Trends are the trader’s best friend. In the world of forex, trends make up the bread and butter of most traders and for a good reason too. Following the trend is an important strategy that is even espoused by expert traders. However, there are risks involved with it as well.

Let us go through the idea of directional trading and a few of its sub-strategies that will help you navigate in the ostensibly complicated world of the forex market.

What is directional trading?

As the name suggests, directional trading consists of strategies that traders utilize depending on the direction they believe the market is headed into. Based on such strategies, traders can take either a long position if the trend is rising or a short position if it is falling. However, they can also backfire if the trader is wrong about the direction of the trend.

Directional trading strategies

There are multiple strategies that traders utilize with directional trading. It is important to have a fundamental knowledge of some of them to ensure profitability.

Follow the trend

Following a trend, the main idea is that once it is established, it will continue in its direction instead of reversing its course. Technical analysis is used to spot trends and patterns and exploit them for profit.

For trading in such a manner, one should either trade in the direction of the trend or within a range. For the latter, a trader looks for a movement pattern within the daily trend and trade within it. This way, a trader doesn’t have to wait for long-term trends and can profit on the oscillation within a day.

Moving-Average (MA) Crossover

According to this strategy, traders look at two moving averages to find opportunities to buy. These present themselves when fast-moving and short-term averages move into the longer-term average. In simpler terms, the former highlights the possibility of a long-term upward trend.

However, these systems can be tricky and have an inherent risk in them as they are subjected to zig-zag patterns that reverse, making them difficult to make profits.

Breakout systems

These are one of the simplest systems to develop. In essence, they consist of trading rules defined beforehand. These rest on the basic idea that when the price moves to a new peak or trough, the trend is going to follow in the same direction. As such, it triggers an opportunity to open a position in that particular direction.

In these systems, it is important to ascertain the period for which you’d want to trade. Trending markets will be detected faster in short time periods. However, faster systems will also be susceptible to the zig-zag pattern and the risks inherent in it.

Identification strategies

Identifying the various patterns utilized by forex traders is useful, but the sheer number of them doesn’t fit within this article’s scope. However, one must at least know the popular and basic patterns that most traders utilize.

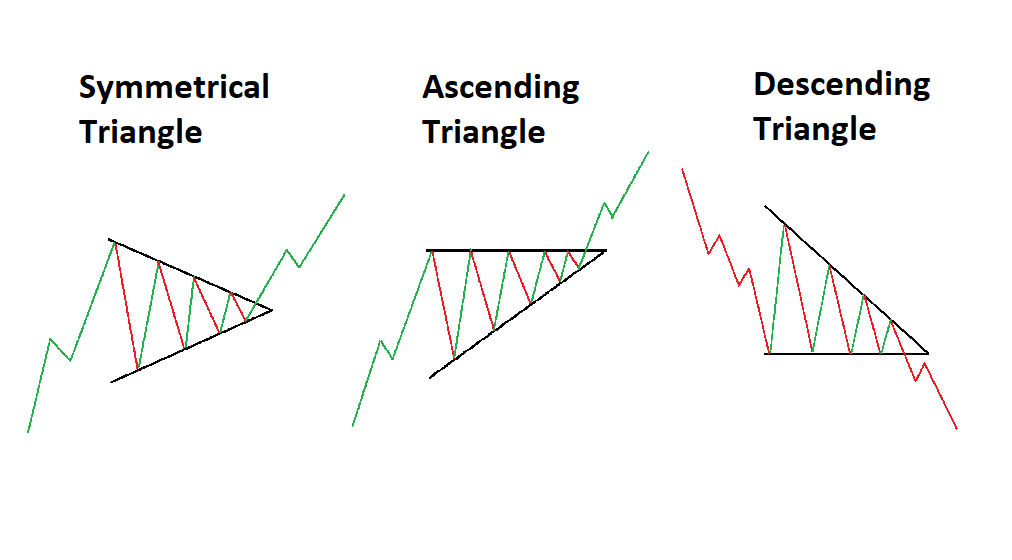

Triangles

Triangular patterns are indications of trend continuation. This means that once the triangular pattern is resolved, the trend running prior to it will resume. Of course, there are many different triangle types, all of them having their special features and implications for forecasts.

