We Like:

- Different accounts to suit different customer needs

- Regulated by top-tier authorities

- A wide range of trading assets

- Low trading fees

We Don’t Like:

- High trading fees on Stock CFDs

- Slow account opening and verification process

- The broker does not provide as many bonuses as other brokers

The Verdict:

Forex.com has been a global forex broker with a strong reputation for providing excellent financial services since 2001. The multi-regulated broker is a subsidiary affiliate of StoneX Group Inc., which lists stocks on the NASDAQ stock exchange.

Clients can trade safely among its top regulators, including the FCA and ASIC, and their funds are secure. Despite limitations like a few deposit and withdrawal methods, Forex.com remains a favorite among investors for its powerful trading features.

Company details

Forex.com launched its operations in 2001, targeting independent investors, organizations, companies, and traders to connect them with the global currency market. It is part of GAIN Capital Holdings Inc., an affiliated subsidiary of StoneX Group Inc. (NASDAQ: SNEX).

As a global market leader, this broker prides itself on superior trade executions and competitive pricing on all financial assets to give traders an exceptional trading experience. With traders accessing over 4500 trading products, Forex.com handles a volume of $5.1 trillion a day from trades, making it the most significant currency market globally.

Regulations

Forex.com extends its services to over 180 countries globally, and therefore a central regulatory body cannot suffice. So instead, it’s regulated by different independent supervisory bodies in seven territories worldwide.

These top-tier regulators include the following:

- The National Futures Association (NFA) – United States

- Financial Conduct Authority (FCA) – United Kingdom

- Commodities Futures Trading Commission (CFTC) – United States

- The Financial Services Agency (FSA) – Japan

- The Australian Securities and Investments Commission (ASIC) – Australia

- Cayman Islands Monetary Authority (CIMA) – Cayman Islands

- The Investment Industry Regulatory Organization of Canada (IIROC) – Canada

- The Monetary Authority of Singapore (MAS) – Singapore

- The Securities and Futures Commission (SFC) – Hong Kong

StoneX Group Inc., which Forex.com is a part of, is traded publicly and adheres strictly to regulations, adequately satisfying requirements for excellent collective governance and expert financial reporting.

Trading platforms

The broker meets all the users’ trading needs through the powerful MetaTrader 5 (MT5) and the proprietary Forex.com platforms. In addition, there’s a downloadable desktop platform and a mobile app, which increases convenience for the trader.

Forex.com proprietary trading platform

- It’s characterized by high speed, simplicity, and reliability, ensuring traders enjoy a superior trading experience.

- You can access it on any browser and operating system.

- It has an intuitive design and excellent features that allow for maximum control when implementing trading strategies.

- The smart trade ticket provides an advanced way to manage risks using P&L, pips, or price to set orders.

- The web trading platform is flexible, so you can customize it so that it suits your style.

MT5 trading platform

- It’s an improved version of MetaTrader, with enhanced features and tools for efficient trading.

- Give access to 500+ markets of all financial instruments.

- It’s available in mobile apps for both Android and iOS devices.

- Its design allows you to view the market broadly in over 29-time frames.

The Web trader, desktop, and mobile apps are integrated and remain in sync such that you can place your trade on one platform and track its progress on the mobile app, which is accessible on the go. In addition, they support different languages such as English, German, Russian, Spanish, Polish, Arabic, and Lithuanian.

If you compare Forex.com and other brokers like NinjaTrader, you’ll realize that the features in both brokers relate, as some exceed others.

Each of these platforms allows users to access a wide range of products in the market. Some of these products include forex, stocks, commodities, cryptocurrencies, and indices.

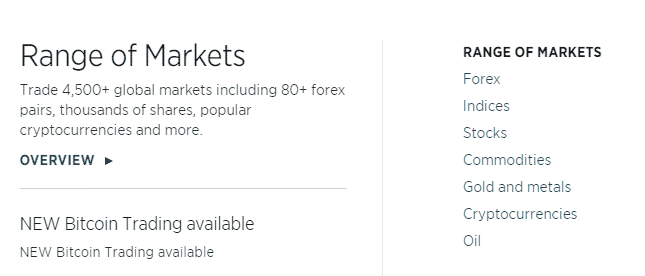

Range of markets

Forex

- There are over 84 currency pairs to trade, with the most popular pairs being AUD/USD, EUR/USD, EUR/CHF, EUR/JPY, USD/CAD, EUR/GBP, USD/JPY, XAU/USD, USD/CHF, GBP/JPY, NZD/USD, and GBP/USD.

