We Like:

- Trade with zero commissions

- No hidden charges

- Fees only added to the spread

- No deposit and withdrawal charges

- No inactivity fees

- Offers negative balance protection

- Regulated by a top-tier body — the FCA

- Leverages innovative technology for smart trading

- Well-furnished educational materials

- Trade over 4000 markets

- Invest in instruments such as stocks

- 24/7 multilingual customer support

We Don’t Like:

- Spreads vary depending on the instrument

- Charges overnight fees depending on the leverage

- Some payment options may include a transaction fee

- Not accepted in the USA

The Verdict:

Capital.com is an online trading brokerage company based in London, England. It offers clients various financial services such as CFDs trading, spread betting, and investments in products like stocks. The broker claims to leverage cutting-edge technology such as AI tools that monitor clients’ trading activities to offer the best-tailored wherewithal information.

It made its debut in the financial space in 2012 under the UK-based investment firm VP Capital. Capital.com, coupled with other financial projects dubbed Banuba and Facemetrics, sum up VP Capital’s umbrella of startups founded by Viktor Prokopenya. The entrepreneur’s goal behind launching Capital.com was to mitigate barriers in financial trading.

The liquidity provider now confirms serving over 788,000 registered clients speculating its 4000+ financial instruments with zero commissions, tight spreads fluctuating from 0.7 pips, competitive leverage extending to 1:200 for professionals, and innovative technology.

Company details

CFDs and spread betting liquidity provider Capital.com operates as a UK-based investment firm, VP Capital. The conglomerate premiered in the financial industry in 2012 with a strong portfolio that entailed an innovative trading broker and supported two other milestone projects cited as Banuba and Facemetrics. Viktor Prokopenya was the brain behind the entire project. His motive towards Capital.com aimed to roll out a state-of-the-art trading platform that allowed seamless trading backed by powerful technology.

Capital.com implemented the founder’s vision by harnessing AI-powered technology among an array of other sophisticated IT solutions to shave down mere barriers in financial trading. The innovative features gave Capital.com traction to offer transparent prices, zero commissions, and competitive leverage. Currently, it notes hitting a milestone of $13 billion traded volume and serves more than 788,000 clients that speculate its wide range of markets for CFDs trading and investment services.

The broker includes:

- Forex

- Commodities

- Indices

- Shares

- Cryptos

These markets yield 4000+ tradable instruments that clients trade with tight spreads and no hidden charges through the broker’s trading platforms. Capital.com offers smart trading platforms integrated with top-notch technology.

Clients choose either the MT4 or its award-winning proprietary platform available as an App and on the Web. The trading tools provide a profitable trading environment by helping clients to double their investments.

Integrated trading tools at Capital.com:

- Economic calendar

- Technical indicators

- Multiple charts

- Price alerts

- Sentiment indicators

- AI-powered tool

But for clients to use these tools to make good returns, they must fund their trading accounts with any amount starting from the accepted minimum deposit of $20. Capital.com provides multiple payment options and assures to cover all deposit and withdrawal fees for clients. However, some payment methods may charge a transaction. But, Capital.com also offers benefits like negative balance protection and no inactivity fees allowing clients to trade with freedom.

Available payment options:

- Mac Pay

- Visa

- MasterCard

- Wire transfers

- Worldpay

Capital.com operates four offices based worldwide, but the head office is headquartered in London, United Kingdom. Each office falls under a specific jurisdiction allowing the broker to have a regulation imprint from different regulatory agencies led by the FCA.

Regulations

- Capital Com (UK) Limited is registered in England and Wales with company registration number 10506220.

- Authorized and regulated by the Financial Conduct Authority (FCA), under register number 793714.

- Capital Com SV Investments Limited is a Cyprus Registered Company with Company Registration Number HE 354252. The Cyprus Securities and Exchange Commission (CySEC) is Authorized and regulated under license number 319/17.

