We Like:

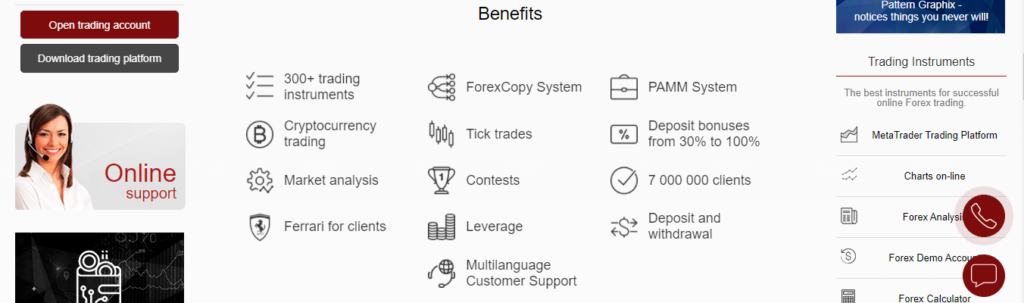

- More than ten years of experience in the trading space

- Trusted by seven million clients

- Deposit bonus 30%-100%

- Multiple payment options, including cryptos

- Provides a PAMM for traders to manage investors and earn incentives

- Offers Tick trades for beginners and inexperienced

- Clients’ funds are held in segregated accounts

- Offers negative balance protection to all levels of traders

- It also provides a copy trading system for investors and signal providers

- Leverage of up to 1:1000

- Provides cutting-edge trading tools like FX calculators and indicators

- Offers a demo account

We Don’t Like:

- Regulated by low-tier regulatory agencies making it a risk broker

- Charges an inactivity fee capped at $10 every month after 12 months of an account’s dormancy

- Limits its services to clients based in the USA and other regions under the same policy

- Fewer tradable instruments compared to other brokers

- It operates entities located in offshore areas such as Belize and St Vincent, and the Grenadines

The Verdict:

It is an online FX and CFDs trading brokerage company headquartered in Moscow, Russia. It is authorized and regulated by the FSC of the BVI under the Securities and Investment Business Act (SIBA). Besides online trading, InstaForex is known to offer investment services backed by a PAMM system and a copy trading platform that, in tandem, allows easy management of investors and strategy mirroring.

The broker pioneered in the trading space in 2007, aiming to offer instant access to a wide range of markets by leveraging innovative IT solutions. It now reports having won the hearts of more than seven million clients from around the globe. The clientele invests and trades the broker’s 300+ tradable instruments with instant market access, spreads from three pips, and leverage of up to 1:1000.

Company details

A group of technology firms dubbed InstaFintech brought their ideas together in 2007 and founded InstaForex. Their goal was to develop an online FX and CFDs trading platform fueled by cutting-edge technology to offer instant market access and an array of investment services.

InstaForex later received registration and regulation from the Financial Services Commission (FSC) of the British Virgin Islands (BVI). The regulation gave InstaForex the force needed to diversify its products and expand.

It quickly inked a deal with the MetaQuotes Software company to integrate the software provider’s popular trading platforms like the MT4 and its predecessor MT5. Next, it collaborated with western liquidity providers giving it access to the foreign exchange market. InstaForex maintained the growth trajectory, and after a decade, it prides itself as one of the best brokers in Europe.

The broker holds a portfolio of awards in its trophy cabinet and claims to serve more than seven million clients worldwide. The client network is composed of traders and investors exploring the liquidity provider’s 300+ tradable instruments. The array of products trade with instant executions, market spreads starting from three pips, and a leverage of up to 1:1000.

InstaForex Markets include:

- FX pairs 110 crosses

- Commodities

- Indices

- Metals

- Cryptos

Traders speculate these assets as FX and CFDs using InstaForex trading platforms on their chosen account type. The trading accounts have different conditions tailored to favor specific clients, but they all have access to the same trading platforms.

InstaForex provides the popular MetaQuote trading platforms (MT4 & MT5) integrated with cutting-edge trading tools for instant market access. Nonetheless, for investors, InstaForex provides a PAMM and a copy trading system that simplifies investment activities for the clients.

