There are several strategies that traders and analysts have developed over the years, all in a bid to milk the forex market for profit. The Elder’s method, also referred to as the triple screen strategy, is one such strategy. It was developed by Dr. Alexander Elder, a psychiatrist, and professor. It was based on his hypothesis that no one indicator can produce accurate signals as a standalone entity. To remedy this, he came up with a method involving multiple timeframe analyses and a combination of several indicators.

How it works

Dr. Elder meant for his method to be used in three time frames. The first was a higher timeframe, which is used to determine the prevailing market trend. Ergo, the chart on this timeframe should be used with trend following indicators. This provides a trading bias.

The second timeframe is a medium-term timeframe, which is used for identifying opportune areas for trading. Here, we use overbought and oversold indicators to identify retracements or pullback areas. Once these areas are identified, you need to be on the lookout for opportune entry signals.

The third chart is set to the actual trading timeframe. As a rule of thumb, each of the three charts is supposed to be at least 5 times shorter than its predecessor. This final chart is where you spot trade entry and exit signals. It is not uncommon to see traders relying on instinct at this step. However, you may use indicators to help you with signal generation.

When using Elder’s method, long-term traders may use a weekly timeframe for their first screen, daily for their second, and a 4-hour chart for their third screen. For medium-term traders, a daily chart would be appropriate for the first screen, a 4-hour chart for the middle screen, and the 1-hour chart for the third screen. For scalpers they may choose the 4-hour chart for trade bias identification, the 1-hour chart for spotting pullbacks and retracements, and a 15-minute chart for generating entry and exit signals.

First screen

As aforementioned, the first screen is set to the highest timeframe. This helps establish the prevalent market trend. In the forex market, you’re always better off trading in the direction of the trend.

For this, you may use trend-following indicators such as Moving Averages. Let’s try the three screens method to trade EURUSD. The idea is to identify whether the pair is in an uptrend or downtrend. If it is on a rally, we will be looking to enter long trends. If its price is in a downtrend, we’ll be looking for short trades.

For our first chart, we will be analyzing the weekly chart. To identify the dominant trend, we’ll utilize the MACD with regular settings and a 13-period Exponential Moving Average. A downtrend will be identified by prices trending below the Moving Average and the MACD histogram trending below the zero line. An uptrend will be the opposite – prices above the EMA and the MACD histogram reading above zero.

From the chart above, we can see that EURUSD prices were in a downtrend for most of 2021. Therefore, we will be looking to enter short trades.

Second screen

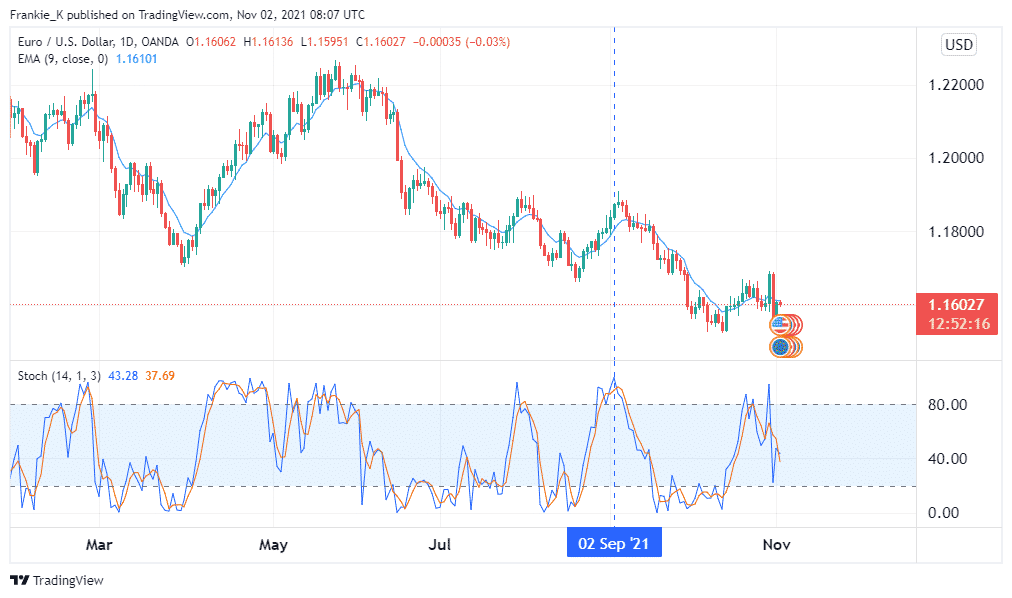

Now we know we’re looking for short trades. We will switch to the second screen to identify an area where the prevalent trend has experienced a short reversal or some sort of dead cat bounce. This break from the trend would indicate that prices will soon resume their original trend, which is what we’re looking to trade.

For our example, we will use the stochastic oscillator to identify when prices leave overbought levels. If we were trading an uptrend, we would be looking for stochastics leaving oversold levels. You may also choose to use other oscillators, such as the Relative Strength Index.

The chart above shows the stochastic indicator leaving overbought levels at the beginning of September. This tells us we should be looking for entry signals around this date.

Third screen

At this stage, we don’t have to rely on indicators to identify entry signals. We can just use the naked eye to identify when a short-term reversal from the original trend ends. For this, we use the 4-hour EURUSD chart.

Since we’re looking to enter a short trade, once we identify the return to the original trend, we can choose to use a trailing buy stop one point below the previous candlestick’s low. This ensures that we only enter the trade once our prediction has been confirmed. The stop-loss should be placed above the dead cat bounce’s swing high so that it is only triggered if the uptrend holds instead.

Take-profit levels can be placed at twice the distance of the stop loss for a 1:2 risk to reward ratio or farther. Some traders opt to use trailing stop-losses once they break even so that they can ride the trend and exit the trade manually when it finally reverses.

From the chart above, we can see prices return to the prevailing downtrend around the 6th of September. This gave our entry signal. The exit signal came a month later when the downtrend ended in a short consolidation in October.

Conclusion

Dr. Alexander Elder was convinced that no one indicator could produce accurate signals. Therefore, he came up with a strategy that utilizes multiple timeframes and several indicators in the analysis process. This strategy is named the Elder Method. This method utilizes trend following indicators on a large timeframe, oscillators on an intermediate timeframe, and pure observation on a short timeframe. A trader following this strategy has the advantage of trading in line with the trend.