- Capital Com Australia Limited (ABN 47 625 601 489) is registered in Australia and regulated by the Australian Securities and Investments Commission (ASIC) under AFSL 513393.

Trading platforms

Clients have the option to choose multiple trading platforms at Capital.com. As mentioned, it provides an array of trading platforms integrated with powerful tools for smart trading. The MT4 platforms operate on all terminals allowing clients to trade from anywhere while the broker’s proprietary platform is available on mobile as web.

Analysis of Capital.com Platforms

MetaTrader 4

- Expert advisors for algorithmic trading

- Accessibility from any device

- Trading signals from top providers

- Market-leading spreads and low commissions

- Leverage up to 1:200

- Lightening-fast order execution

Capital.com Web trading platform

- Award-winning online trading platform

- 75+ technical indicators

- Multiple trading chart types

- Extensive drawing tools

- Ability to control risks with stop-loss and take profit

- Personalized watchlists

- Integrated hedging and risk management tools

Capital.com mobile app

- User-friendly interface

- Access to over 4,000 markets

- In-depth financial analysis fueled with 70+ technical analysis indicators

- Price alerts

- Education and support

- User data protection

- Create up to 10 demos and live accounts

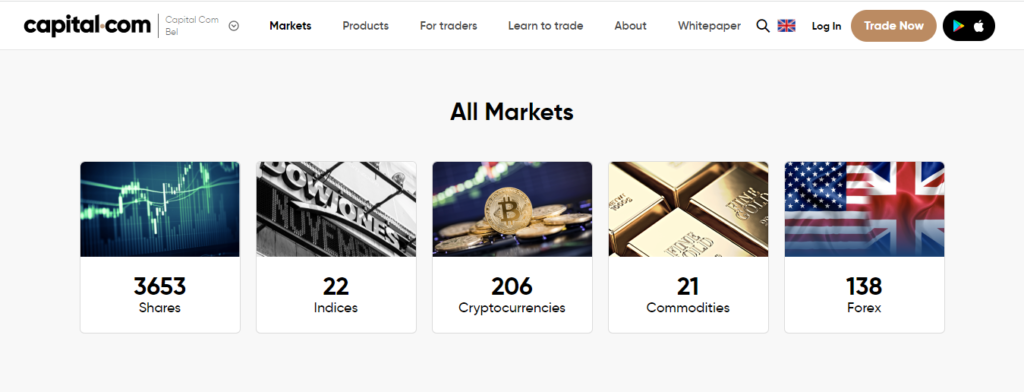

Range of markets

Capital.com notes to provide a wide range of markets supporting more than 4000 tradable instruments. Clients trade and invest in some of these products with leading-market spreads, zero commissions, and competitive leverage.

Forex

The broker supports 100+ currencies consisting of significant, minors, and exotic pairs. They trade either as CFDs allowing clients to speculate on the falling and rising prices or with a leverage of up to 30:1. Such instruments include GBP/USD, EUR/USD, and many others. The market opens 24/5, and the products trade with leading-market spreads.

Indices

About 22 indices from the world’s major stock markets trade at Capital.com as CFDs. Clients go long or short on popular indices such as the Dow, FTSE 100, S&P 500, and many others.

