Williams % R is a leading indicator described in 1973 by Larry Williams. It is an effective and a famous technical indicator. This indicator is used mostly in case of short term trading methods.

Like many other leading indicators, this indicator has overbought and oversold levels.

Calculation:

This indicator has a simple calculation. Here it is,

%R = (Highest High – Close) / (Highest High – Lowest Low) x (-100)

Here,

Lowest Low = Lowest Low for the specific look back period

Highest High = Highest High for the specific look back period

The default look back period of %R indicator is 14. However, traders can change this parameter if they want.

Interpretation:

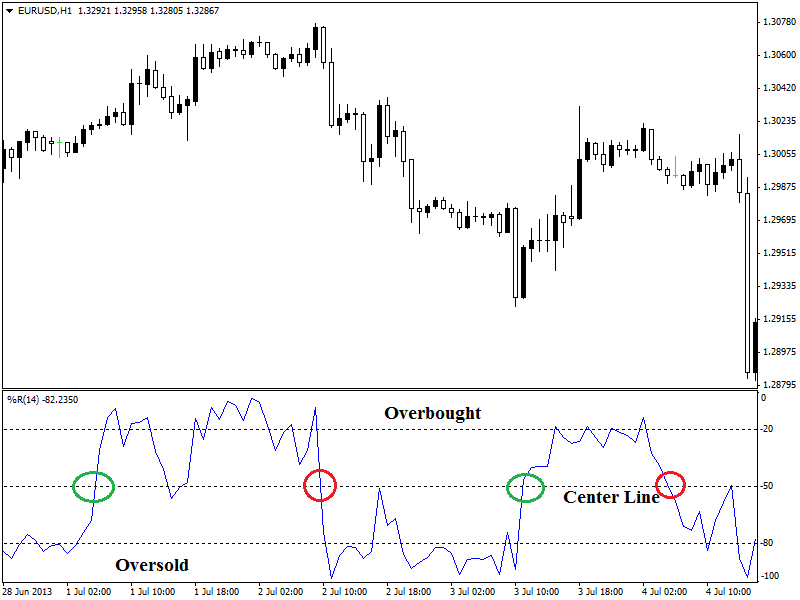

Like many other leading indicators, Williams % R has a range and overbought-oversold levels. The range of this indicator is 0 to -100 which means the value of this indicator always lies in this range. -80 to -100 level is considered as oversold and 0 to -20 level is considered as overbought level.

The oversold region is a psychological support level and the overbought region is a psychological resistance level.

The basic method to use this indicator is to buy at oversold region and sell at the overbought region. But this technique carries many false signals. Thus, most of the traders use the centerline crossover of this indicator. -50 line is the centerline of % R indicator.

A buy signal generated as % R moves upward from the oversold region and crosses above the centerline.

Inversely, a sell signal generated as % R moves downward from an overbought region and crosses below the centerline.

1 Hour EUR/USD chart (given above), is showing overbought, oversold and centerline of % R indicator. The Green colored circle is showing buy signals and red colored circles are showing sell signals.

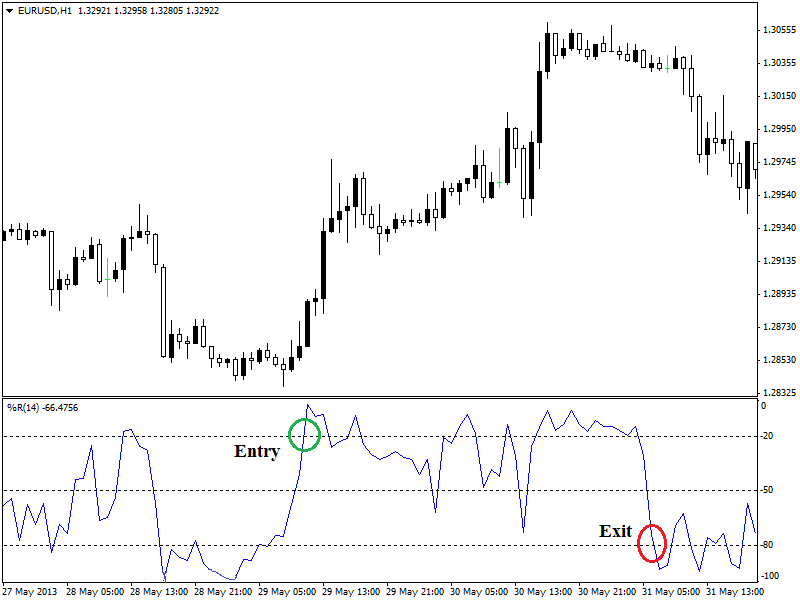

Another method to use this indicator trading is to buy at overbought and sell at oversold. There are many traders who like the crowd and jump into it to make money from the crowd. When a pair is overbought, it means that there is a strong buying pressure.

This buying pressure does not fade out immediately and most of the times provide an opportunity to make a profit. Traders often take a long position as soon as % R becomes overbought and take a short position as % R becomes oversold.

1-hour chart of EUR/USD (given above) showing entry and exit signal for a long position. Entry signal has taken as soon as % R moves above -20 which is overbought region. Exit signal has taken as % R moves below -80 line which is oversold region.

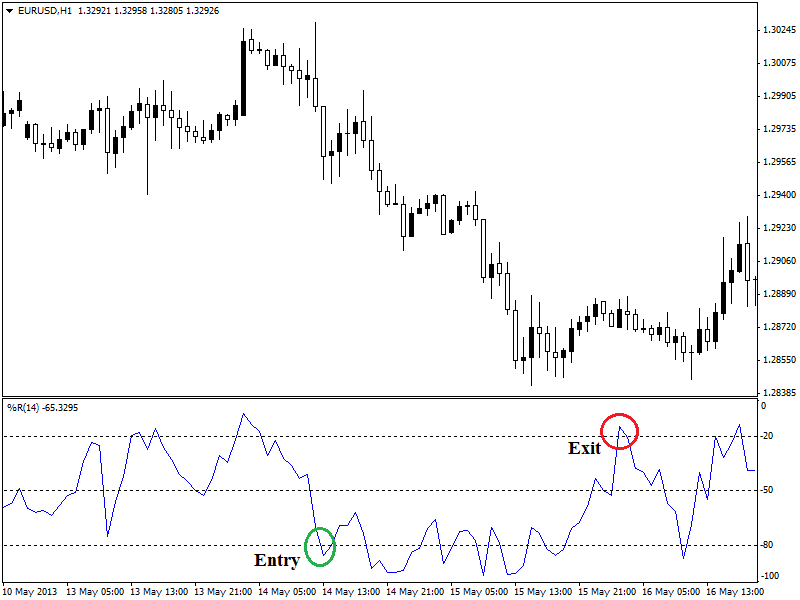

1-hour EUR/USD chart (given above) is showing entry and exit signals for a short position. Entry signal has occurred as % R moved below -80 which is oversold region. Exit signal generated as % R moves above -80 line which is considered as an overbought region.

Summary:

Williams % R indicator is a leading indicator applicable for the short term trading approach. This indicator is useful for the price change momentum. This indicator can not identify the long-term trend, thus, other trend indicators should be used in a combination.