Commodity channel index (CCI) is a popular oscillator which was developed by Donald Lambert. He described this oscillator in Commodities magazine in 1980.

Donald Lambert developed this indicator to identify cyclic turns of commodities, but this indicator has shown its effectiveness in currencies, stocks, indices, ETFs and other financial instruments.

Calculation:

The basic period for this indicator is 20. For 20 days CCI, the calculation is as follows.

CCI = (Typical Price – 20 period SMA of Typical Price) / (0.015 x Mean Deviation)

Here, Typical price = (High+ Low+ Close) / 3

0.015 is a constant in this calculation.

Interpretation:

Commodity Channel Index (CCI) is a leading indicator that can be used in various ways. Such as,

Trend Identification:

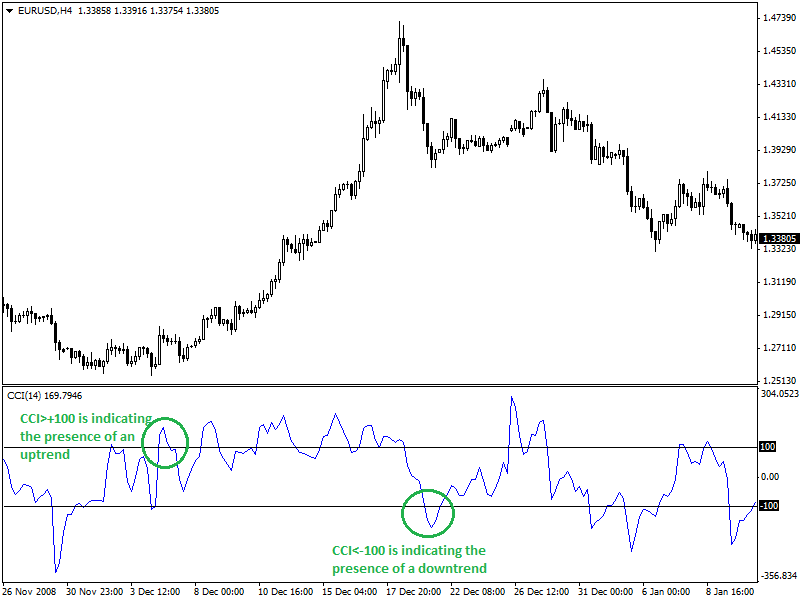

This indicator has the capability to measure the trend direction. Trend direction is identified as CCI surges above +100 and plunges below -100. The prevailing trend is considered as uptrend when CCI line is above +100. On the other hand, the prevailing trend is considered as downtrend when CCI is below -100.

Here is an example chart showing uptrend given below.

4-hour chart of EUR/USD is showing both uptrend and downtrend identified by using CCI indicator. Traders look for buy signal or entry signal for the long position as CCI moves above +100. Traders look for sell signal or entry signal for the short position as CCI moves below -100.

Overbought and Oversold:

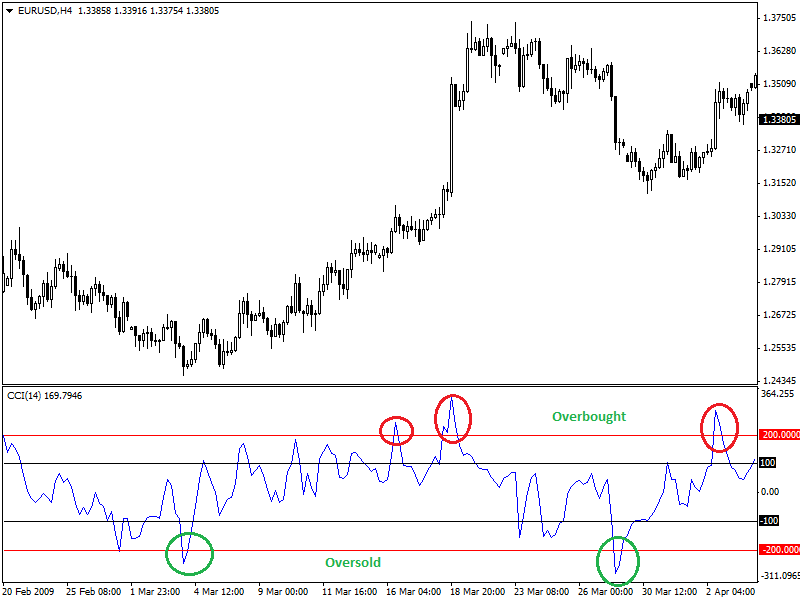

Overbought and oversold level are complex to identify and trade as there is no range for this indicator and price can continue moving in the previous direction after reaching overbought or oversold region. Some traders use +100 and -100 levels as overbought and oversold level respectively. But +200 and -200 levels are more extreme and work better to determine oversold/overbought region.

It is considered that the price will get support and become bullish as soon as CCI reaches below +200. This is a psychological level that indicates that demand might increase after heavy selling. It is considered that the price will get resistance and become bearish as soon as CCI indicator moves above +200. This is another psychological level where supply arises due to heavy buying pressure.

Here is an example chart showing oversold, overbought, buy and sell signals. Here is an example is given in the chart below.

4-hour chart of EUR/USD is showing overbought and oversold levels with buy and sell signals.

Summary:

This indicator works better if combined with other indicators. Different traders use different periods while using CCI indicator. However, lagging indicators like moving average can be combined with this indicator to develop a better trading strategy.