The forex market is driven by many variable factors, making it quite unpredictable. To make your investment journey smoother, you might be tempted to rely on sources that claim to provide accurate market insights. However, it is imperative to be careful and rely only on credible resources and techniques to prevent your assets’ major loss. Read further to understand predictions in the forex market and why you probably should steer clear off of them.

Forex Market Predictors: What are Predictions and Who are the Predictors?

Simply put, forex predictions estimate and forecast the conditions of a market at a later date – such as the future values of currencies, the behavior of different indices, major investment decisions, etc. Identifying patterns and trends in the market is one of the most crucial skills for a forex trader. However, with the volume of tools and resources available today, traders may feel inclined to use their limited experience to predict price action. But the jury may still be out on the reliability and authenticity of such predictions. Forex trading is not a game of odds and not certainties. Loose market predictions without strong market analysis have no match for analytical reports’ accuracy based on actual historical performance.

Business analysts, individual investors, and even large investment houses claim to provide accurate forex market forecasts. Newspapers, blogs, and periodicals publish regular updates about their predictions, which tend to draw investors away from reality more than helping them. While seasoned analysts rely on sophisticated software, algorithms, and historical data to develop high-accuracy forecasts, many investment pundits also provide their own predictions that seldom hit the accuracy mark. It is easy to be misled by the flood of information and courses on the internet while they mint money off your desire for an easy way out. They thrive on the ignorance of amateur traders to create weak signals in the market. It is imperative that you check where these forecasts are coming from, whether they are strong signals based on credible analysis or just weak predictions made to delude you.

The Efficiency of a Crystal Ball

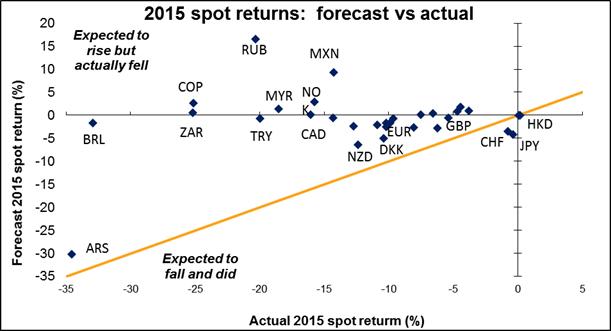

Without sound technical analysis, predicting in the forex market is akin to guessing or hoping. To understand why merely relying on predictions is not a smart move, consider their accuracy rates over the past years. You will be able to check for yourself whether they offer competitive and credible forecasts. Consider the predictions made by traders worldwide regarding the forex market in 2015 – It was found that the prediction was correct only for 17 of the 31 currencies, i.e., 55% of the predictions by forecast pundits held true in reality. A prediction of 55% is not a very strong forecast; rather, it is a basic probability statistic with just a little more than half a chance of being true. The market underestimated factors like fall in commodity prices, especially oil, Turkey’s turmoil, and China’s slowdown. One could simply rely on a game of heads or tails. Relying on such odds may or may not prove profitable. You wouldn’t bet on a horse with just a 55% success rate, so why should you choose to make decisions based on a prediction with such a low accuracy rate.

Figure 1 – Market Forecast Spot Returns for 31 Currencies (2015) – the yellow line represents the accuracy of the prediction – currencies above the line did worse, and the ones below the line did better

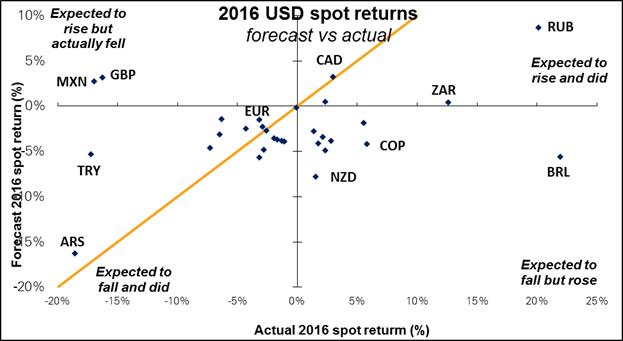

In 2016, even though the prediction pandits did witness an increase from their declarations in 2015, it was still far from accurate. In 2016, they got predictions right for 20 currencies – thus a rate of 65%. Relying on such a loose prediction is like relying on a crystal ball – it gives no guarantee of putting the odds in your favor. Seasoned experts dismiss such predictions for true technical research on the market and its trends.

Should Traders Predict?

Predictions can be quite tricky to depend on, even for seasoned players, as they leave a huge margin for errors. It is a contentious subject whether traders should rely on predictions or not. However, enterprising traders should take predictions with a grain of salt. Market predictions can make you feel like you have more information and, therefore an edge above others. However, the available predictions may or may not be true – taking them into your market strategy blind is nearly the same as letting go of your funds voluntarily.

It would be more reliable to analyze the variables affecting the forex market, such as government policy, economic growth, inflation, interest rates, and socio-political climate, to name a few. Technical analysis by making use of the historical performance of the exchange rate will definitely help you make more informed decisions. Traders should also use the economic calendar to keep up with major events that may influence forex. Instead of relying on predictions, it is smarter to learn how to develop biases. Predictions carry with them an expectation of the certainty of the occurrence, whereas a bias can be subject to confirmation from the markets. This will help you be more flexible and in control of your trades. Since you can’t control the market, the main focus should lie on managing your risks.

Keep track of various currency indices and charts on when and where to invest. It is advised to invest your time, effort, and funds in reliable, trustworthy sources proved to be true in the past. With that too, the best thing for you to do as an informed investor is to diversify your portfolio to manage risks. Further, always be aware of your own risk appetite and only enter a situation after assessing it from every angle possible.

Conclusion

The forex market is dynamic and uncertain, making it challenging for investors to understand the right actions. However, at your disposal, there are many options to help you improve your decision-making and reduce potential risks. Analytical and technical market analysis helps you make more conscious decisions regarding your investments by painting a picture of the future market. Relying on weak predictions or hearsay regarding the future market conditions will never get you sustainable and consistent wins. Many tools, software, pundits, and firms try to predict price action, but their accuracy and reliability are always questionable.

Opt for analytical reports, risk studies, high-end algorithms as opposed to predictions with low success rates. Keep track of various currency indices and charts on when and where to invest. Diversify your portfolio to manage risks and base your decisions on reliable and trustworthy sources. In conclusion, always be aware of your risk appetite and only enter a situation after assessing it from every possible angle.