- The Australian dollar was boosted by the rise in iron ore prices in 2021.

- Brazil created more than 401,000 jobs in February 2021 despite an upsurge in COVID-19 cases.

- Brazil’s public debt is at 90% of its GDP.

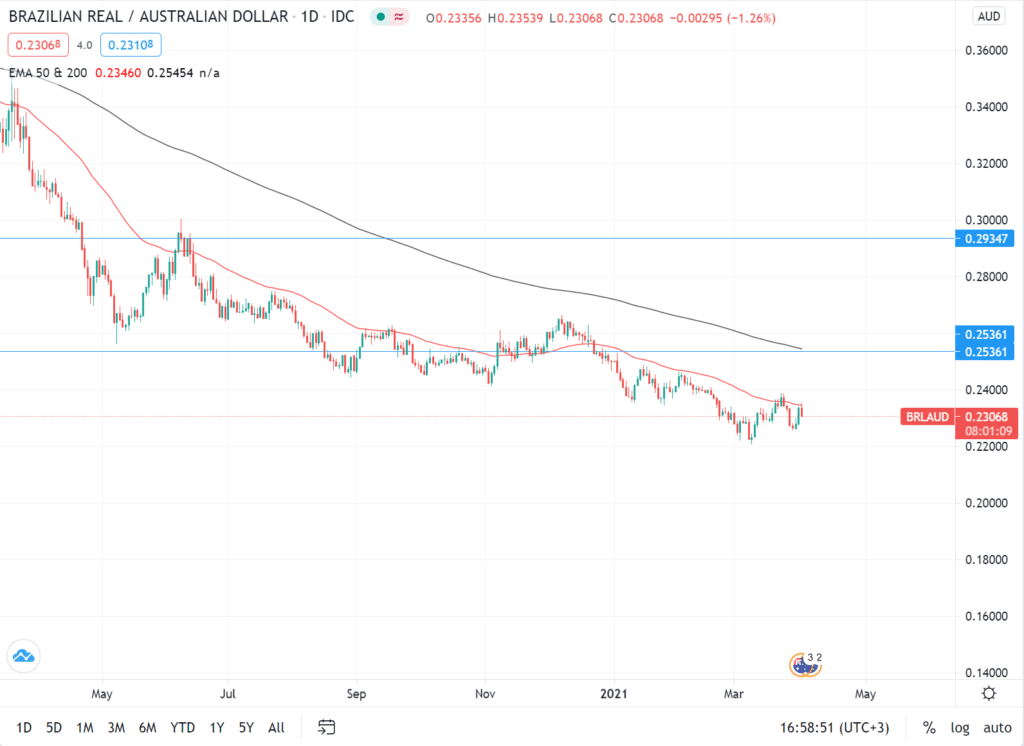

The BRL/AUD trading pair has declined 8.83% since the beginning of Q1 2021 to close at 0.2281 as of March 31, 2021. The Brazilian real took a hit after Brazil’s unemployment rate fell to 14.2% from a previous reading of 13.9%. The Australian dollar has been buoyed by high iron ore prices that are expected to continue into Q2 2021. China’s heavy infrastructural development as it emerged from the COVID-19 pandemic into 2021 increased iron ore’s value. Prices hit $167 a ton as of March 30, 2021, an increase of 90% YoY. However, new data showed that Brazil added 401,639 new formal jobs in February 2021. This data caused the BRL/AUD pair to open trading on April 1, 2021, at 0.2341.

Job growth

Brazil added 260,353 jobs to its economy in January 2021 after a loss of 67,906 in December 2020. The new February 2021 data shows that Brazil’s job growth is on a record high of 54.27% MoM. The country is fighting the effects of the second COVID-19 wave that has increased the death toll to more than 318,000 and up to 12.7 million cases as of March 31, 2021. As the country fights off the reinstatement of new lockdown measures, the services sector added 173,547 new jobs. The industry added 90,000 jobs in the same month of February, while retail created up to 70,000.

Australia, on its part, had an increase in job vacancies by 14% from November 2020 to February 2021. The Australian Bureau of Statistics (ABS) reported that job vacancies in February 2021 hit 289,000 (representing an increase of 61,000 YoY). The pace of economic recovery in Australia is higher than the pre-pandemic times, with labor shortages expected to continue into Q2 2021. Restaurant services grew its job vacancies by 88% in the February 2021 quarter, while construction increased by 60%, driven by mineral prices.

Iron ore prices

January 2021 saw the 62% iron ore hit $169.97 per ton while the iron ore was priced at $171 per ton. As of January 19, 2021, the prices had increased by 0.27% for the 62% iron ore and 0.89% for iron ore. The increase was the result of China’s demand for more than a billion tons of crude steel into 2021. Top Australian steel miners recorded phenomenal share price surges among them BHP group at 88.12% since 2020.

Other miners such as Fortescue Metals and Rio Tinto rose by more than 73.41% since March 2020, owing to the rise in iron ore prices. The continued increase in the iron price will increase the demand for the AUD and thus provide a bullish cushion for the currency against the real.

Public debt

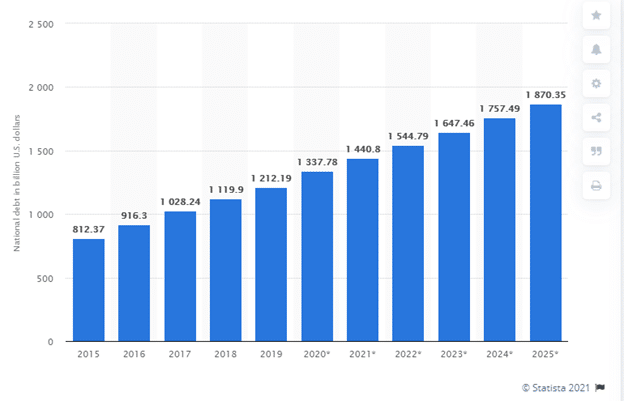

Brazil’s celebration of jobs’ data growth in February 2021 may be overshadowed by an increase in public debt to an all-time high of 90% of its GDP.

In the 12 months ending February 2021, the primary deficit was 691.7 billion reals (9.2% of GDP). As of 2019, the national debt was $1.212 trillion. The debt is poised to grow to $1.87 trillion in 2025.

Technical analysis

The BRL/AUD shows a descending scallop formation between April and July 2020. A downward breakout ensued after the pattern formed resistance before it reached 0.29350.

As of this writing, the pair may not sustain the push above 0.24000 if, despite the present downward reversal, a bullish trend is adopted in the nearest future. In the short term, the analysis supports the bearish real against the Australian dollar. The 14-day RSI indicates the pair’s buying activity is at 52.05. The 200-day and 50-day EMAs show that the bears are in control whenever the asset is concerned.