- All these currency pairs are tradable on different platforms like the MetaTrader 5 and the Forex.com platforms.

- Trade on competitive spreads that go as low as 0.8 pips on EUR/USD.

- Active trader program members have a chance to get a monthly rebate of up to $10/million dollars.

Stocks

- Trade stocks from global giants like Microsoft, Amazon, Facebook, and over 4500 other popular stores.

- You can trade US stocks on a 1.8 cents commission.

- Buy long or sell short on top global companies.

Commodities

- Commodities like gold and oil have spread from 0.04 pts.

- The UK crude oil has fixed spreads, and you can trade at a 1% margin.

- Firex.com allows you to trade on the UK and US crude oil by going either long or short.

Cryptocurrencies

- Trade the globally recognized cryptocurrencies like Bitcoin and Ethereum.

- You can buy and own the cryptos or trade them as CFDs.

- Despite the high market volatility, Forex.com provides a friendly trading environment where risk is manageable.

Indices

- Trade over 15 world’s most popular indices.

- You can trade Germany 30 and UK 100 on spreads from 1 pt.

- Trade on low fixed spreads from 1pt during market hours.

Main features

This broker has many features that make trading easy and profitable. Some of them include:

- Charts

It has advanced charting tools that allow you to personalize your chart layouts, amplify analysis, and place and modify orders using drag and drop features.

- News

Traders have access to the latest research, market insights, and weekly reports that keep them abreast with information on their preferred financial instruments.

- Signals

Forex.com has a smart signals feature that provides traders with trading ideas and signals based on statistics and market analysis.

- Automated analysis tools

These tools from Recognia and AutoChartist help traders save analyzing time and get better results.

- Performance analytics

This feature provides traders with insights and training for better trading habits to trade with discipline and profit more.

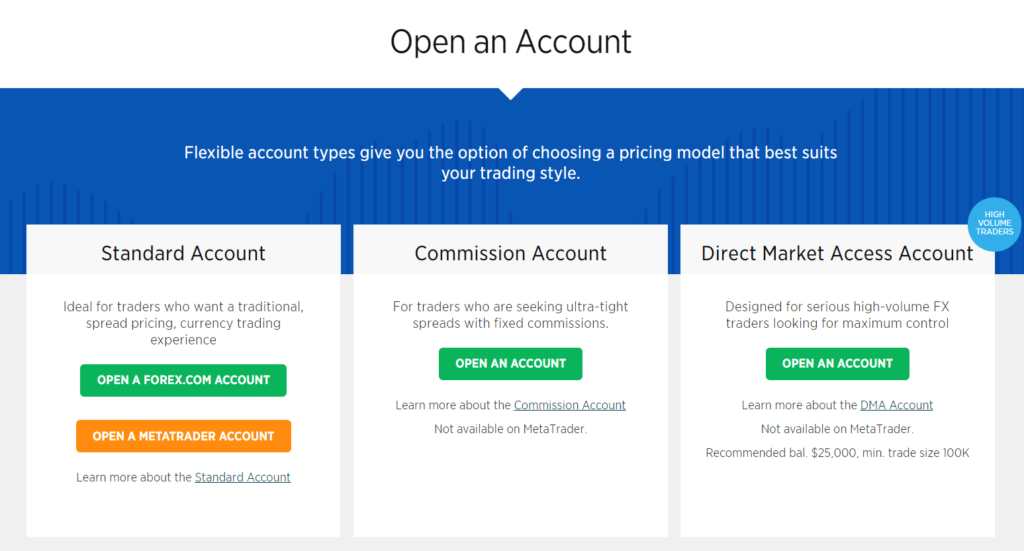

Types of trading accounts

Forex.com permits traders to own accounts that satisfactorily meet their trading needs and give them a profitable trading experience. Here’s a summary of the different accounts.

| Standard account | Commission account | Direct market access account |

| Highly competitive commission-free spreads Trading platforms: MT4, MT5, WebTrader Available trading instruments: 84+ forex pairs, 4500+ stocks, 4 cryptocurrencies, 12+ commodities and 15+ indices Minimum deposit: $100 API trading: yes | Low fixed commissions on ultra-tight spreads Trading platforms: web trader Available trading instruments: 84+ forex pairs, 4500+ stocks, 4 cryptocurrencies, 12+ commodities and 15+ indices Minimum deposit: $100 API trading: yes | Commission only pricing Trading platforms: web trader Available trading instruments: 58 forex pairs, silver, and gold Minimum deposit: $10,000 API trading: no |