As soon as the price action breaks out beyond the boundaries’ limits, traders should look to open position.

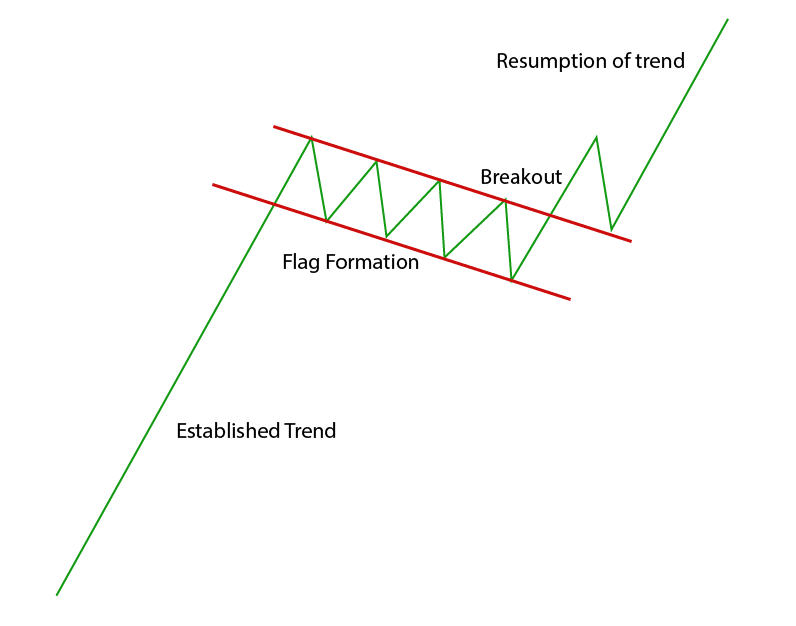

Flags

Here is another pattern that can be seen as either a continuation of a consolidation pattern. It highlights the price action moving in a back and forth manner that is sloped against the main trend. The flag is a highly reliable pattern. Most of the time, it consolidates the primary trend, and only seldom does it indicate a reversal in trend.

Similar to the action taken with triangles, only when the price action breaches the flag pattern boundary traders should look to open positions. As is the case with most such continuation patterns, this too tends to occur around the middle of the primary trend.

Risk management strategies

Traders ought to remain wary of the risks inherent in directional trading strategies that threaten to annihilate one’s account capital. Some of the strategies to manage risks include setting points at which they exit losing positions or place stop-orders.

A well-known strategy to trade is to utilize forex robot systems that override the predefined logic that one follows to make trade decisions. The benefits of using such a system are numerous and well documented. One of the game-changing advantages is that it takes the factor of greed and fear out of the equation. As such, these systems enable traders to avoid the pitfalls associated with trading manually, such as exiting positions prematurely or trading excessively.

Another well-known advantage is the consistency that one gets out of them. Trade robots observe all the market signals and triggers and make decisions based on them as well as on predefined rules set by the trader. Their automated mechanisms allow traders to keep their losses under control. This is because any reversal will randomly trigger signals for reversing or closing open positions.

But, these are also not devoid of all risks. They are only as good as the data one inputs in them and depend on how well they have been backtested.

Final Thoughts

Traders looking to trade with directional strategies will have to evaluate and assess them for their efficacy. Since conditions are always in flux, traders have to continually adapt their strategies to the particular condition they happen to be in.

It is always good to remember that these strategies will work only as well as their assumptions. If a trader misses out on an important piece of information or makes an objective mistake, no amount of strategizing or backtesting can help them. There is no fool-proof strategy that will help you profit all the time. But, the ones mentioned in this article should define in broad terms where trends start and where they end.