Gaps are specific candlestick pattern and generally occur when there is a significant gap between two candles. In this case, the low and open price remains higher than the high and close price of the previous candle.

Gaps generally represent extreme conditions during any news release or price sensitive information.

Gaps are profitable as the price movement is very sharp during gap formation. Here is an example showing a bearish gap in the candlestick,

In the bullish gap, low price of the current candle would be higher than the high price of the previous candle. In the bearish gap, the high price of the current candle would be lower than the low price of the previous candle.

Types of Gap:

There are different types of the gap. These are as follows,

- Breakaway Gaps

- Exhaustion Gaps

- Common Gaps

- Continuation Gaps

Breakaway Gaps:

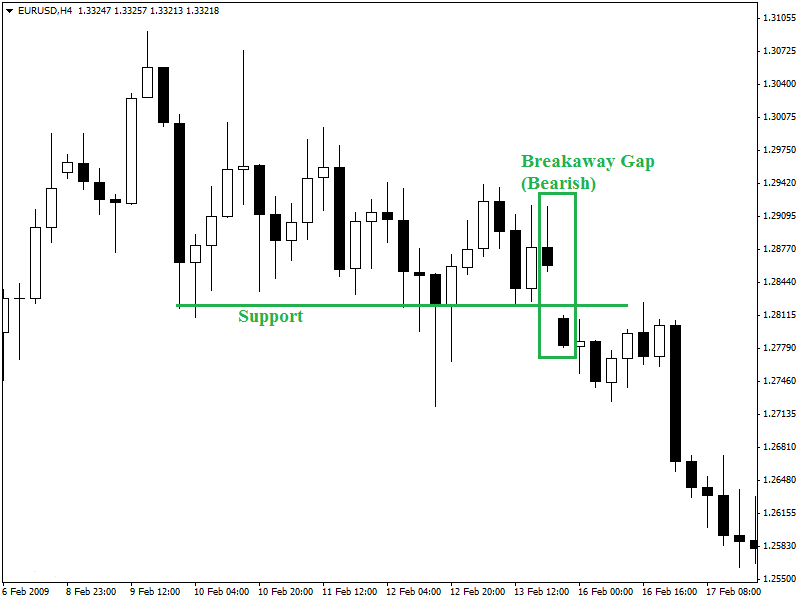

This pattern is generally found during breakout or breakdown. This pattern can be taken as the buy or sell signal which is the beginning of a new trend. If this pattern is found during a breakout of resistance line, then it is considered as a bullish candle. This scenario indicates a highly possible bullish trend.

4-hour chart of EUR/USD (given above) is showing a bearish breakaway gap. This gap occurred during the breakdown of the support line. This breakaway gap should be considered as an entry signal for a short position.

Exhaustion Gaps:

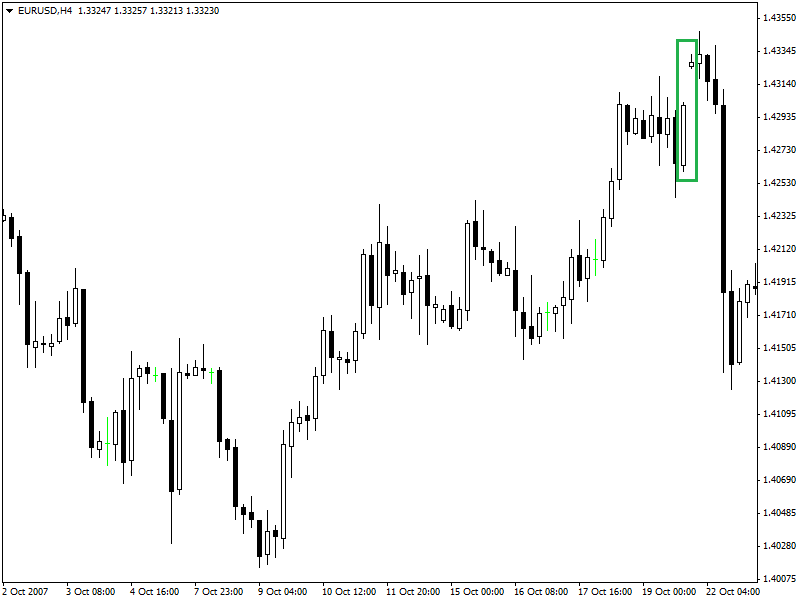

This type of gap generally found after a prolonged up or down trend. This pattern exposes the extreme up or down move and indicates a possible reversal. Traders get into a long position as they find an exhaustion gap pattern after a prolonged downtrend.

