Bollinger band is a volatility indicator developed by John Bollinger. This indicator measures volatility based on standard deviation. Bollinger band is most used volatility indicator and one of the widely used indicators in technical analysis.

Calculation:

Calculation of Bollinger band is based on a simple moving average. The default period of Bollinger band and moving average is 20. However, many traders use Bollinger bands of 15 or 25 periods. The calculation of Bollinger band is as follows,

Middle Band = 20 day SMA or Simple Moving Average

Upper Band = 20 day SMA + (20 day Standard Deviation)

Lower Band = 20 days SMA – (20 day Standard Deviation)

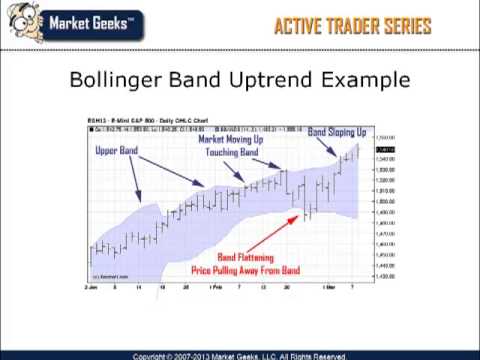

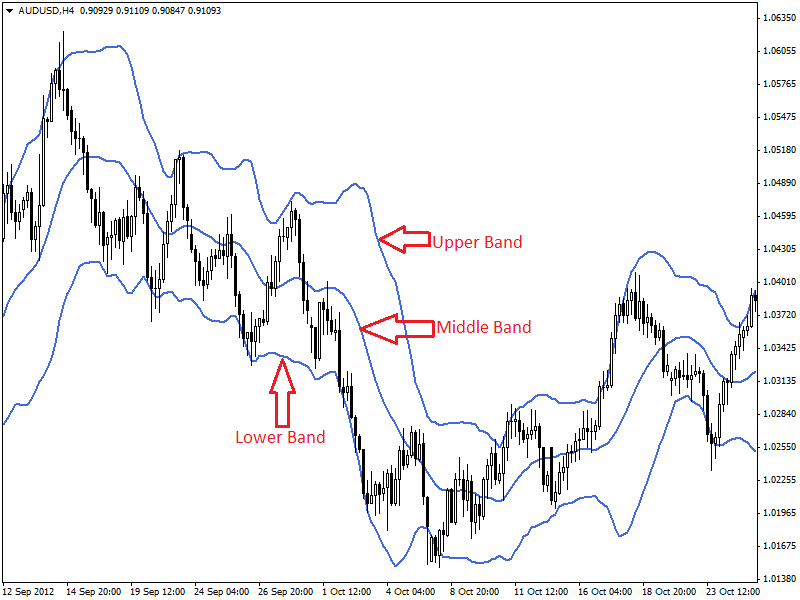

Bollinger band appears as a band consists of 3 moving averages like lines. Here is an example chart containing Bollinger bands.

Interpretation:

Bollinger band can be used in many ways. Different traders use this indicator in different ways. Such as,

- Bollinger Band Bounce

- Bollinger Band Squeeze

- Bollinger Band Breakout

Bollinger Band Bounce:

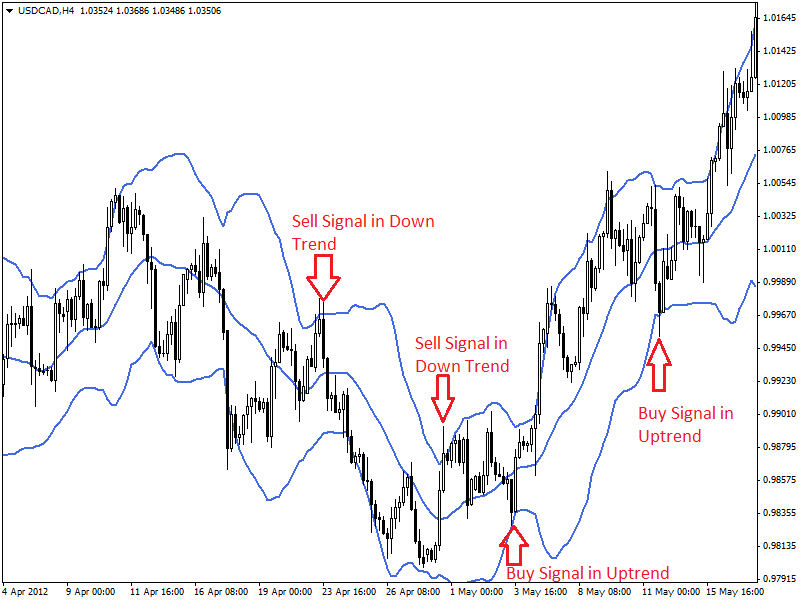

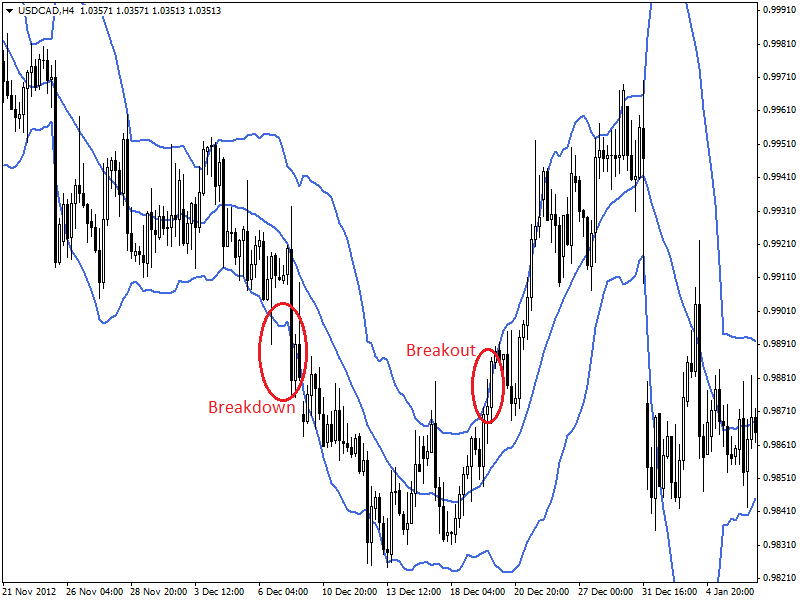

This is very simple and effective trading method for short term trading. Traders usually use this for short term trading or scalping in the forex market. This strategy involves buying when candlestick hit the lower Bollinger band and selling when candlestick hit upper Bollinger band.

