Stochastic oscillator is a popular technical indicator that is used in the short term, midterm and long term trading. This indicator was developed by George C. Lane in 1950.

The stochastic indicator is a momentum indicator that actually follows the speed or momentum of price rather than following the price.

This is why this indicator can change before the price and lead the price. This is a leading indicator that has a specific range of 0 to 100. Like many other leading indicators, this indicator also has overbought and oversold levels.

Calculation:

The calculation of stochastic indicator is as follows,

%K = (Current Close – Lowest Low) / (Highest High – Lowest Low) x 100

%D = 3 day SMA of %K

Here,

Lowest Low = lowest low for n number of periods

Highest High = highest high for n number of periods

The default period for this indicator is 14 (n=14). However, traders can change the period according to their own preference.

Interpretation:

The stochastic indicator consists of two different lines, %K and %D. These lines move according to the price change momentum in a range of 0 to 100. This range has given this indicator a leading nature over price. This indicator has overbought and oversold levels.

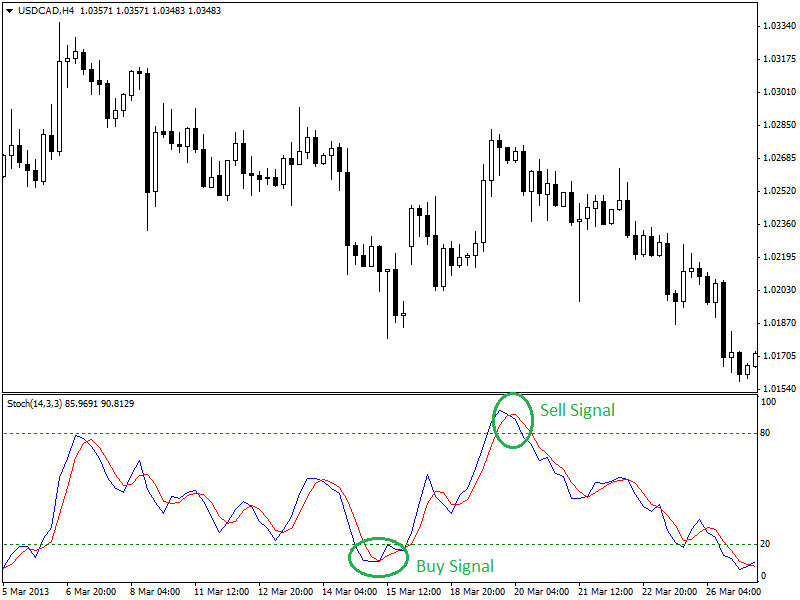

The overbought level is a psychological resistance level that lies between 80 and 100. The oversold level is a psychological support level that lies between 0 and 20. In a case of many other leading indicators (such as RSI), buy signal generated as indicator moves into or above oversold region. But this indicator generates bullish crossovers in the oversold region that help traders to take early entries.

Traders can take early sell decisions as stochastic indicator generates a bearish crossover in overbought region. A bullish crossover occurs as soon as %K line crosses above %D line. The bearish crossover occurs as %K line crosses below %D line.

4-hour chart of USD/CAD (given above) is showing buy and sell signals at oversold and overbought levels. Combining with other indicators such as moving averages to understand trends would boost up the performance of trading with this indicator. Traders can also use trend lines for trend following trading approach.

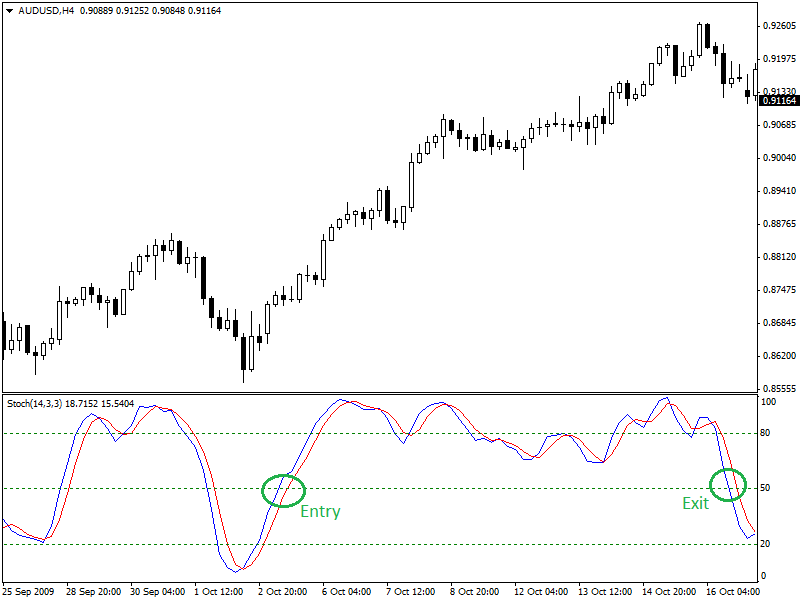

For more confirmed trading signals, traders might use the 50 line or centerline of the stochastic indicator. Buy signal generates as %K line crosses above 50 line or centerline. Inversely, sell signal generates as %K line crosses below centerline or 50 line.

4-hour chart of AUD/USD is showing entry and exit signals for a long position. Entry signal has taken when %K line crosses centerline after crossing 20 line. Exit signal generated as %K line drops below the centerline. This strategy works best while combining with lagging indicators such as MACD, Moving Averages etc.

Summary:

Leading indicators or oscillators should not use individually as most of them can not determine trend direction. Lagging indicators or trend indicators should be used with a stochastic indicator as a combination.