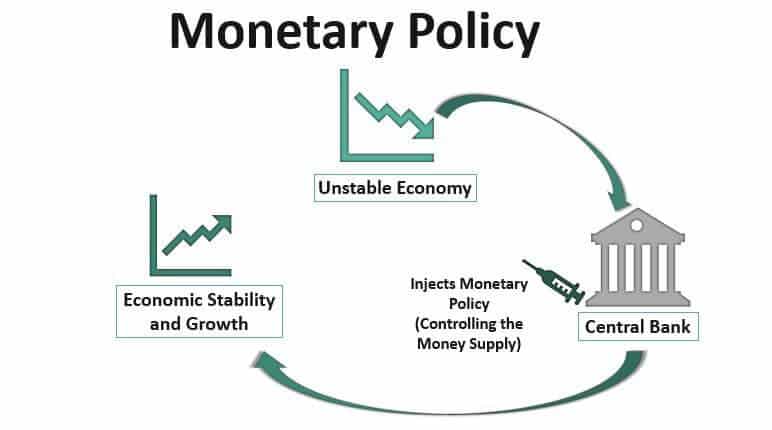

Monetary policy in the US and Switzerland is one of the main factors influencing the USDCHF price action in the forex market. The US Federal Reserve (FED), which implements various policies that sway traders’ sentiments on the US dollar, is commonly watched while trading the pair. Participants also pay close attention to policies deployed by the Swiss National Bank (SNB).

The two central banks pursue various actions with regards to interest rates, quantitative easing, and economic growth forecasts that sway traders’ sentiments and actions on USDCHF. While the actions are intended to stabilize the economy and the underlying currencies, they often trigger wild swings on the pair.

Interest rate hikes and cuts are some of the monetary policies that people watch while trading the USDCHF. For instance, whenever the FED hikes the benchmark rate in the US and the SNB retains or cuts, the net effect is usually the strengthening of the greenback, which in return causes USDCHF to move up in the currency market. In this case, one would need more Swiss francs to buy one dollar.

Similarly, the Swiss franc tends to strengthen across the board whenever the SNB increases interest rates and provides positive economic forecasts about the economy. The net effect is usually the depreciation of the USDCHF. Traders enter short trades, causing the exchange rate to decline. Conversely, one ends up paying much less Swiss francs to buy one dollar.

Economic indicators

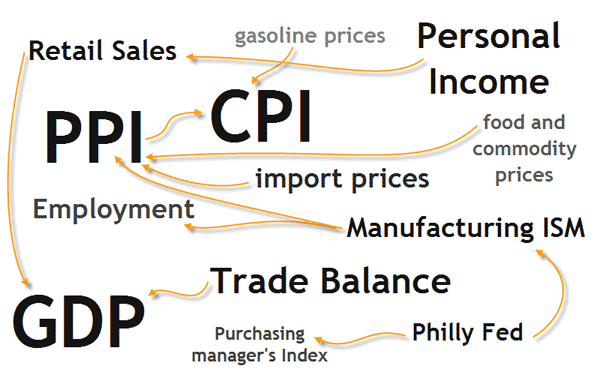

In addition to monetary policy, the health of the US and Switzerland economies influence a great deal of how the USDCHF fluctuates in the currency market. To analyze the two economies, market players analyze a number of economic indicators.

Gross domestic (GDP) numbers from the two countries paint a clear picture of how the economies are doing. Consumer Price Index, unemployment rate, industrial production, and retail sales are some economic indicators that people pay close watch to.

The economic indicators have strong potential to move USDCHF as their outcome goes a long way in influencing the kind of monetary policy that the central banks will pursue. For instance, the Non-Farm Payroll is one economic indicator that accrues a lot of interest.

The NFP paints a clear picture of the health of the US labor market. The report comes out on the first Friday of every new month. A better than expected print indicates the US economy is growing at an impressive rate, thus able to create more jobs. The unemployment rate is also part of the report.

Whenever the NFP beats expectations, the US dollar tends to strengthen. The net effect is usually the appreciation of the USDCHF pair due to people bidding on the USD against the Swiss francs.

While economic news out of Switzerland can move the pair, most attention is usually given to the economic data out of the US.

Political events and uncertainty

By virtue of being a safe haven, political developments influence USDCHF a great deal. The relative stability of the Swiss Francs sees it attract more bids whenever the globe is plunged into geopolitical tensions.

For instance, whenever there are tussles between the US and China, considered the two biggest economies globally, people scamper for safety on the USDCHF. In this case, players tend to hedge against the market risks created by the tensions by buying the Swiss francs, given the country’s relative political and financial stability.

Whenever the world is thrown into disarray, similar to the quagmire triggered by the COVID-19 pandemic, people also scamper for safety in safe havens such as the Swiss francs. During such uncertainties, the USDCHF will tend to edge lower in the currency markets traders bet on the francs at the expense of the dollar.

During the 2009 financial crisis, the Swiss franc appreciated against all the major trading partners. Consequently, the USDCHF declined significantly, hitting lows of 0.7066

Final thoughts

The prominence and popularity of the US dollar and Swiss francs is one of the reasons USDCHF is considered a major currency pair. Consequently, a huge amount of liquidity flows into it, giving rise to unique trading opportunities.

The economic data makes it an exciting pair to trade, given that information is readily available to gauge how the two economies are doing, consequently the strength of the underlying currencies. In addition, the monetary policies deployed by the FED and the SNB also influence USDCHF.