Integrated trading tools at InstaForex include:

- Economic calendar

- Trading calculators

- FX indicators

- Online charts

- VPS hosting

- PAMM (for managing investors)

- Copy-trading system (for investors to follow and mirror strategies of signal providers)

- Educational tools (for novice traders)

The above trading tools make it easy for the InstaForex community to hedge when speculating the markets. Either as a trader, investor, or a beginner. However, the clients must fund their trading accounts with a set monetary value to reasonable net yields.

The broker offers a minimum deposit of $1 across the accounts but urges clients to increase their balances for effective trading and investing. Clients also benefit from various incentives at InstaForex, including a bonus of 30%-100% on deposits. Moreover, the broker provides multiple payment options to aid in seamless and real-time transactions to the 7M+ worldwide clientele.

Available payment options

- Credit/Debit cards like Visa and MasterCard

- Bank wire transfers

- E-wallets like Neteller and Skrill

- Cryptocurrencies — mainly BTC

InstaForex assures to hold clients’ funds in segregated accounts once funded for security. It also couples this monetary benefit with negative balance protection, preventing users from losing more than they invested.

In addition, it operates under the surveillance of the FSC of BVI, St. Vincent, and the Grenadines and abides by financial laws imposed by the CySEC. However, top-tier agencies do not regulate InstaForex and lead branches based in offshore regions, making it a risky broker to trade with.

Regulations

Its licenses and registrations:

- InstaForex Limited is authorized and regulated by the FSC of the BVI, license number SIBA/L/14/1082.

- Insta Service Ltd is registered with FSC Saint Vincent, reg. number IBC22945.

- Insta Global Ltd is also registered in Saint Vincent, reg. number IBC24321.

- The forex and CFDs liquidity provider also falls under the CySEC jurisdiction.

Trading platforms

InstaForex provides an array of trading platforms tailored to meet different clients’ needs. Traders can choose the MT4 or MT5 and have access to a web trader and the broker’s proprietary platform dubbed InstaTickTrader.

Analysis of InstaForex Platforms

MetaTrader 4

- Time frames — 9

- Multiple tools for technical analysis — yes

- Online financial news feature — yes

- Automated trading — yes

- Locked positions — yes

- Free indicators and advisors — yes

- Programming language — MQL4 (create your indicators and advisors)

- One-click trading — yes

- Trailing stop

- High security fueled by 128-bit encoding

MetaTrader 5

- 21-time frames

- Market Depth (level II pricing) and contract specifications

- MQL5 – the new-generation programming language for designing expert advisors and indicators

- Quotes archive

- An advanced set of technical tools

- Fill policy — a new field in the order window

- Expiry dates for pending orders

- Ready-made expert advisors, indicators, and scripts available on the in-built online store

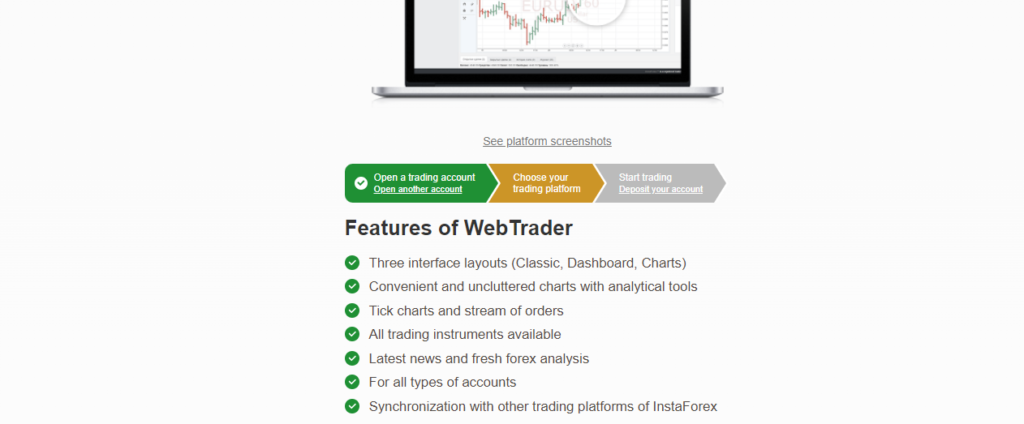

WebTrader

- Three interface layouts (Classic, Dashboard, Charts)