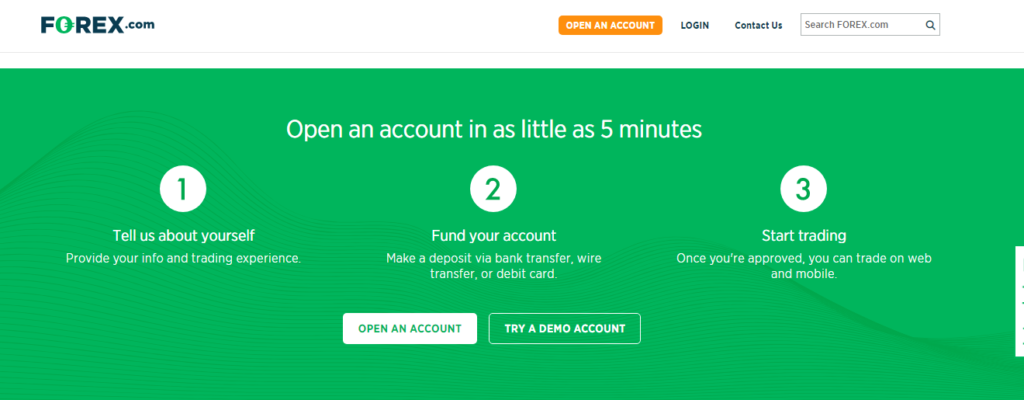

Opening an account at Forex.com

Registering a Forex.com account is straightforward.

First, you’ll fill in an online application form, verify the account, and then deposit a minimum of $100 (or a similar amount in your base currency) as your initial account funding. If you choose to practice first before going live, open a demo account and get started.

Commissions and spreads

On Forex.com, different account types have variable spreads. For example, a EUR/USD pair will spread one pip on a standard account and 0.2 pips on a commission account. Non-US clients using the direct market access account enjoy no markups on spreads but are charged a commission on trades.

Commission accounts have a fixed fee of $5 for every trade, making it possible for the account to offer reduced spreads of 0.2 pips.

Traders owning standard and commission accounts may join the active trader program if they trade a volume of $25 million in a month or open either account with a minimum of $10,000. The program offers fee reductions due to the high trade volumes in the accounts.

Other fees include:

- Swap fees on overnight trade positions

- Inactivity fee of $15/month after 12 months of inactivity

- No deposit and withdrawal fees

Customer service

Get instant answers to your questions in the FAQ section. If you need changes to your account, you fill out a request form from your account. The support team is online 24 hours a day from Sunday 10 am to Friday 5 pm.

The most effective contact method is through the phone, where you only wait a few minutes before speaking to a representative. The email is also effective and is best for long-form, in-depth questions. You can also connect with Forex.com, the website live chat, on YouTube, Twitter, and Facebook.

The Review

Forex.com

Forex.com is a safe, secure, and trustworthy broker with user-friendly features that make trading easy and profitable. Investors can build a trading portfolio and become successful with a wide range of financial products to trade on. It’s an excellent site for both amateur and veteran traders. However, the broker offers demo account services for only a month. If you’re a beginner, you must take advantage of the one month to familiarize yourself with the platform. Another downside is the lengthy registration and verification, but once you’re through with it, you’ll enjoy seamless trading and excellent customer support.

PROS

- Different accounts to suit different customer needs.

- Regulated by top-tier authorities.

- A wide range of trading assets.

- Low trading fees.

- High reliability. Management companies’ shares are traded on the stock exchange — licenses from regulators of the USA, Japan, Great Britain, etc.

- A modern, robust, convenient platform.

- Ability to trade with direct access to bank liquidity providers.

- No commissions for deposit/withdrawal of funds.

CONS

- High trading fees on Stock CFDs.

- Instruments from European financial markets are not well represented.

- There is no service for copying transactions, PAMM, or investment products.

- Each account has built-in maximum leverage (there may be differences depending on the unit’s jurisdiction).

- Slow account opening and verification process.

- The broker does not provide as many bonuses as other ones.