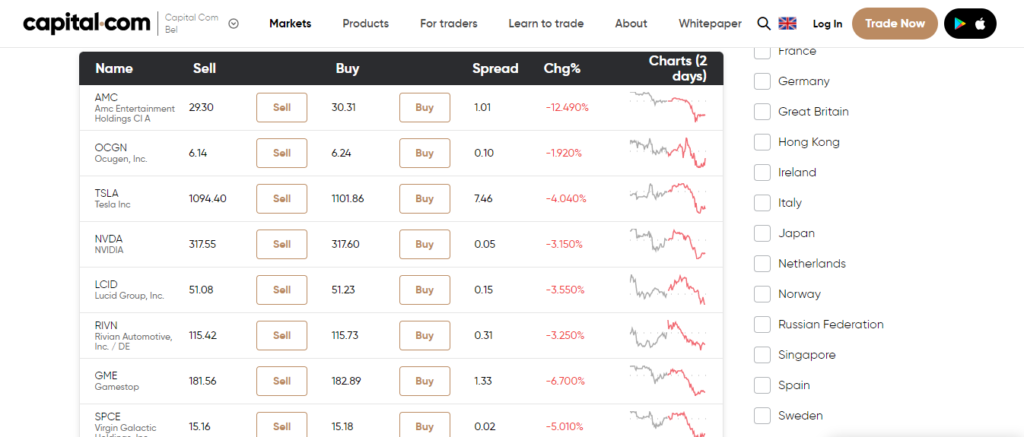

Shares

Clients trade more than 3,000 shares from global companies as CFDs with speedy executions and competitive spreads. Shares traded include TSLA, AMC, BABA, PYPL, TWTR, and a lot more.

Commodities

Capital.com offers a wide range of commodity products encompassing hard and soft commodity products. The market generally holds energies, metals, and agricultural products like cotton. They all trade as CFDs allowing clients to go long or short hence having the hedge even when the markets go down. The instruments include natural gas, crude oil, gold spot, silver, and many more.

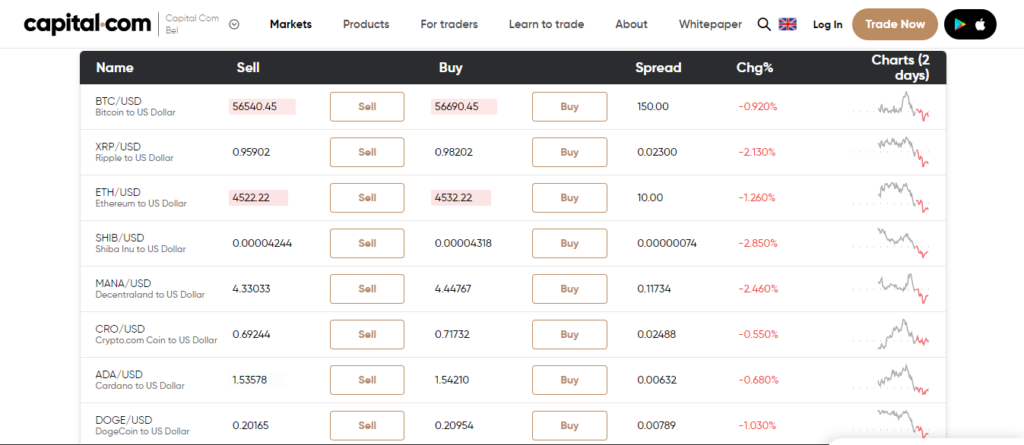

Cryptocurrencies

Capital.com confirms to offer a spectrum of digital assets instruments as CFDs allowing clients to trade the products without owning the underlying asset. Such assets include BTC, ETH, Ripple, LTC, and a few others. They trade with competitive leverage and spreads quoted against the USD.

Main features

- Trade with a state-of-the-art trading platform designed to make trading smarter and simpler.

- It offers an AI tool that analyzes your trading behavior and helps make profitable decisions.

- Clients have access to over 4,000 markets.

- Traders can never lose more than they invest as the broker provides negative balance protection, stop-loss, and take-profit.

- It operates under a reputable regulatory framework pillared by the FCA.

- Waives all deposit, withdrawal, and inactivity fees for clients.

- Provides powerful trading platforms integrated with cutting-edge tools.

Types of trading accounts

Capital.com alleges to provide an array of live accounts tailored to serve special types of clients and a demo account for novice traders to uplift their skills. The accounts come with different conditions suited for retail or professional traders.