- Convenient and uncluttered charts with analytical tools

- Tick charts and stream of orders

- All trading instruments available

- The latest news and fresh forex analysis

- For all types of accounts

- Synchronization with other trading platforms of InstaForex

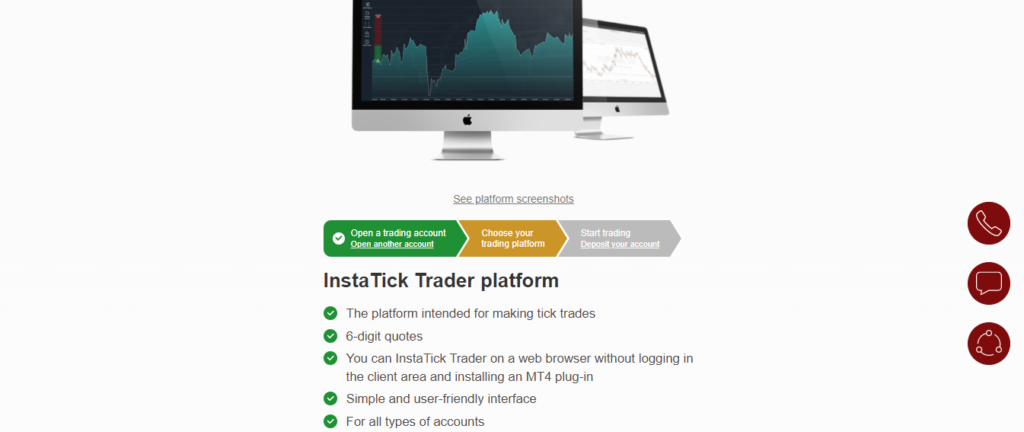

InstaTick Trader platform

- The platform intended for making tick trades

- 6-digit quotes

- You can InstaTick Trader on a web browser without logging in to the client area and installing an MT4 plug-in

