Price in the Forex market does not always move in one direction. After a significant move in one direction, up or down, periods of consolidation are common. During consolidation, chart patterns develop, presenting an opportunity to either trade along with the underlying trend or bet on potential reversals.

What is an Ascending Scallop?

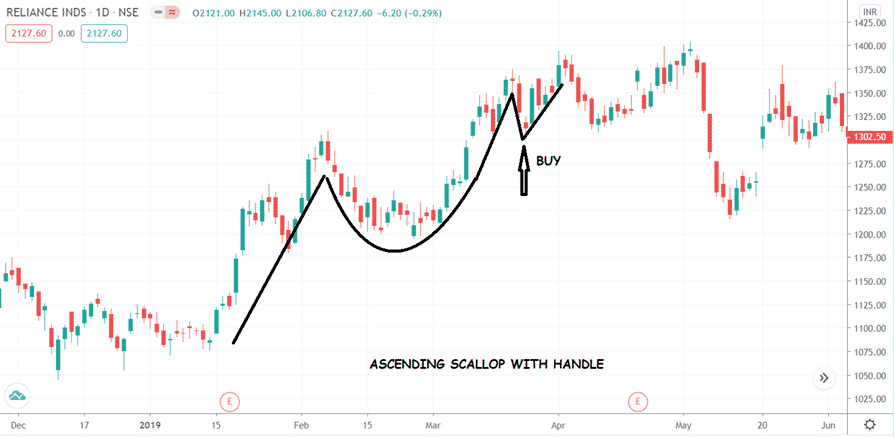

We can see this common chart pattern that comes about when markets are trending up. The pattern appears to be in the shape of J tilted to the right after a bullish rally. A rounded bottom that forms the J-shaped pattern acts as a consolidation whereby an asset oscillates, forming small higher lows until it breaks out.

The pattern forms after the price have moved up significantly, resulting in a small pullback. The drop is usually much less and reverses back up. The reversal in line with the underlying uptrend at the start is usually not strong resulting in further pullbacks. The back and forth between pullbacks and reversals result in a wider round bottom, affirming a period of consolidation with no directional bias.

However, after the wider bottom line, a breakout to the upside comes into play resulting in the formation of higher highs from the round bottom. Once the price breaks out and rises above the previous high, a j-shaped outline emerges, as shown above.

The fact that the price has risen above the previous high, as is the case in the chart above, affirms that bulls are in control. The break out above the previous high confirms the Ascending scallop.

How to Identify Ascending scallop pattern

- The asset should be trending up, forming higher lows.

- A pullback should come into play after the price has moved up significantly.

- The pullback should result in a round bottom that looks like the letter J.

- Should be able to identify two peaks off the rounded valley.

- A break out from the two peaks signals an upward break out.

How to trigger trades

Once the price has broken out and affirmed an uptrend, the next step entails analyzing probable entry points for the long positions. While it is not good practice to open a long position at a high, it is essential to wait for a pullback.

A small pullback makes it appropriate to open a buy position at a discount. The pullback should not dip significantly below the previous high.

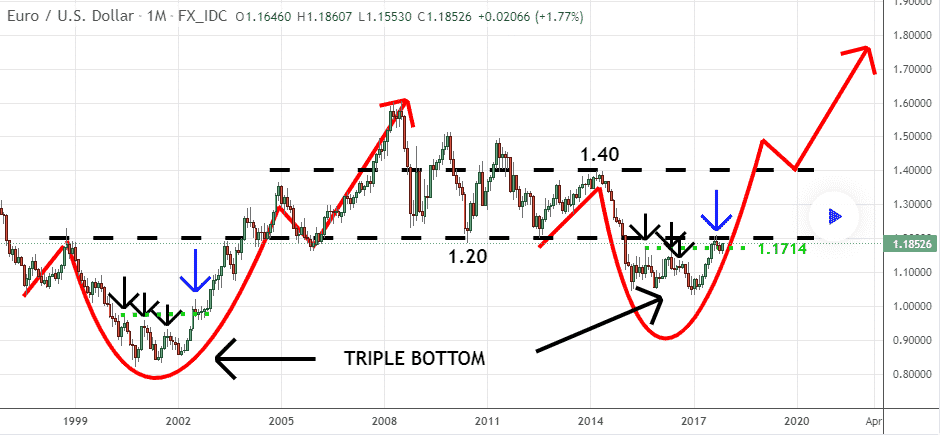

The EURUSD chart above shows the formation of an Ascending Scallop in the first phase. Following the formation of a round bottom, the price starts moving up and consequently breaks out from the rounded bottom to the upside.

Once it breaks out and rises above the 1.8526, which was the previous high, a trader can go long once it pulls back, resulting in the formation of the handle from the J pattern. Once a break-out occurs, the previous 1.8526 level becomes the immediate support.

Once the price pulls back and fails to break the 1.8526 level to edge lower, a trader can trigger a long position as it indicates further upside action in continuation of the long-term uptrend.

Setting take profit and stop-loss

A stop-loss order is essential while trying to profit from the j-shaped outline. In this case, the stop-loss order can be placed a few pips below the entry point to mitigate prospects of a correction from the uptrend and starting to edge lower.

In the case of the example above, it can be placed 10 to 20 pips below the 1.8526 support level. Price correcting and moving below the 1.8526 level would only confirm it is likely to continue edging lower back to the round bottom of the J-shaped outline.

The take profit order, on the other hand, can be calculated. In this case, subtract the price valley, the lowest point of the round bottom from the peak, from the new high created after the break. The difference is extrapolated from where the pullback ends; the point at the long trade is triggered. Its final position acts as the profit target.

Example

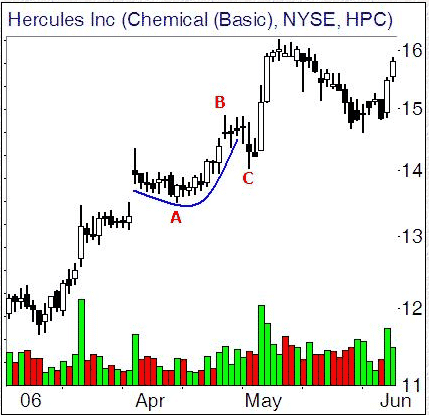

The chart below shows the formation of an Ascending scallop shape on the Hercules Inc. stock.

The chart above clearly shows that the J-pattern is from the round bottom at point A to point B. Once the price rose to point B, it pulled back, resulting in the formation of a handle at point C. The fact that the stock did not edge lower signifies bulls are in control and that more upside action should be expected.

In this case, one can go long from point C. The stop loss on the long position can be placed a few pips below point C. The price target, on the other hand, can be calculated by measuring the difference between point A and point B.

Following the pullback to point C, the price is expected to edge higher at the same height as point A to point B. Consequently, the height level to the upside will act as the profit target.

Early entry

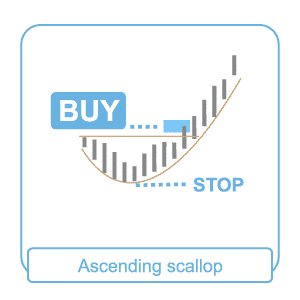

While it is common for people to enter long positions once the price has broken out and pulled back to form a handle, aggressive traders also trigger long positions much earlier.

Instead of waiting for a break out to form a new high, one can open a long position as soon as the price breaks out of the round bottom as the J-pattern starts to form.

In the chart above, it is clear that a long position can be triggered slightly above the round bottom to try and profit as price tries to break out. The stop loss, in this case, is placed a few pips below the round bottom to avert the prospects of accumulating significant losses on price correcting and moving lower.