Inversely, an exhaustion gap after a prolonged downtrend would be an entry signal for a short position.

4-hour chart of EUR/USD is showing an example of exhaustion gap which has found at the end of an uptrend. This is a reversal and an entry signal for a short position.

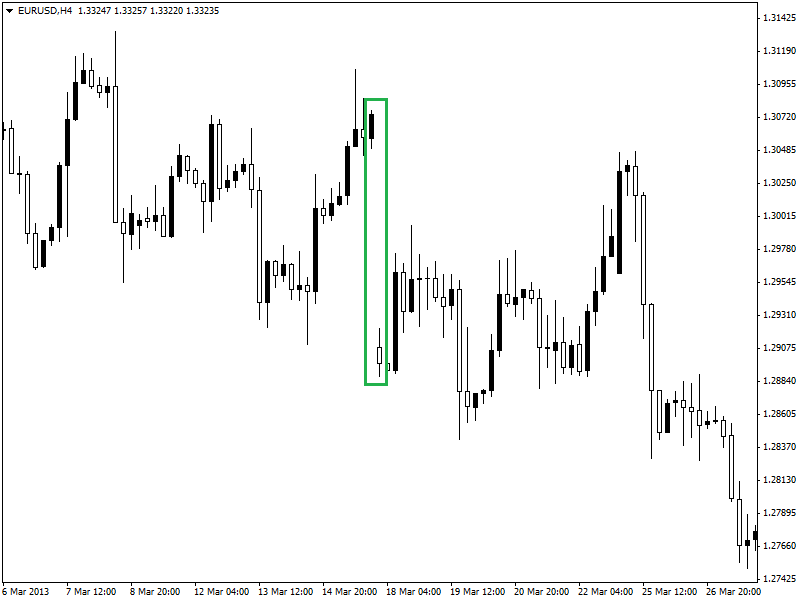

Common Gaps:

These gaps are neither breakaway nor exhaustion gaps. These gaps are not considered as patterns. The distance between two candlesticks confirms this type of gap. Traders usually do not trade or take any decision based on this gap.

4-hour EUR/USD chart is showing a common gap as there was a distance between two candlesticks.

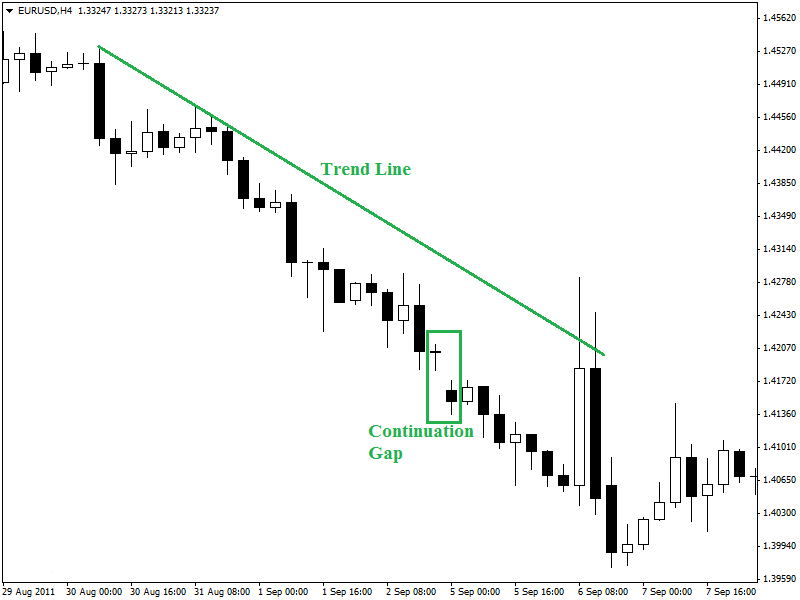

Continuation Gaps:

This type of gap is found in the middle of chart pattern and indicates the possible continuation of the current trend. Continuation gap in an uptrend indicates the possibility of the continuation of the uptrend.

Inversely, in a downtrend, a continuation pattern indicates a possible continuation of the prevailing trend.

4-hour chart of EUR/USD (given above) is showing a continuation gap pattern as it was found in a downtrend. Due to this bearish continuation gap, the price of this pair has suffered further fall after the pattern formed.

Summary:

Trading the gaps is an effective trading strategy. Traders should use defined stop loss, profit target, and other money management tools. A disciplined approach is a must requirement for any kind of successful trading.