- Simple and user-friendly interface

- For all types of accounts

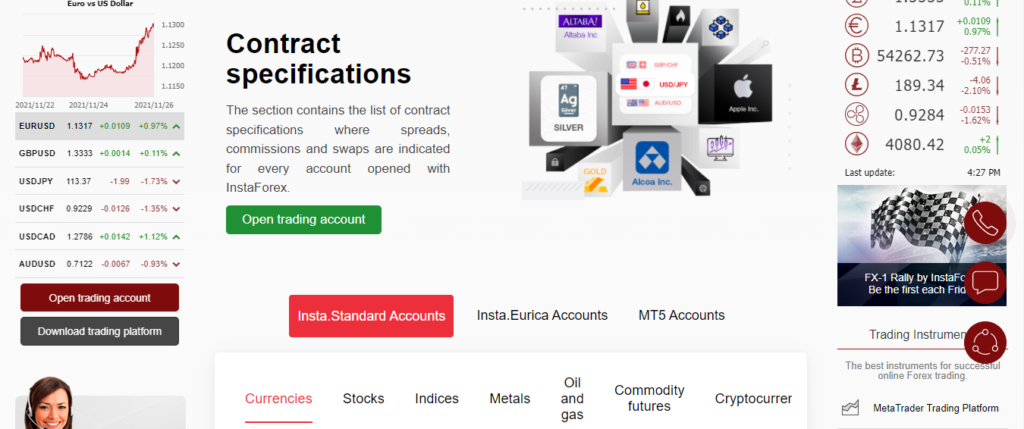

Range of markets

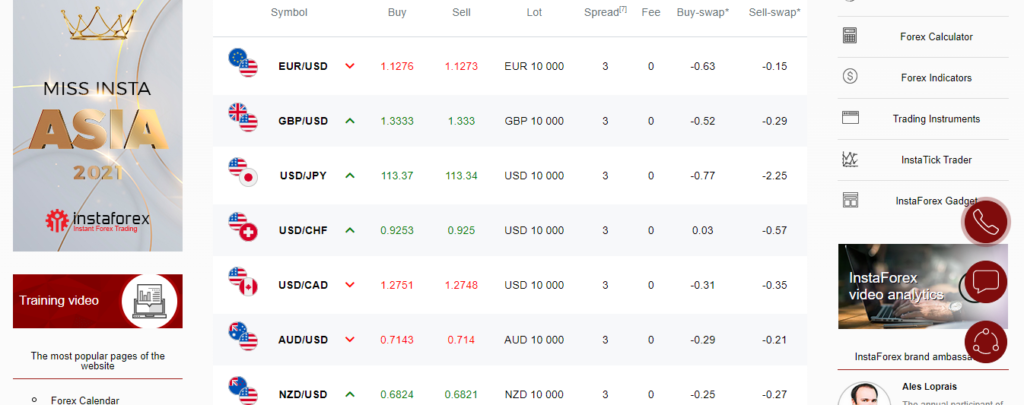

InstaForex allows traders and investors access to a wide range of markets that they speculate as forex and CFDs with instant executions, meager spreads starting from three pips, and leverage of up to 1:1000. Collectively, the markets yield 300+ plus tradable instruments that include 220 forex crosses, Stocks, Indices, Metals, and commodities.

Forex

The foreign exchange market at InstaForex supports about 220 currency pairs involving significant currencies, minor, and exotics. They trade 24/5 with instant executions and competitive spreads starting from three pips. Traders can buy-swap or sell-swap on these instruments like EUR/USD, GBP/USD, and many more.

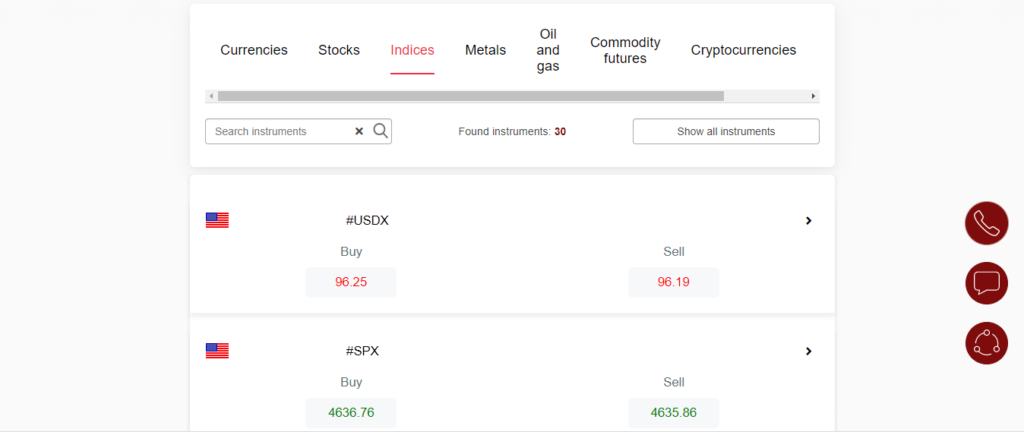

Indices

InstaForex provides access to 30 indices from global exchanges that traders and investors speculate as CFDs with low commissions and competitive margins. The market supports products such as France 40, FTSE, DAX, and a couple of others.

