The Balance of Power (BOP) indicator is an analysis tool created by Igor Livshin in August 2001. It tracks the price movement of assets in a given market and uses it to weigh the strength of buyers against that of sellers. In essence, it assesses the power of buyers versus that of sellers to help determine the likely price trajectory. Additionally, it assesses the market’s health by comparing the combined strength of buyers and sellers.

We compute BOP as shown below:

BOP = (CLOSING PRICE – OPENING PRICE)/(HIGH PRICE – LOW PRICE)

As may be seen from the equation:

- First, deduct the asset’s open price from the close price.

- Next, you find the difference between the asset’s highest and lowest price.

- Third, you must divide the first result by the second result.

- As the last step, compute the Simple Moving Average of all of the results obtained above.

However, you do not need to understand the methodology used to construct the indicator. A basic understanding of how the indication works is all that’s required instead.

Uses of the BOP

For the most part, the BOP is utilized for three distinct objectives.

- For determining the trend’s trajectory

- When looking for potential trend changes or continuations

- To profit from overbought and oversold market circumstances

Determining the trend’s trajectory

- The direction of the BOP is typically a good predictor of the overall trend.

- The trend is generally positive when the indicator rises.

- In most cases, when the indicator is declining, the trend is negative.

The chart above shows how the BOP confirms the trends.

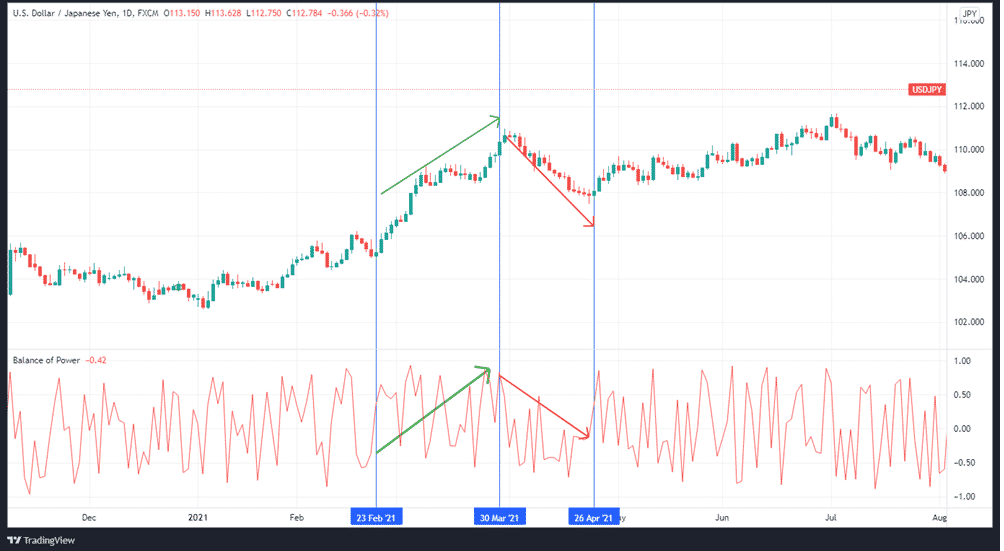

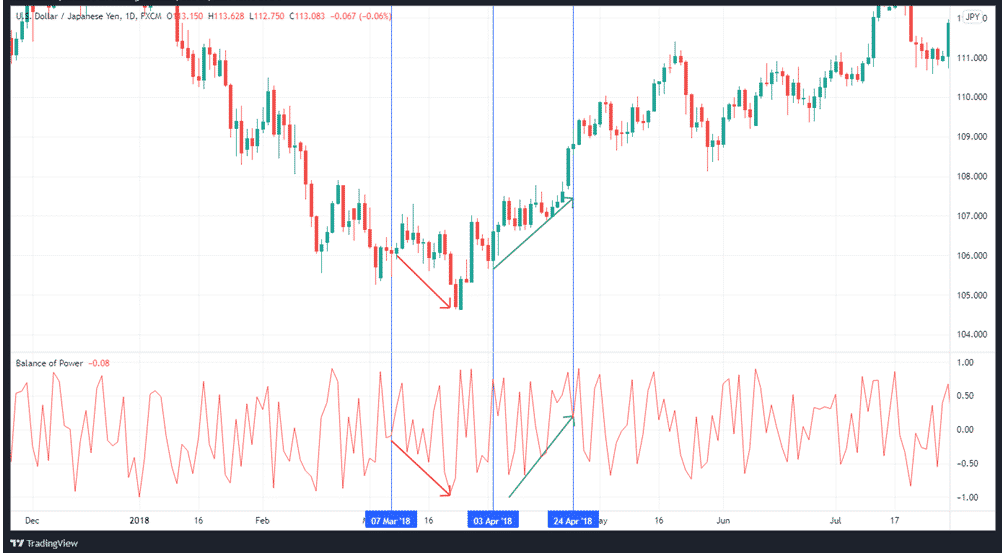

How to spot trend reversals and continuations

- In most cases, a divergence between price and the BoP signals an oncoming market reversal.

