The AUD/USD price has formed a bearish flag pattern after the latest interest rate decision by the Reserve Bank of Australia (RBA). The pair is trading at 0.7795, which is 0.76% above Monday’s low of 0.7733.

RBA interest rate decision

The Australian economy has emerged from the pandemic better than other countries. That’s because of the resurgence of the Chinese economy and the rally of global commodities. The country also handled the pandemic better than most comparable countries.

It is against this backdrop that the RBA concluded its second monetary policy meeting of the year. The bank left interest rates unchanged at 0.10%, as most analysts were expecting. It also left its A$200 billion quantitative easing (QE) program unchanged.

The decision came a day after the bank decided to boost the size of the daily government bond purchases to A$4 billion. In its statement, the bank said that the decision was necessary to deal with the recent rally of government bonds.

In its monetary policy statement, the bank reaffirmed that it would continue supporting the economy. Precisely, it said that it would leave interest rates and QE policies unchanged until inflation rises to 2% and the unemployment rate drops.

In the past few days, Australia has released relatively mixed economic numbers. On Tuesday, data showed that the current account increased from A$10 billion in the third quarter to A$14.5 billion in the fourth quarter. Other numbers showed that building approvals declined by 19.4% in January, while private house approvals fell by 12.2%.

And on Monday, data by Markit revealed that the manufacturing PMI declined from 57.2 to 56.9. Another report by the Australian Industry Group (AIG) showed that the PMI increased from 55.3 to 58.8. While manufacturing is a relatively small sector of the Australian economy, its growth is a positive sign.

US dollar performance

The AUD/USD is also reacting to the performance of the US dollar. The greenback has gained this week after the US Treasury bonds retreated. The closely-watched ten-year Treasury bond declined to 1.42% on Monday. Since then, it has crawled back to the current 1.434%. The Australian government bonds also rallied last week before pulling back this week.

Some analysts, including many progressives, have argued against the proposed $1.9 trillion stimulus package. They argue that the package will take the total US government to almost $30 trillion. Also, they note that the package is not necessary considering that a substantial amount of the $900 billion packages that was passed last month has not been spent.

Further, analysts point to recent strong economic data. Last week, data showed that the overall initial jobless claims have started to drop. Also, the US manufacturing PMI data was relatively strong.

AUD/USD technical analysis

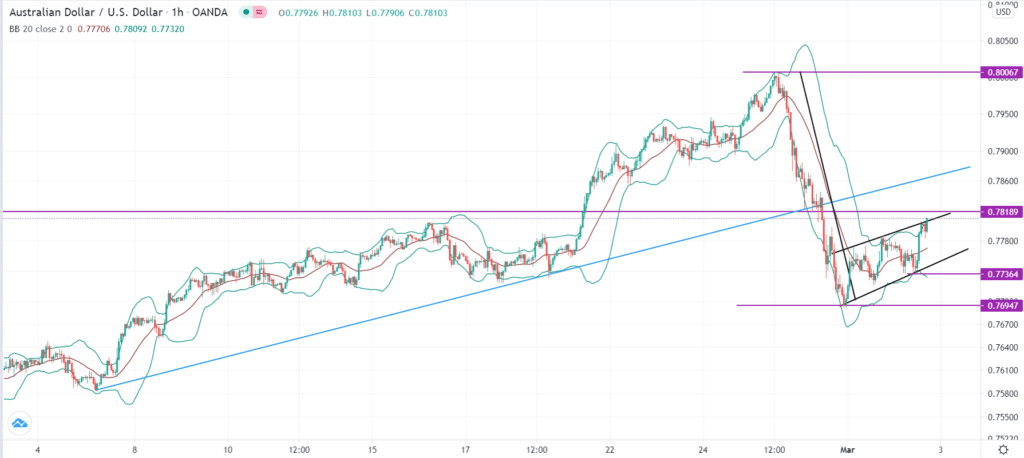

The AUD/USD price rallied to a multi-year high of 0.800 in February. The pair then dropped sharply on Friday because of the performance of the bond market. It reached a low of 0.7695.

On the hourly chart, the pair has formed a bearish flag pattern that is shown in black. Indeed, the price is at the upper side of the flag’s channel. The pair is also along the upper side of the Bollinger Bands.

Therefore, there is a possibility that the pair will resume the downward trend. If this happens, bears will need to first retest the lower side of the flag at 0.7736. If it moves below that level, the next point to watch will be 0.7700.