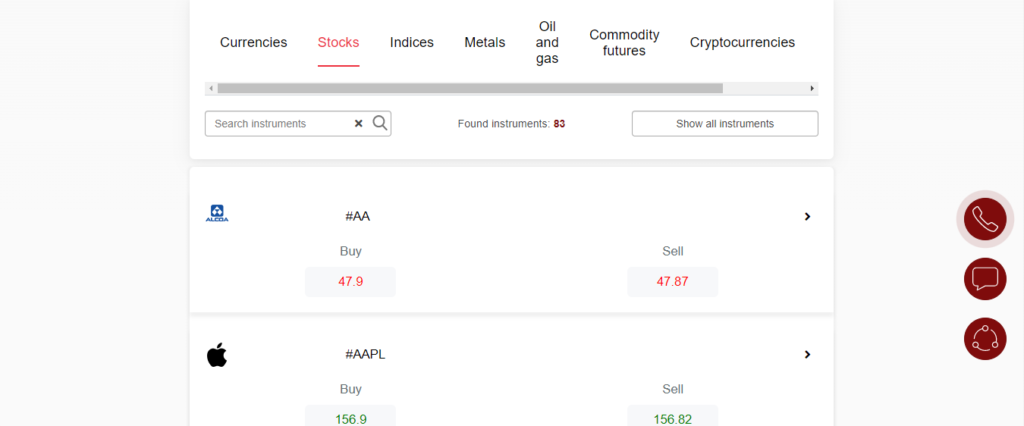

Stocks

The stock market at InstaForex holds 83 tradable stock instruments from major companies. Traders can buy-swap and sell-swap the stock products with competitive spreads guided by the 24/7 InstaForex multilingual support. Stock trading also attracts fees depending on the instrument being traded. Some of the available products include #AAPL, #AMD, #AMZN, and a lot more.

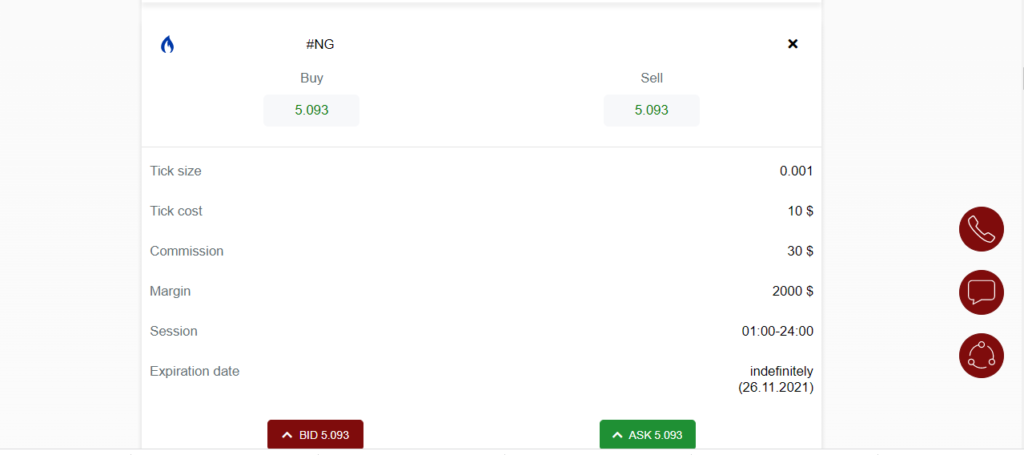

Oil and gas

They are hard commodities under the energies class offered by InstaForex as CFDs. Traders and investors speculate on these instruments without owning the underlying asset. About 34 oil and gas products, including natural gas trade with commissions and tick costs, capped at $30 and $10, respectively.

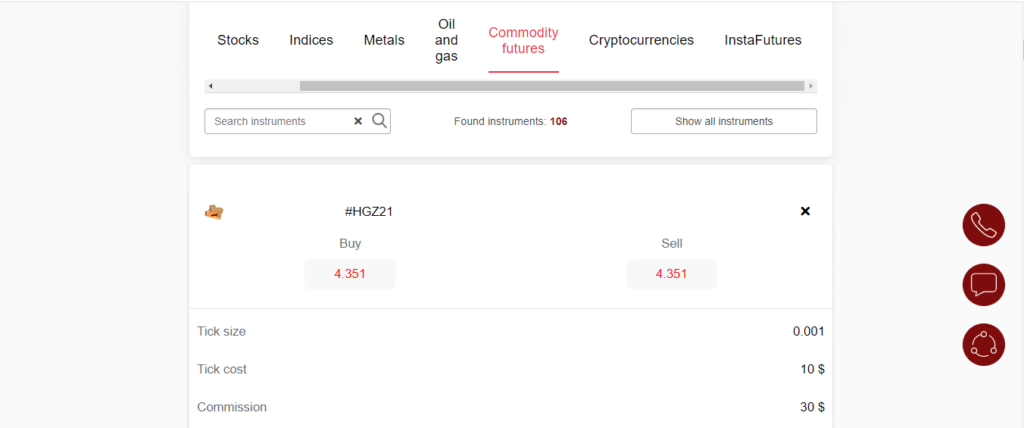

Commodity futures

Futures are simply assets traded at predetermined times and prices. InstaForex offers such assets on commodities such as precious metals, energies, and an array of soft commodities. The products sum up to 106 and trade with a commission capped at $30 and a tick cost of $10.

