Day trading is the art of executing your trades and closing them within 24 hours. The people who perform this act are called day traders. They make up the industry’s significant portion as day trading is an intermediate between short-term scalping and long-term swing trading that is not profitable.

It is also possible to day trade almost any type of market. The range of companies that allow you to execute day trading strategies is too extensive. Brokers offer tight spreads, better execution speeds, quality education, market research, various account types, deposit/withdrawal methods, and good customer support for helping daily investors reach their goals.

Top day trading strategies for beginners

Let us look at the popular day trading strategies that novices can easily use to their advantage.

Gap strategy

For this game, plan your lookout for stocks or any other instrument that gap up or down exclusively after the open. The primary cause for the significant change is usually the release of a fundamental move acting as a catalyst. Once you spot out the stocks in play, use the technical analysis to determine possible long or short positions. Big gap equities usually tend to move downwards as investors take in profits that result in panic buying or selling.

Image 1. C gaps down several points after the opening due to a hiccup in the banking service. Investors look out to short the stock even further. They wait for the initial 1-minute bearish candles and then enter on the downside.

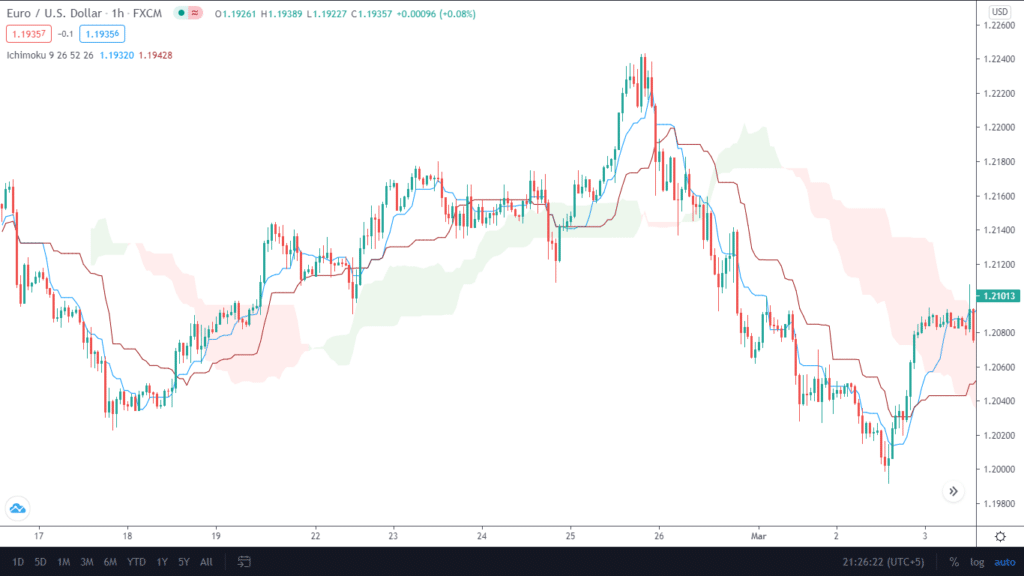

Using Ichimoku indicator

Day traders can use Ichimoku as an indicator for determining the current trend. The cross-over between base and conversion lines can indicate that the trend is reversing. Use the two factors in confluence with one another for increasing the overall trading probability. For simplicity, switch off the lagging span.

Image 2. Can you highlight the setups at the H1 chart on EUR/USD? Remember to keep the time frame low as we are day trading.

