Forex is the most liquid market in the world, with the daily volume surpassing $6 trillion in 2019. Such volumes mitigate market risks, in general, allowing traders to enter and exit the currency market at expected prices.

Although forex is a busy market, the trading volume isn’t distributed evenly throughout a trading day. Why does it matter? The larger amount of money involved during a particular time, the more genuine and powerful moves tend to happen.

If more participants with big capital are involved in a particular price move, it’s easier to find and execute viable setups, enjoying a higher win rate and better risk-to-reward ratio.

Forex gaps are rare events that happen mostly at the week opening on Monday, so traders can usually anticipate them.

One of the drawbacks of forex is the inability to assess the accurate amount of volume information at any time, like in the stock market. However, if we know the periods when the market activity is logically and historically high, we won’t fall far behind seeing volume bars provided by stock exchanges.

Let’s look through the most active and intriguing times of the trading day in forex to be equipped for the next move!

New Zealand opening – let the day begin (22:00 UTC)

The trading week in forex starts on Monday when New Zealand opens. Usually, there’s not much volatility at this time, and a few traders may simply close their positions, causing pullbacks in Friday’s trends.

On Monday, the trading often starts with a gap, so make sure you’re aware of the risk in case the market gaps against your position.

In the 15m chart above, NZDUSD opened with a gap in early Monday, pulling back after Friday’s downtrend.

Trading warm-up as Tokyo and Sydney open (00:00 UTC)

When traders from Sydney, and especially Tokyo, join the market, the volatility picks up. You can expect decent price spikes. Also, this opening is some of the most volatile times for the pairs involving AUD, NZD, and JPY.

The chart below shows how the uptrend resumed at this time (see the circled candle).

You can consider closing your existent positions at this time as well if the price action gives a signal. Each price swing carries more meaning due to the higher volumes than during the “thin” New Zealand session only. We want to take the price action seriously at the critical price areas when Japanese traders join the market.

Suppose you were holding a short-sell position in AUDJPY (see the chart below), riding a short-term downtrend (see the orange arrow).

Look at the circled area in the chart above. Fifteen minutes before the Tokyo opening, the market tried to make a new low, slightly piercing 84.90; right after that, at the beginning of the Japanese session, the market confidently held above the 84.90, signaling that bears were losing the game. The sharp upward profit-taking started on the forty-fifth minute of the session.

Therefore, if you’ve been holding a trade overnight, be ready for radical reversals at this time.

Corporate and macroeconomic news from Japan is common around the opening, prompting investors to enter the market. Often the herd mentality kicks in, and other Japanese investors follow the direction of the trade.

Singapore tries the waters on the Tokyo’s 2nd hour (01:00 UTC)

Thirty minutes before the openings of Chinese financial centers – Shanghai and Hong Kong (01:30 UTC), the trading pace speeds up as participants are getting ready for massive trading volumes from China.

At the same time, a tiny Singapore tries the market waters, starting a city-state’s trading session. Due to the thin volumes, Singaporean traders usually don’t affect forex majors. However, if you’re interested in exposure to Singapore, try trading USDSGD at the opening, as it’s one of the most liquid and volatile periods for the exotic pair.

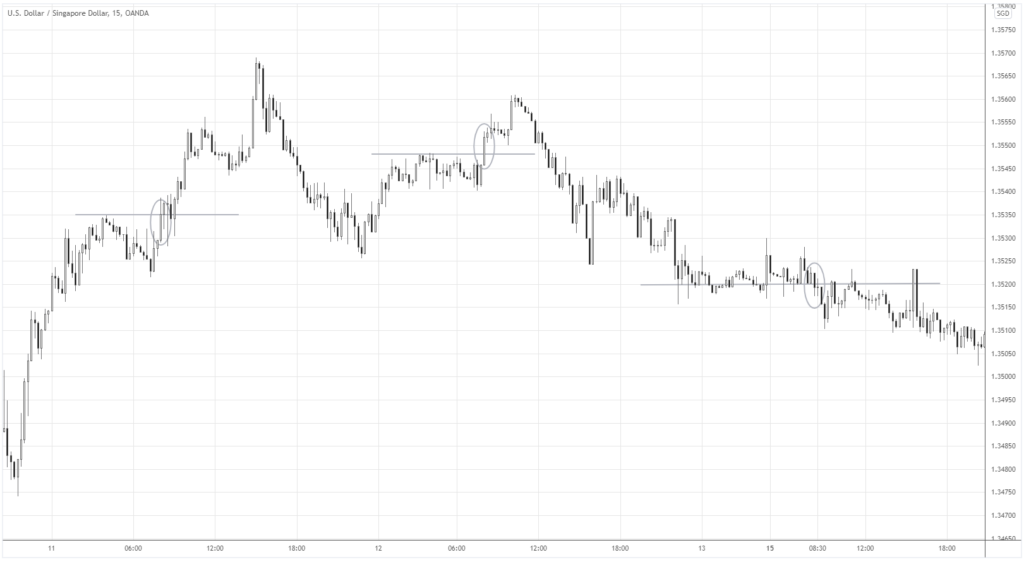

If you employ solid risk management, you can day trade the Singaporean dollar at the start of its session. The chart below shows how the pair breaks out the local levels in the first 15 minutes of the session, providing decent intraday moves.

Due to the pair’s modest volumes of trade, you can notice long wicks on the chart now and then. Stay vigilant as it’s often tricky to enter and exit the market as spreads can get pretty erratic.

Chinese step-in (02:30 UTC)

During the half an hour after Singaporean opening at 01:00 UTC, the euro tends to be weak, likely due to the need of Asian players to use USD for international trade. The illustration below shows that EURUSD was weak prior to the Chinese session (Singaporean opening is marked with a grey vertical line).

When Hong Kong and Shanghai open, the euro often grows. Such a phenomenon is related to China’s lack of need for more dollars in its export activities as China holds enormous gold and currency reserves and consistently buys US bonds.

The intraday EURUSD chart above shows how the euro starts growing when Chinese markets open (see the green vertical line)

Around the end of the Tokyo session, markets can get mixed as Asian exporters take some profits, grabbing both dollars and euros.

Asian-Pacific closing and the Chinese hour (06:00 UTC)

As the Australian and Japanese exchanges close, the volatility cools off, marking the end of a liquid Asian-Pacific period.

From 06:00 to 07:00 UTC, the Chinese traders set the market tone, like Hong Kong, Shanghai and Singapore are still open, but Europeans still didn’t get to their desks.

Often, If the euro has been declining till this point, the Chinese may drive up the prices.

The illustration above shows the euro growing intraday during the “Chinese hour.”

There is a lot of dealing going on in Asia, as the economic powerhouses like Japan and China export huge volumes of goods at competitive prices; thus, there’s a strong need for foreign currencies.

Summary

Forex is a unique market involving different economies, influencing forex depending on operational hours, sentiments, and seasonal factors. If you’re fluent in FX sessions’ personalities, it’s easier to control risk and find quality setups. Use the tips in this article to trade the Pacific and Asian sessions.