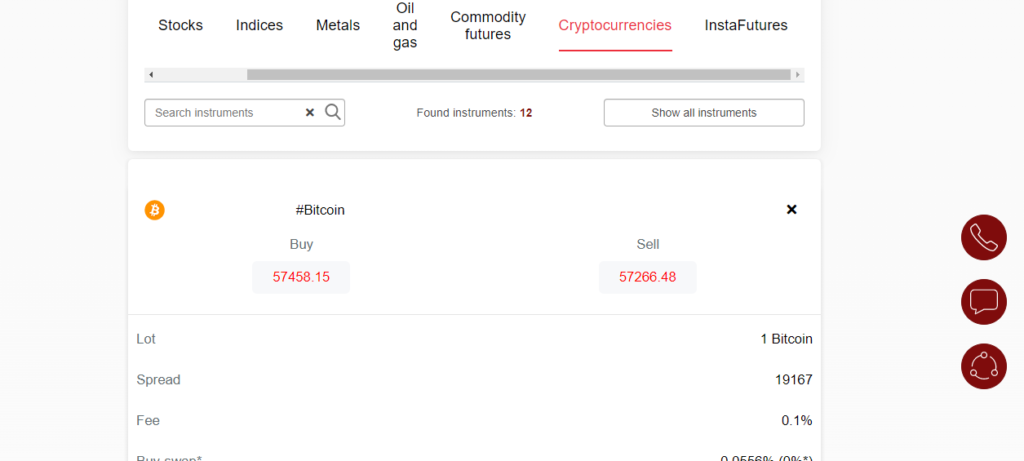

Cryptocurrencies

InstaForex offers clients access to the world’s most volatile markets. Clients speculate 12 digital assets as CFDs with a fee capped at 0.1%. The instruments include BTC, BCH, Cordano, and a few others.

Main features

- Powerful trading tools and platforms

- Market analysis feature

- Copy-trading system for signal providers and investors

- A PAMM system for traders to manage investors

- 24/7 Multilingual customer support

- Multiple payment options

- A wide range of markets

- Participate in Tick trades that best come in handy to newbies.

Types of trading accounts

InstaForex provides an array of account types tailored to meet the needs of different clients. Traders and investors select the account type that best fits their motives geared by features such as commission on trades, swap-free, and others. Moreover, the broker provides a demo account to traders looking to boost their trading skills.

The live accounts include:

- Insta.Standard trading account

- Insta.Eurica trading account

- Cent.Standard trading account

Insta.Standard account

- Deposit currency — EUR, USD

- Min. deposit — $1

- Max. deposit — no limit

- Spreads — 3-7 pips

- Fee — 0%

- Minimal trade — 0.01 of the lot

- Max. trade — 10000 lots

- Leverage — 1:1000

- The margin for locks — 25%

- Margin call — 30%

- Stop Out — 10%

- Order execution — Instant execution

Insta.Eurica account

- Deposit currency — EUR, USD

- Min. deposit — $1

- Max. deposit — no limit

- Spreads — 0.0 pips

- Fee — 0.03% – 0.07%

- Min. trade — 0.01 of the lot

- Max. trade — 10000 lots

- Leverage — 1:1000

- The margin for locks — 25%

- Margin call — 30%

- Stop Out — 10%

- Order execution — Instant execution

Cent.Standard account

- Deposit currency — EUR, USD (cents)

- Min. deposit — $1

- Max. deposit — $1000

- Spreads — 3 – 7 pips

- Fee — 0%

- Min. trade — 0.10 of the lot

- Max. trade — 10000 lots

- Leverage — 1:1000

- The margin for locks — 25%

- Margin call — 30%

- Stop Out — 10%

- Order execution — Instant execution

Cent.Eurica account

- Deposit currency — EUR, USD (cents)