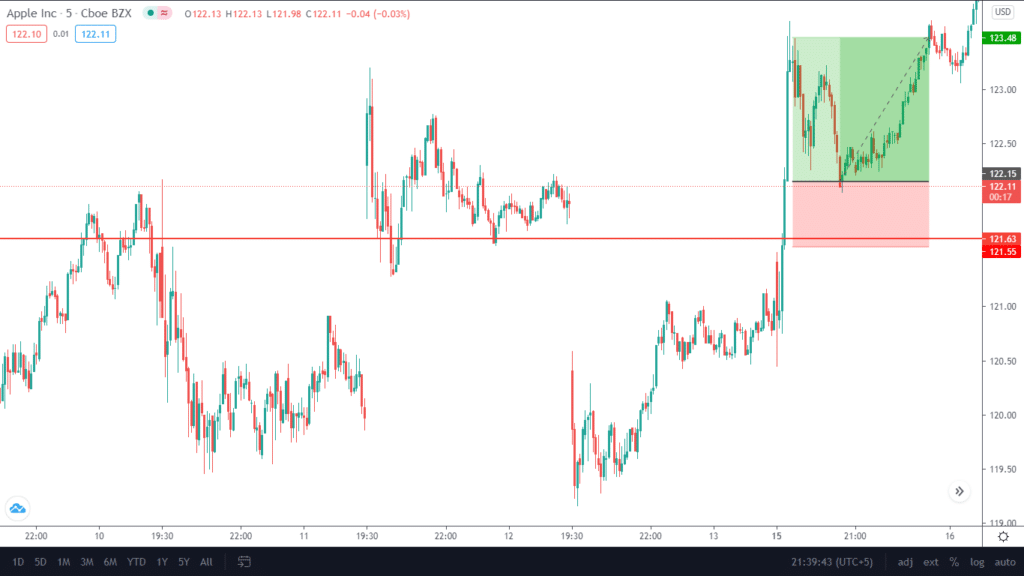

Trading news

Turn on your news websites and use the catalyst for taking positions in the stocks. The criteria here is to look for breaks in support and resistance levels and open trades as soon as you spot one. Put your stop losses just beneath the broken points aiming for a risk to reward ratio of at least 1:2.

Image 3. A trade on AAPl stock as the news release breaks the current resistance. The trade takes as long as the 5 min candle finishes its production and finishes taking profit in style with an R:R of 1:2.

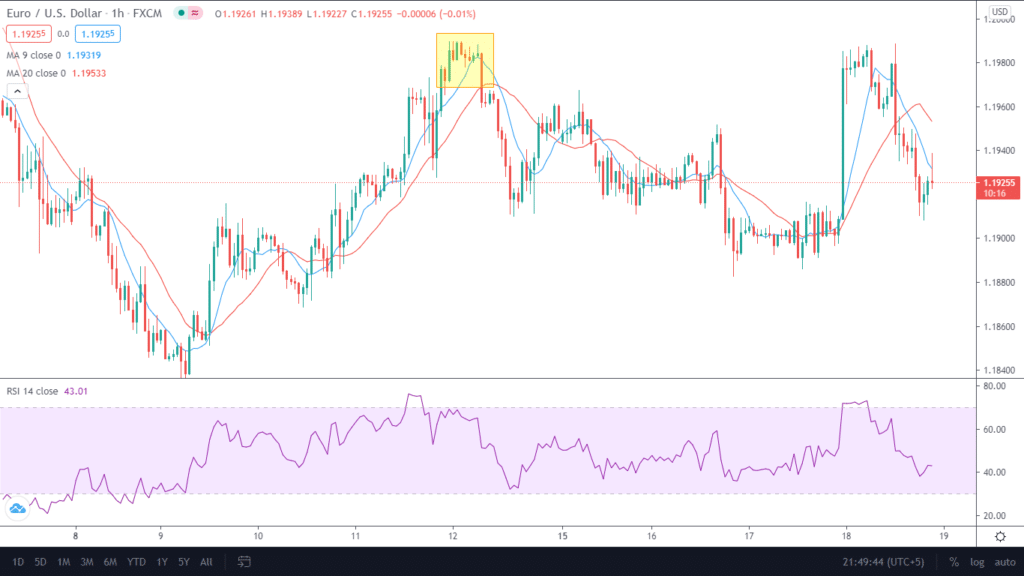

RSI and moving averages

RSI and moving averages go hand in hand with one another for spotting and trading reversals. The strategy is simple enough for any beginner to follow. It involves using the overbought and oversold conditions in the relative strength index and the cross-over in 8 and 20 period SMA.

Image 4. A beautiful setup on the H1 EUR/USD chart with the crossover in moving average coupled with the oversold condition on the RSI. For our settings, we have set the values on RSI as 30 and 70.

