This article is a continuation of the five lessons we can learn from ‘The Market Wizards’ book series, one of the best-selling and most insightful trading books in the industry.

Along with the previous work, one should have grasped some crucial lessons from some of the most accomplished figures in financial markets (although reading the entire book itself is worthwhile).

Lesson 6. Accepting it when you’re wrong (Jack Schwager)

Schwager, being the author and a trader himself, also provides countless nuggets of wisdom along with those of his interviewees. One of the most challenging things for many in all financial markets is losing, especially when real money is on the line.

Emotionally, it is an uncomfortable and sometimes painful feeling, more so during a losing streak. However, trading isn’t about proving you’re right all the time; it’s about executing an edge with a positive expectancy over a long series of trades.

Being wrong is merely a cost for doing business; it never is a personal attack since the markets are irrational. Traders should expect they will be wrong countless times in their careers. It is how they deal with this that separates amateurs from professionals.

The acceptable way of being wrong ensures you never take above a predetermined loss within your trading plan. Staying wrong means letting a losing position run well beyond what is necessary, often at the risk of a margin call (effectively blowing an account). As we see in the quote, this is totally acceptable.

Lesson 7. Give the utmost respect to risk (Larry Hite)

With any financial market, there is risk, the magnitude of which depends on how each person approaches it. The most skilled and experienced trader constantly questions everything before entering into a position and never assumes over-confidence or that they are always right.

The reason for doing this is due to respecting risk; the risk of not knowing what will happen next has defeated many. However, a trader’s success often hinges according to this principle, and mastering this may never truly come for some.

Whatever amount of money is in a position, at any given time, there is always the possibility of losing it due to the incredible amount of uncertainty that exists. Despite whether someone possesses all the knowledge in the world, unfortunately, there is no crystal ball, and no person will predict price movements every time without fail.

In a nutshell, these are the risks that traders have to deal with any time they take a position. Ultimately, it is about ensuring they are comfortable with the worst-case scenario and sticking with it.

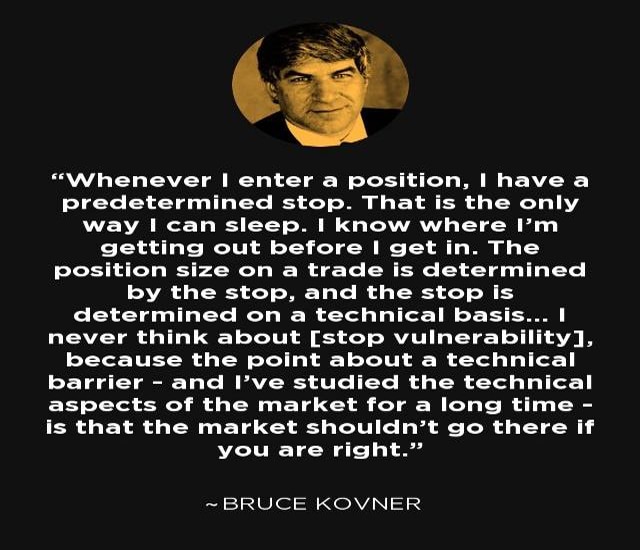

Lesson 8. The significance of stop losses (Bruce Kovner)

As Kovner so eloquently puts it, the only way any trader can ‘sleep soundly at night’ is by having a predetermined stop. Before executing any position, this is perhaps the most important aspect to consider; one should always know where they are getting out in the worst-case scenario.

A fixed stop (rather than not using one or using a ‘mental stop’) is arguably the only method to effectively manage losses with very little or no manual intervention. If we consider that nearly all financial markets use high amounts of leverage, a stop loss becomes ‘make or break.’

A stop is not only an effective mechanism for managing your downside but psychologically, it allows one to move on and look for new trade set-ups without being stuck on what-if situations.

Lesson 9. The importance of moving on and capital preservation (Marty Schwartz)

We can interpret the quote above both as a lesson about moving on and capital preservation. When a trader is wrong, they should accept this realization and look for new opportunities with a fresh mind.

Losing traders often have emotional attachments to their losing positions, which is why they’ll usually let them get out of hand.

Moving on is a skill, especially when outcomes are random where each trade is completely independent of the previous. Capital preservation is simply about patiently saving your money only for what one believes to be the best opportunities and not using it haphazardly or recklessly.

Lesson 10: You don’t need to be very smart to trade (William Eckhardt)

The above quote Eckhart perfectly dispels the myth that traders have to be highly educated to be successful. Unless one is trading for an institution such as a commercial or investment bank, average intelligence (as he puts it) is sufficient.

This, however, shouldn’t assume one mustn’t rigorously study any financial market they’re trading. It’s not the quantity of knowledge that matters but rather the quality. The key is to draw a line as to where the information flow ends to prevent analysis paralysis.

A highly intellectual person is susceptible to this action, mainly if they have never traded before. You need average intelligence to make well-informed trading decisions consistently instead of being the smartest person in the room.

Emotional makeup is equally important, like Eckhardt says, and is something that every successful trader has mastered. All the mistakes a person can make in trading are often results of sentimental errors instead of a lack of intellect. Thus, one aims to find a balance between adequate knowledge and emotional mastery.

Conclusion

For everything a trader struggles with, the book series surely has sufficient quotes to provide perspective. This part and the first one give several powerful food-for-thought moments that anyone can appreciate regardless of the instruments they trade.