- Min. deposit — $1

- Max. deposit — $1000

- Spreads — 0.0 pips

- Fee — 0.03% – 0.07%

- Min. trade — 0.10 of the lot

- Max. trade — 10000 lots

- Leverage — 1:1000

- The margin for locks — 25%

- Margin call — 30%

- Stop Out — 10%

- Order execution — Instant execution

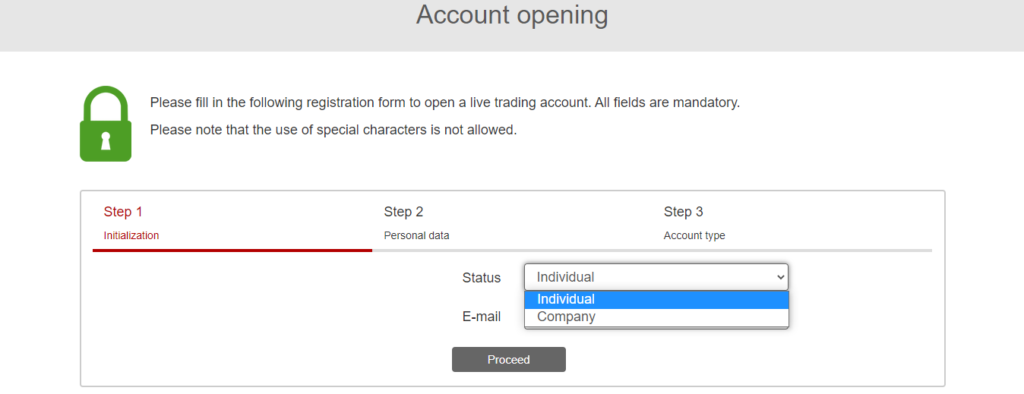

Opening an account at InstaForex

Step 1. Log into their website and click the Open a trading account button.

Step 2. Choose an Individual or Company account.

Step 3. The data is processed, and the email is verified.

Step 4. Select the account type and receive log-in details.

Step 5. Fund your account.

Step 6. Start trading.

Commissions and spreads

The broker primarily operates as a market maker but couples an NND service through Insta.Eurica account. The spreads through the other accounts start from one pip and three pips to a maximum of seven pips, meaning clients incur fees added on the spread.

On the other hand, Insta.Eurica account clients trade with low spreads but face commissions averaging 0.03% to 0.07% on trades. This fee is also applicable to the one pip traders. In addition, the broker adds commissions on CFDs such as stocks, commodities, and futures, and Tick trades.

Customer service

InstaForex claims to provide a 24/7 multilingual customer support team that helps clients accomplish their trading goals. Clients can contact the support team through emails, live chat, and calls. In addition, the broker’s website supports bots that allow clients to request a callback from the support team or a response message.

Moreover, InstaForex provides a FAQ section and an educational platform that allow traders to search for answers about the most raised queries and understand more about trading.

InstaForex Review

What we liked

- Easy to open an account

- Offers copy-trading

- Rich educational platform

- Several trading platforms and accounts

- Instant executions

- Dedicated customer support

- Powerful trading tools and platforms

What we disliked

- Not accepted in the USA

- Operates subsidiaries in offshore regions

- Not regulated by reputable agencies

- Commissions on CFDs

The bottom line

FX and CFDs brokerage company InstaForex operates as online trading and investment platform. The broker reports serving over seven million clients from around the globe that speculate and invest in its 300+ tradable instruments.

It offers competitive spreads from three pips and instant executions and shuffles its market-making model with an NDD service via Insta.Eurica account that provides clients with meager spreads capped at 0.0 pips. Also, InstaForex offers vast leverage that extends up to 1:1000.

However, it could be risky trading with InstaForex as it does not own any top-tier regulation licenses and operates offices based in offshore regions. In addition, the broker charges commissions on CFDs and some of the accounts. It also adds an inactivity fee capped at $10 per month after a year of dormancy.