If you are a trader in the forex market, the first thing you need to do is to be sure about when you are going to exit the market, even before entering a position. This is because as a trader, you are not going to hold on to the position indefinitely. Thus, to determine your exit points and price, you need to be aware of the timeframe that you will use to hold on to your open position.

For instance, if you choose to hold a position for a week, your profit objectives will naturally be higher compared to if you held it for a few hours. This is because traders expect the price to move further as it’s a longer period of time. Choosing the timeframe is a trader’s personal decision which should be made after considering factors such as his/her risk tolerance level, desired lifestyle, and the amount of time they can dedicate to analyze the markets.

Strategies Used

Position Trading

Position trading refers to traders holding their positions for weeks or even months, and thus spans the longest period of time. Position traders look to select and trade currency pairs where there is a signal that a medium to the long-term trend is playing out. However, it should take more than a few days to play out. Traders belonging to this category close their positions before the trend runs out of power. Because there is not much need for intensive market monitoring, this time frame is the least time-consuming one. The majority of expert position traders place a trailing stop to automatically close their position in the event that the price retraces past a particular point.

Swing Trading

In Swing Trading, traders tend to hold their positions for a few days but rarely more than a week. The central objective of this trading style is identifying and riding trends as early as possible. The swing trader expects that by holding out for a few days, he/she can get a better chance of capturing a larger price move. This is why the profit objective set in this case is higher compared to day trading, Unlike the day trader, the swing trader also has to endure risk overnight.

Swing trading requires much less minute to minute market monitoring compared to other trading methods. This makes it an ideal type of trading for those who have existing day jobs. Regardless of this fact, swing traders still need to be updated with the latest fundamental or technical changes in the market even when they aren’t directly monitoring it.

Day Trading

Arguably regarded as one of the most popular types of trading, day trading involves opening and closing trade positions within a day. The main reason for not holding their positions overnight is because of the added risk of not knowing if the price would change dramatically while they are away. The holding period for this type of trades may range from mere minutes to hours.

Day trading is influenced heavily by intraday momentum which brings the current price to the desired price level in one direction. They lookout for signs that a currency pair has a high probability of moving in a particular direction, regardless of whether that price is moving in a range or trend.

Compared to scalping where trading goes on frantically, day traders tend to wait for good trading opportunities. Thus, this style of trading requires immense concentration from the trader as they must monitor price charts to close their positions.

Scalping

Scalping involves the shortest time frame in trading as it exploits small changes in currency prices. It refers to the ultra-rapid action of opening and closing a position within a few seconds or minutes. The aim here is to “steal” a few pips from each of the trades. Since the profits of each of these winning trades are small, the trader must win a substantial number of trades for these small profits do add up into a substantial number.

The nature of scalping is such that traders need access to the tightest spreads available and the fastest net speeds possible. This is to ensure that they can carry out trading at bullet-speed. This is one of the reasons scalping is used by a number of forex robots and expert advisors where traders do not have to execute trades directly themselves. Expert Advisors automate the trading execution part of the process, collecting winning trades many times a day to accumulate the small amounts of profits that are harvested. However, you will have to limit your losses in such a way to prevent one large loss from wiping out your entire profits earned.

There are many forex market makers who do not prefer and actively discourage scalping because they find it difficult to cover the opposite side of the transactions, due to the fast nature of this type of trading.

How to Choose a Timeframe?

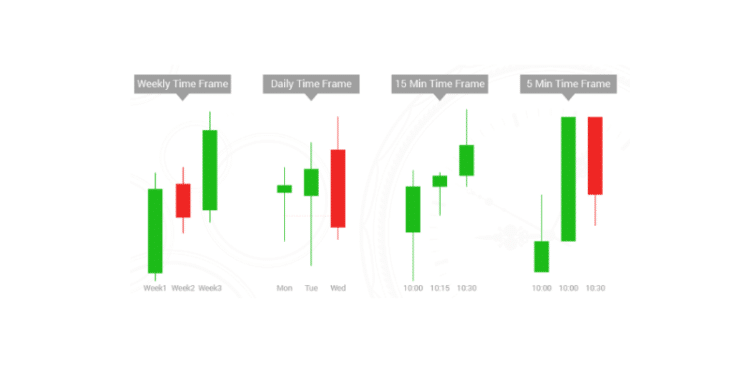

There are four main time frames that traders have to be aware of: Day trading, Swing Trading, Position Trading, and Scalping. As a general rule of thumb, the smaller the timeframe traded, the more time is required to be allocated towards monitoring markets. Someone who is engaged in day trades tends to be more in line with the price swings and goings-on of the market. This is because their positions are opened and closed on the same day. A position trader on the other hand does not need to monitor markets in such an intensive manner.

When it comes to risk, however, the longer the timeframe used, the more risk the trader assumes. This is mainly due to the market having more time to move against them. It can move much further against them if a smaller timeframe is used.

The above trading strategies are mainly meant for short-term trading. However, as a trader, you should decide on the length of your holding period according to your personal preference. Adjust the stop-loss and profit target accordingly, which should be proportional to the length of your holding period. As a general rule, the longer the timeframe selected, the wider your profit target and stop loss can be set. Consequently, the shorter the time frame, the smaller your stop-loss, and profit target is.

Final Thoughts

Ultimately it depends on your skill and understanding of the forex market when selecting a time-frame. There is no one-size-fits-all approach when it comes to selecting them and different traders might have different levels of success with each.