- During a bullish divergence, the price registers lower lows while the BoP hits higher lows.

- Positive divergence happens when price and BoP are at different levels. As long as the price and BoP indicator diverge, the present trend is likely to hold,

- When the price makes higher lows, and the BoP makes lower lows, there is a hidden bullish divergence.

- The market is in a bearish divergence when prices are making lower highs, and the BoP is making higher highs.

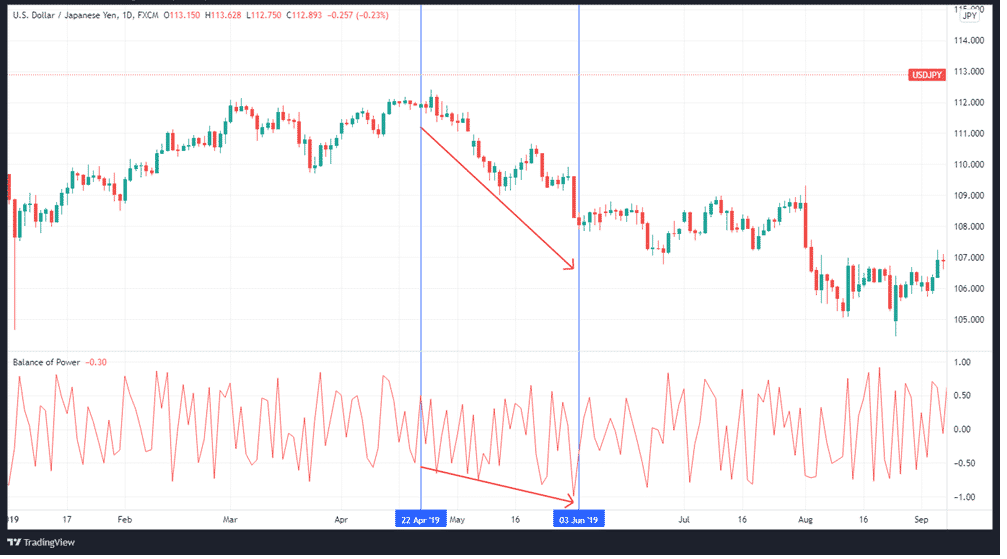

The chart below shows a hidden negative divergence between the price and the BoP.

Thereafter, we see a steady depreciation of the currency pair.

Overbought/oversold conditions

Overbought or oversold situations are existent when the BoP’s tops and bottoms form a cluster at either end of the spectrum. In order to maintain their long or short positions, experienced traders keep a watch on these clustered peaks or bottoms from the indicator.

BOP strategies

Using the indicator, traders can see how the price has changed over time. Balance of Power may be used to identify patterns, price divergences, as well as overbought and oversold conditions, much like any other oscillator.

- Zero-line crossovers

Using zero-line crossovers, traders can see whether to buy or sell. By default, the BoP oscillates from -1 to +1, with point 0 as the midpoint/centerline. Zero-line crossovers show buy or sell signals since they signify a shift into either positive or negative territory. Signals are generated by crosses above and below the centerline.

Moving Averages are used to decrease the number of whipsaws in the data. Reduced responsiveness is a side effect of using a longer-period SMA.

The BoP’s primary signal comes from zero-line crosses; it may also be used to detect the trend, check for price divergences, and identify oversold/overbought assets.

- In identifying trends

In technical analysis, an ascending BOP line suggests an upward trend, whereas a descending BOP line indicates a depreciating trend. The trend shift is confirmed by the crossing of the zero-line at the conclusion of the period.

- Divergences

Whenever the BoP is out of synchronization with the market price, several issues arise. A negative divergence occurs when the price of an asset rises but the BOP does not; a positive divergence occurs when the price of an asset falls, but the BOP does not.

When the market is on an uptrend, it makes two higher peaks in quick succession. There is a higher peak, followed by a higher peak that is slightly lower.

This indicates that the trend is about to turn around. The same holds true for a downward trend. When you see a divergence in the trend, you should be prepared to enter a trade against it. Reversal of the trend is imminent.

In the chart above, we can see how the price is in an uptrend as the BOP registers higher lows. Similarly, the price enters a downtrend when the BOP registers lower lows.

- In overbought/oversold markets

In order to evaluate if a security is overbought or oversold, traders usually look at historical data for that asset. Look for dips that go beyond the established overbought/oversold thresholds for that asset. Using the BoP, traders can see how the price has changed over time.

Limitations of the BOP indicator

- Its inside look at the distribution or accumulation is not a surety that traders will make profits if they initiate a long or short position on each signal supplied by the indicator.

- It can indicate both bullish and bearish divergences, but they can also swiftly reverse once a trader initiates a position.

In summary

Traders can use the BoP indicator to get a sense of the market’s underlying activity. It demonstrates whether or not there is a surge in the systematic buying or selling activity in a particular asset.