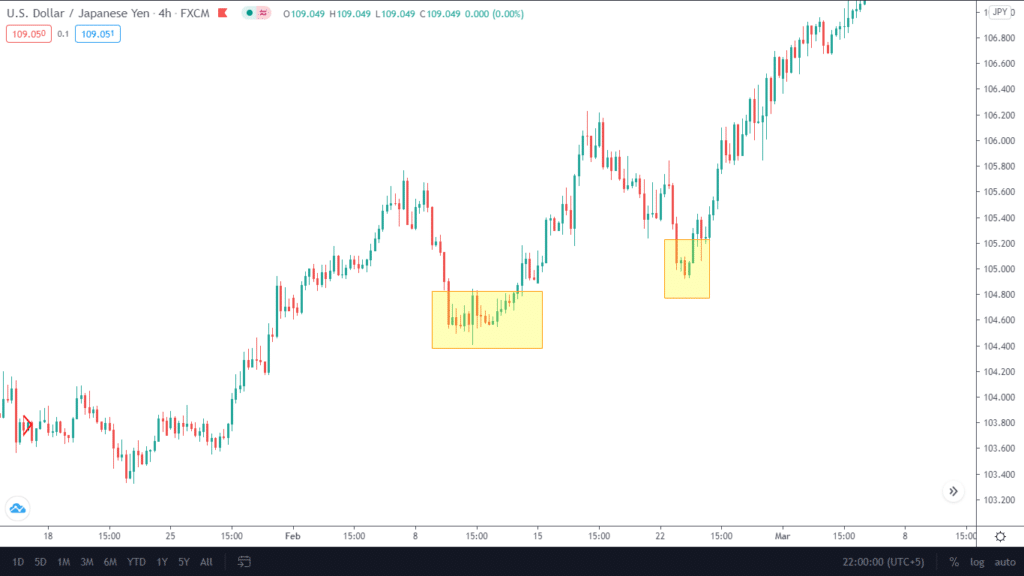

Trend trading

All new traders who learn at big financial institutions are taught that trend is your friend. Trend and momentum are available when the market is moving with full force in one direction. In between, it may stop to take a breather here or there, but investors further capitalize on this opportunity to enter alongside big players. It helps determine the trend on the larger time frames and then uses the lower periods to enter successfully.

Image 5. The H4 chart on USD/JPY indicates a strong trend and momentum in the long direction. As the market comes for pullbacks, traders wait for bullish candles so they can enter the buy-side. The yellow portion highlights the entry points. Let us view them on lower time frames for entry.

Image 6. The H1 chart provides us with entries as we see bullish candles.

Range trading

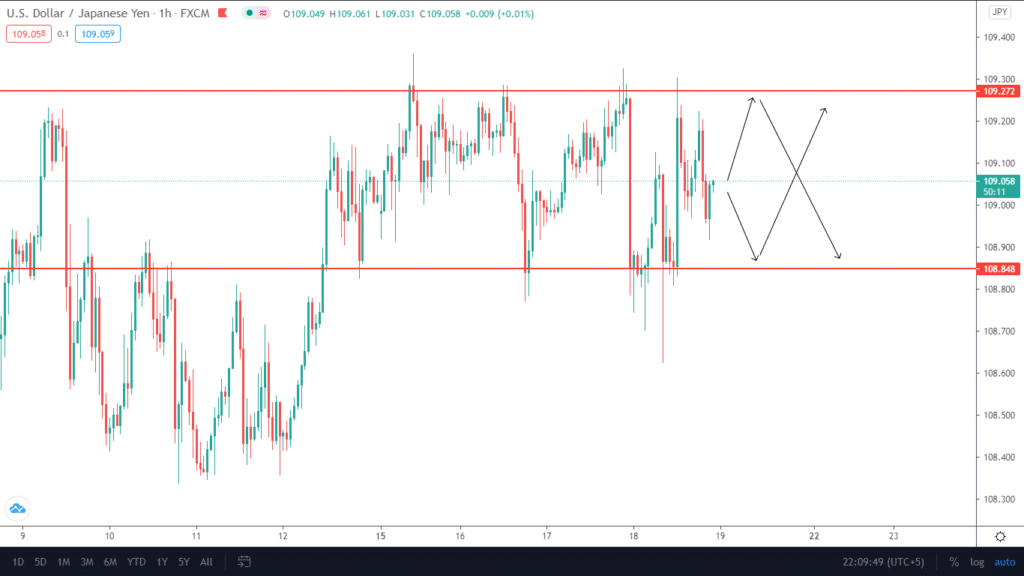

Like chasing trends, you can keep an eye out for the markets ranging between specific support and resistance. Here, the idea is to sell at any resistance and buy at the support level with a stop loss just beneath and take profit at the opposite end.

Image 6. The two red lines represent the specific support and resistance levels. See how the market is constantly fluctuating between the two. Based on the price action, you can see what the future holds.

Important points to consider while day trading

You should consider the following points before beginning to day trade:

- Use the appropriate amount of risk management and only risk capital that you can afford to lose.

- Take a good note of your trading psychology.

- Journal your trades daily. All the top investors have a huge catalog of their daily executions.

- Do not change your trading strategy quite often and trade on a few sets of instruments as beginners—novices who constantly change their style and technique never succeed.

- You must know the entry and exit points of a trade before you even enter. Do not decide to manipulate your stop loss and take profits during a trade.

- Learn from a good trading mentor. A good teacher can help cut down the losing and breakeven period by a significant margin.

- Trade only using reliable brokers. Ensure that top-tier authorities regulate the company you are trading with, as it will reduce the chance of getting double-crossed.

- Avoid systems that promise immense riches.