Gold is one of the most traded securities in the forex market despite not being a major currency pair. While it is traded in many forms, the XAUUSD pairing attracts the most orders as it shows the relationship between the precious metal and the US dollar.

Its popularity as one of the most traded pairing stems from investors seeking stable investment returns during periods of market instability. During such periods, players scamper for safety in safe-havens, opting to bet on the yellow metal instead of other metals and currency pairings.

Additionally, it attracts the most bids as a hedge against rising inflation and the impact of geopolitical tensions between world powers. The stability of XAUUSD prices also makes it an exciting pairing whenever participants want to shun heightened volatility.

Below are some of the things to remember while trading the yellow metal.

Focus on the New York session

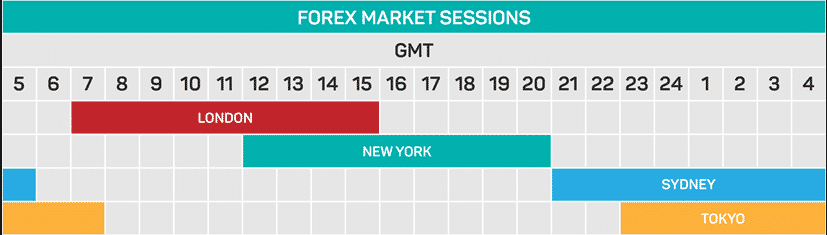

While gold can be traded 24 hours, as long as the market is open, it tends to generate the best trading opportunities during certain periods. Liquidity in XAUUSD tends to increase significantly whenever the New York session is opened and overlaps the London session.

During this period, the number of market participants eyeing opportunities on XAUUSD increases significantly. Increased liquidity makes it possible to enter and exit trades easily at tight spreads and at the best prices.

Additionally, during the New York session, many factors that affect the dollar sentiments come into play. The release of economic reports such as the Non-Farm Payroll report, GDP, retail, and manufacturing data sway traders’ sentiments on the dollar, consequently, XAUUSD price action.

Target previous highs and lows

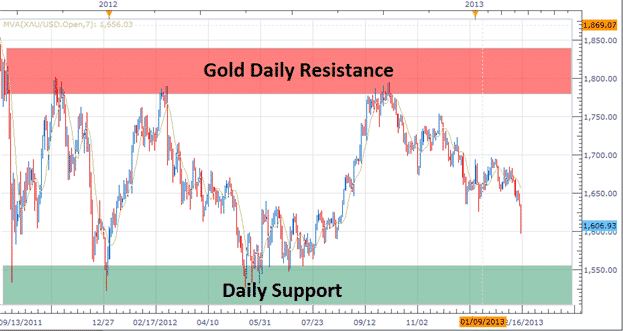

The relative stability of XAUUSD prices means it trades in a range most of the time instead of generating strong moves or big trends. Therefore, it is important to pay close watch to previous highs and lows when looking to open and close trades.

For instance, whenever the underlying trend is bullish, one can enter a buy position and target profits at the previous high. Similarly, one can enter a short position when the metal is edging lower and look to lock in profits at the previous lows.

Given that it can take quite some time for XAUUSD to bounce back to the previous high or fall to the previous low, this strategy won’t be good for day trading. The relative stability of XAUUSD prices means it is best suited for long-term traders and investors looking to take advantage of long-term price patterns.

In addition to targeting lows and highs, the use of Moving Averages can go a long way in fine-tuning one’s technical analysis of XAUUSD. The fluctuations that come into play in a range trigger crossover of different Moving Averages, making it easy to identify entry and exit points.

For instance, whenever a short-term 20 Exponential Moving Average crosses the long-term 100 EMA and starts moving up, one can look to enter a long position.

Similarly, whenever the short-term MA crosses the long-term MA and starts moving lower, one can look to enter short positions as it indicates the momentum is to the downside.

Pay close watch to geopolitical developments

Political and economic uncertainties trigger fear in the forex market. Risk appetite tends to decline during such periods as participants remain extremely cautious and pay close watch to safe haven. Gold has often been seen as a safe haven for hedging against uncertainties that cause people to shun riskier currencies.

The fact that the yellow metal can be a reliable means of protecting other assets during uncertainties sees it attract the most bids during such periods. Conversely, it is important to be on the lookout for any geopolitical tensions involving some of the biggest world powers.