The live accounts include:

- Standard account

- Plus account

- Premier account

- Professional account (no negative balance protection, but clients trade high leverage)

Standard account

- Min. deposit from $20 up to $3,000

- Leverage up to 1:30

- Access to advanced charts and a range of markets

- Negative balance protection

Plus account

- A min. deposit of $3,000

- Leverage up to 1:30

- Access to advanced charts and a range of markets

- Negative balance protection

- Access to customized analytics

- Access to a dedicated account manager

Premier account

- Min. deposit of $10,000

- Access leverage up to 1:30

- Access to advanced charts and a range of markets

- Negative balance protection

- Access to customized analytics

- Access to a dedicated account manager

- Access to exclusive webinars

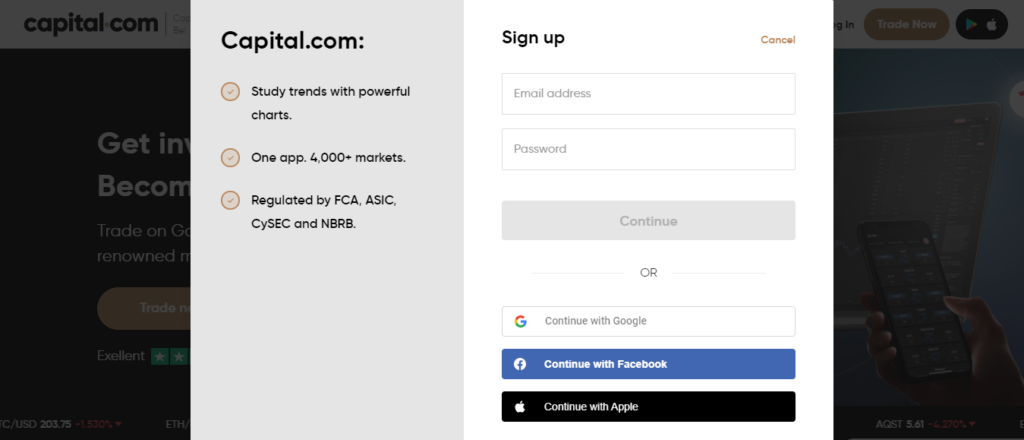

Opening an account at Capital.com

Step 1. Log into their website and click the trade now button.

Step 2. Enter your email address in the form that pops up.

Step 3. Verify email and choose the account type.

Step 4. Log in to your account.

Step 5. Fund the account with the required amount.

Step 6. Start trading.

Commissions and spreads

Capital.com operates entirely as a market maker backed with innovative technology to offer clients leading-market spreads. It discloses that it only adds fees on the spread and does not charge traders any commissions. However, the minimum spread depends on the instrument. In addition, it notes to cover all fees on deposit and withdrawals, but some payment options may charge their fees. Clients also trade with freedom as the broker does not charge any inactivity fees.

Customer service

The London-based CFDs provider claims to provide 24/7 multilingual customer support. Clients can reach the support team through various channels such as live chat, email, and phone calls. Nonetheless, Capital.com also provides its social media accounts like telegram, WhatsApp, Messenger, and Viber to diversify the customer service channels. It also provides resourceful educational materials that help boost traders’ skills.

Capital.com Review

What we liked

- Easy to open an account

- Top-tier regulated broker

- Zero commissions

- Rich educational platform

- Instant executions on the MT4 platform

- Dedicated 24/7 customer support

- Cutting-edge trading platforms integrated with smart tools

What we disliked

- Not accepted in the USA

- Does not provide the account type information on the website

- Clients incur overnight fees

The bottom line

Capital.com operates as a market maker broker offering clients a wide range of markets that they speculate with competitive spreads, leverage, and zero commissions as CFDs. Besides trading, the liquidity provider also alleges to offer investment services of products like stocks.

It also falls under a legit regulatory framework led by agencies such as the FCA, ASIC, and CySEC, giving it the imprint of a safe broker. However, clients may face high spreads on some instruments, and the broker fails to provide detailed information about its account types on the website.