What is a currency pair?

Yes, it sounds obvious but we can say with certainty that a good number of investors in the foreign exchange market cannot define a currency pair. Therefore, we will go ahead and define it. A currency pair refers to the two currencies in which one trades.

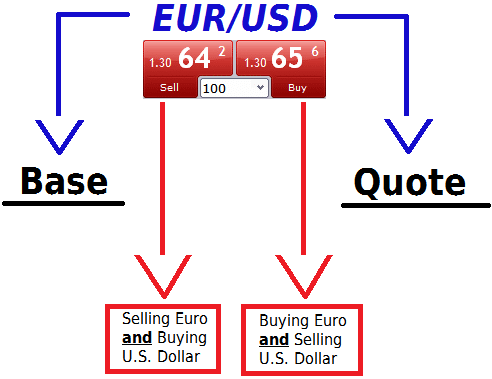

In the currency market (forex), one buys one currency and sells another simultaneously. This simultaneous operation implies that currencies are traded in pairs. The reading of a currency pair depends on whether one is buying or selling the pair. Consider the EUR/USD pair in the figure below. When one buys the pair, one reads the pair as buying the Euro and selling the US dollar. From the perspective of a seller, one would be selling the Euro and buying the US dollar.

Currency trading guide

Why does this trade appear this way? Follow this forex trading guide to understand this magic. The first currency (or the currency that appears on your left) is the Base currency. The Base currency is the basis of the forex transaction. As such, the market will quote the price of the currency pair in terms of the Base currency.

In the figure above, the Bid (Sell) price of the EUR/USD pair is 1.3064. This means that the market is willing to buy one Euro for $1.3064 from you. Conversely, the Offer (Buy) price of the pair is 1.3065. This means the market is willing to sell one Euro to you at $1.3065.

The other currency (the currency on your right) is what investors in forex call the Quote currency. It goes by that name because the market quotes the price of the pair based on its price relative to the Base currency. Consequently, all quotes for the EUR/USD pair are in terms of US dollars.

What are the most liquid currency pairs in the market?

Liquidity in forex refers to the ability of an investor to sell a currency pair quickly and within a small margin of error. After developing your strategies using fundamental analysis or technical analysis, or both, the next step is to use the information to find appropriate market entry and exit points. It would be hear-breaking to discover that no buyers exist for whatever currency pair you intended to sell. From the foregoing, liquid currency pairs are those whose demand in the market is high.

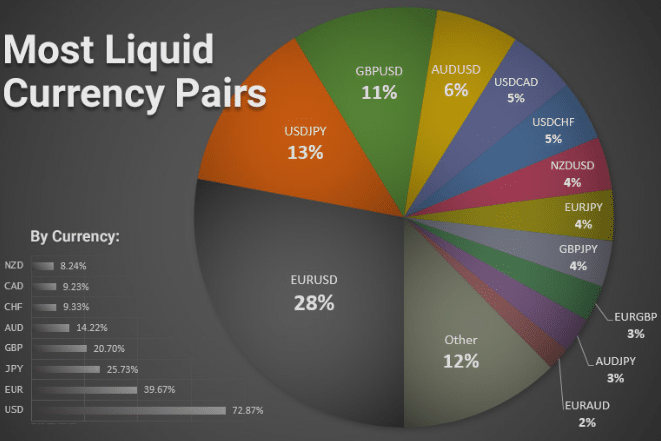

The most liquid currency pair is that which investors want to trade more frequently. However, this liquidity keeps changing as economic, political, and social conditions shift in the home economies of each of the currency in the pair. At the time of writing, the EUR/USD pair was the most liquid at 28%, followed by the USD/JPY pair at 13%. This is not to say that the figure below stays like this forever.

Factors that influence the liquidity of currency pairs

1. Slippage

In forex, slippage refers to the difference between the market order execution price and the actual price at which an order closes. In high volatile markets, slippage is bigger because the momentum of price action is high. Another reason why slippage happens is that brokers cannot match orders at desired prices. This is common for currency pairs whose demand in the market is inferior. Therefore, the more in demand the currency pair, the rarer the slippage. Let us say you have studied the chart patterns well and you have your price targets ready. Unfortunately, your broker may fail to find a matching order at the targeted prices. In such a case, the broker fulfils the order at the next best price, which might result in slippage.

2. Spread

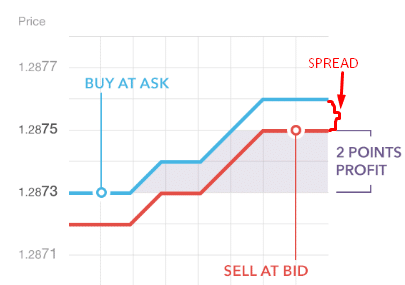

Spread is what remains after subtracting the Bid price from the Offer (Ask) price. In the figure below, the Bid Price is 101.15 and the Ask price is 101.20. Subtracting the two, the difference is 5 pips.

In retail forex trading, investors prefer currency pairs with smaller spreads to maximize the profit potential. Why does this matter? The profit generated in forex trading, whether it is manual or automated trading, depends on the size of the spread. As you can see in the figure below, the spread eats into your earned pips.

If you bought a currency pair, for example, you would buy at the Ask price. However, you will sell at the Bid price. In the process, your earnings are equal to the distance between the buying price and the selling price minus the spread. You should always consider this as one of the most crucial trading tips in forex. Always go for currency pairs with smaller spreads.

Bottom line

In conclusion, it is worth noting that the individual status of each currency in a pair determines the liquidity of the pair. The EUR/USD pair, for example, consists of the top two strongest currencies in the world. On the one hand, the US dollar is backed by the world’s largest economy and the most powerful central bank in the world. Additionally, the US dollar is the world’s reserve currency and the currency of choice for international trade. Similarly, the Euro has considerable power in terms of international trade.