Understand gold commercial demand

A number of factors influence gold prices a great deal. Given the precious metal fixed global supply, fluctuating demand tends to have one of the biggest impacts on the yellow metal. Commercial demand coming from certain industries is one important aspect of trading and investing that one should pay close watch to.

For instance, whenever there is a strong commercial demand for the metal for use in consumer projects, prices tend to tick up given the limited supply. Additionally, strong consumer demand for gold jewelry, especially from India, also tends to influence market sentiments leading to a significant uptick in prices.

In addition to commercial demand, it is important to pay attention to changes in gold production. Amid the strong demand, gold production faces high costs due to difficulties assessing hard-to-reach places to mine the precious metal.

While trying to reach underground reserves, increased production costs have resulted in limited supply. The net effect has always been an uptick in prices, given the strong demand in the market amid low supply.

Monitor central bank actions

Gold is often relied upon as a hedge against many things in the global markets. Central banks are some of the biggest institutions that turn to the yellow metal whenever faced with the risk of heightened volatility against certain currencies.

In the recent past, China and Russia’s central banks have made significant investments in gold, becoming increasingly concerned about the long-term future price of the greenback. Strong price movements are usually the outcome when such institutions enter the market and pump billions of dollars in precious metals.

Therefore, whenever central banks start buying gold, it should be a warning sign that the authorities expect currencies to plummet. Conversely, one can also use the opportunity to ramp up a long position on XAUUSD. The buying spree should also be a warning sign that it is time to start moving investments into less volatile funds.

Track interest rates

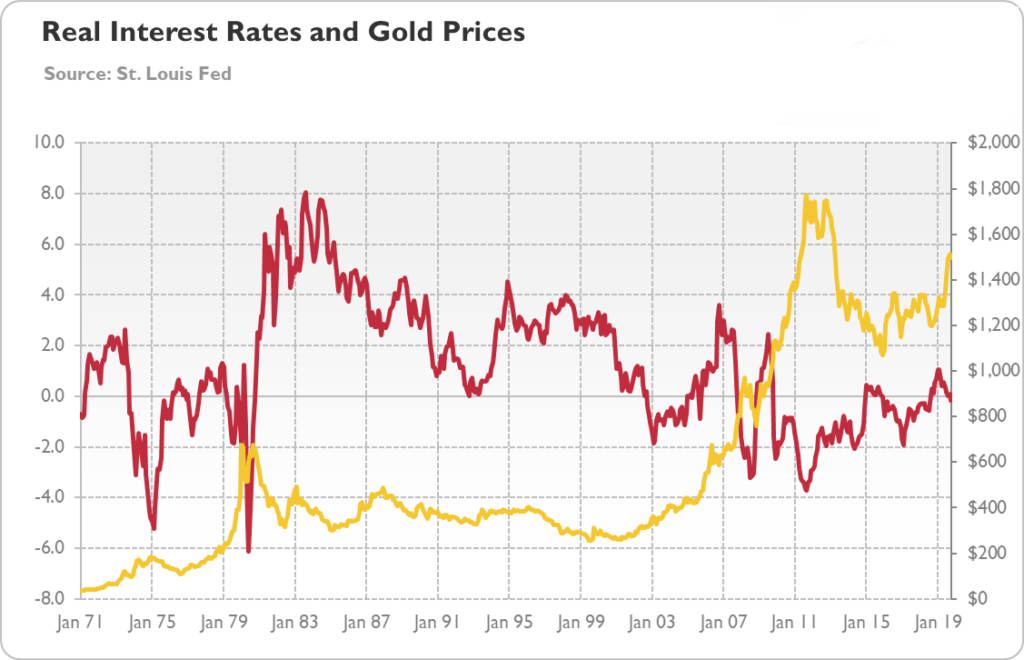

Gold has an indirect correlation with interest rates. Conversely, XAUUSD tends to rise whenever central banks such as the Federal Reserve or the European Central Bank cut interest rates. Strong price movements to the upside come into play whenever the real interest rates dip below the 1% threshold.

Similarly, central banks hiking interest rates above the 2% mark only goes to deflate the value of the precious metal. That said, by paying close watch to central bank decisions on interest rates, one can identify ideal buy and sell opportunities on gold.