It is better if you follow the trend while trading Bollinger band bounces.

4-hour chart of USD/CAD is showing several entry signals for both long and short positions.

Bollinger Band Squeeze:

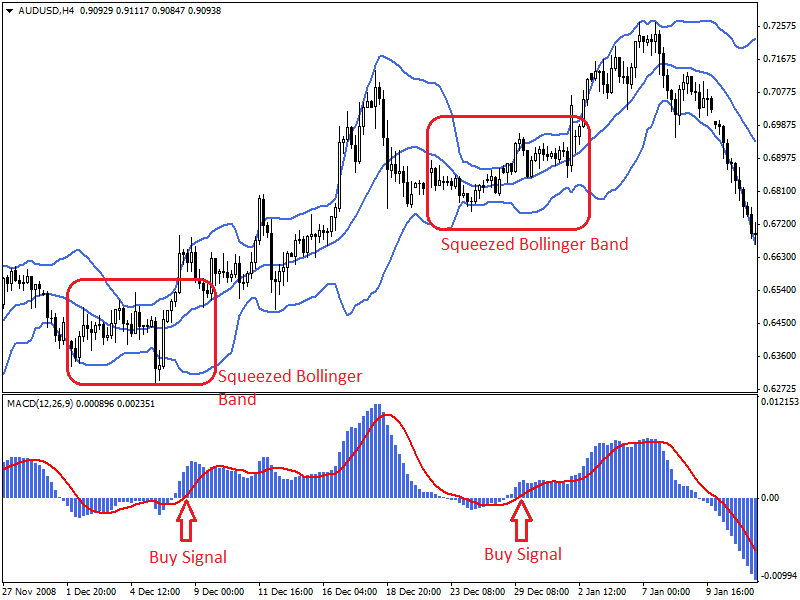

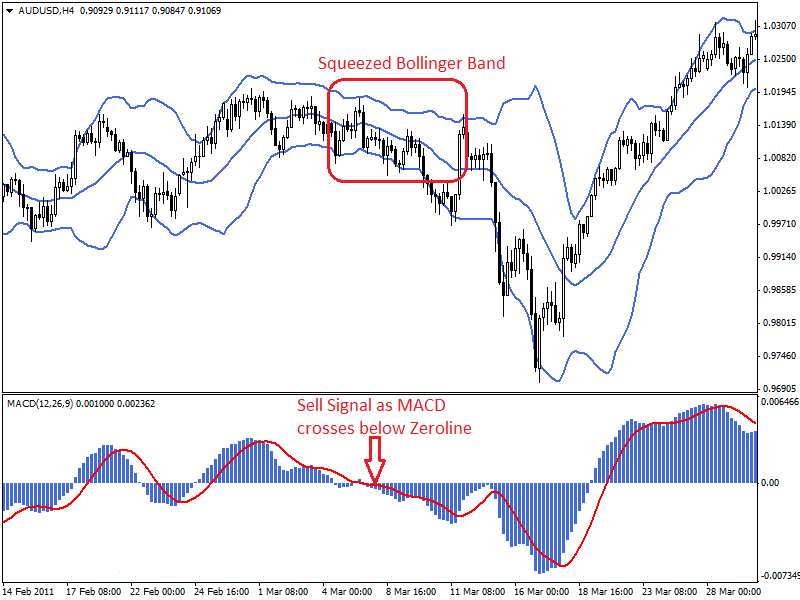

When a currency pair becomes less volatile, Bollinger band becomes squeezed. In squeezed condition, the distance between upper, lower and middle bands becomes narrow. This scenario occurs when the price of the pair is ranging in a narrow range.

This indicates low volatility and a sign of a breakout or breakdown. Squeezed Bollinger band after a prolonged downtrend indicates accumulation period. Inversely squeezed Bollinger band after a prolonged uptrend indicates distribution period. But it is extremely difficult to identify accumulation and distribution phase properly.

This is why traders usually add other indicators to understand the possible price direction after the squeezed state.

On the 4 hour chart of AUD/USD, we can see entry signals for long positions as Bollinger band was squeezed and MACD moved above the zero line.

4-hour chart of AUD/USD (given above) is showing sell signal or entry signal for long position when the Bollinger band was squeezed and MACD crosses below the zero line/center line.

Bollinger Band Breakout:

A breakout occurs when candlesticks hit upper or lower Bollinger band. Breakouts and breakdowns mostly occur after a squeezed state of the Bollinger band. A squeezed condition of Bollinger band indicates the possibility of a breakout or breakdown.

Thus, traders generally trade breakouts or breakdowns after Bollinger band squeeze.

4-hour chart of USD/CAD is showing breakout and breakdown after a squeezed state of the Bollinger band.

Summary:

Volatility plays a vital role in Bollinger band trading strategies. Such as, Bollinger band bounce strategy works well when there is a confirmed trend and volatility is high. Breakouts and breakdowns carry more success if found after a prolonged squeeze state of the Bollinger band.

Traders should consider these factors while trading with Bollinger bands.