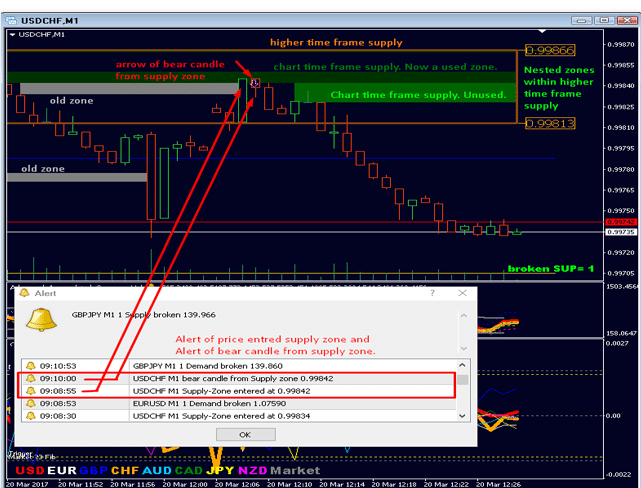

Advanced Supply Demand claims to be a unique and affordable indicator. The developer Bernhard Schweigert claims that the system has many proprietary features along with a fresh formula. The updated system will display two timeframe zones. You can show a high TF with nested zones along with the chart TF.

Is it a perfect indicator still good to go?

Bernhard Schweigert is the developer of this system published first in February 2017. The system is in version 4.0 now with the recent update done in June 2021. He has more than five years of experience in trading and has created 13 products and 3569 demo versions.

As per the info provided in the MQL5 profile, Schweigert has been in the field since 2005. However, he does not provide a location address or phone number. For customers with queries or issues, the only method of support present is messaging the developer via the MQL5 site. The lack of customer support options makes this system look unreliable.

While the developer does not explain the strategy used, he claims that this indicator can improve your trading by identifying accurate entries. With the help of new algorithms, the system can easily spot the potential imbalance between the sellers and buyers.

This is possible as the system graphically displays the strongest zones of supply and demand and the past performance (old zones). The developer states that this feature can help to find the best zones for entry. The indicator works well on all timeframes and products.

How to start trading with Advanced Supply Demand

To buy this trading tool you need to pay $148. Rental options are also present that cost $65 for three months and an annual rental that costs $85. The developer offers a free demo option. There is no mention of a money-back guarantee which makes us suspect the reliability of the product.

As per the developer, the new features include dual-zone strength functions that can be adjusted with user input. By using the proprietary features, traders can identify the strength of a zone. The supply and demand zones work as alert triggers for entry, breaking a zone, and when a reverse candle formation occurs. This system can also identify nested S/D zones.

Parameters provided include S/D settings, MTF, Chart, Alerts, Color, and other settings. While the developer does not provide recommendations on the minimum balance or leverage that has to be used, he suggests reading the user manual and his template for optimizing the zone strength. He also asks users to follow his blogs and news related to trading examples and trading systems.

Advanced Supply Demand backtests

No backtests are present for this indicator, which is disappointing. It is puzzling that the developer does not provide backtesting reports as the system has been in use since 2017. Without backtests, it is difficult to make a thorough assessment of the strategy and performance of the product.

Trading results

No verified trading results are present for this system which raises a red flag. There are few trading examples posted on the MQL5 site. But these do not provide any details on the trading stats. We prefer trading results verified by reputed sites like myfxbook, FXBlue, etc. which provide info like the total profit, drawdown, lot size, risk to reward, and more. The absence of a proven track record raises a red flag.

People feedback

We found 179 reviews for this MT4 trading tool on the MQL5 site. While most of the feedback is positive, there are a few negative responses.

From the above reviews, we can see that the graphical zone representation avoids drawing of the zones manually and the entry and exit zone identification is easier. Another user indicates the difficulty in using the settings as there are too many.

Wrapping up

Advantages

- Alerts with multiple functions

- Affordable price

Disadvantages

- No explanation of the trading approach

- No verified trading results

- Insufficient support options

Summary

Advanced supply demand claims to be perfect for all kinds of traders. Our evaluation of the features, settings, working method, and performance reveals this is an untrustworthy system. The developer fails to provide backtests and explanation of the trading approach used which makes it difficult to know about the performance and strategy.

Further, he does not provide a verified track record which raises a red flag. Without backtests and real account trading details, it is not possible to know how the system has performed and predict its efficacy. The lack of a money-back guarantee is another downside that indicates this is an unreliable trading tool.