Successful forex trading boils down to strategy. The most profitable trades are a product of carefully crafted strategies. Whether you are using forex expert advisors or manual trading, strategy guides you towards profits in the market. Important to note, a good strategy is incomplete without the right entry and exit points. These points play a crucial role in the ultimate success of your trading strategy. Just how significant are these points? Read on and get the answer.

What are entry and exit points in forex trading?

The entry point is the price at which a trader takes a position in the market. It must be known that the point at which you enter the market determines the profit potential of the trade. Imperatively, a trader must always avoid trading on emotions. An emotion-led strategy always results in numerous cases of second-guessing. Every second-guessed trade has a higher likelihood of resulting in the loss.

Equally important is the point at which you exit the market. Every successful trading strategy entails enabling the trader to exit the market at the right time. However, emotions could be detrimental if they come into play when looking for an ideal exit price. That is why automated trading is ideal for an emotion-free experience. Here, special algorithms make the buy and sell decision-based on concrete data. It may include insights from both technical and fundamental analyses.

Understanding entry and exit points in forex

Whether it is automated forex trading or manual, the activity entails buying and selling forex products. For example, you may enter the market by selling the USDCHF pair or buying the AUDJPY pair. The decision on whether to buy or to sell a currency pair depends entirely on the product of your analysis. Either way, you take a position in the market through an entry price. Similarly, you exit the market at a specific price that you feel is profitable enough. Nevertheless, traders have to exit their positions sometimes due to the markets moving against them.

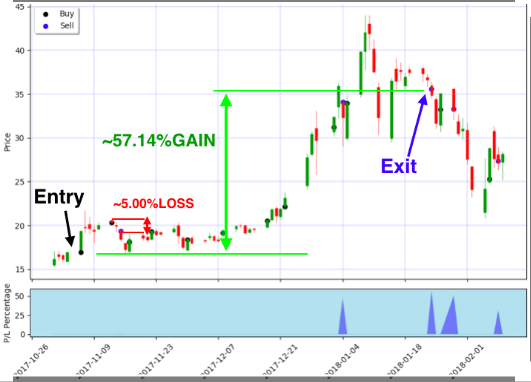

Traders have numerous tools at their disposal to help them devise a trading strategy. Important to note, a trading strategy includes the points at which the trader will enter as well as exit the market. The idea is to keep the distance between these two points as significant as possible. A large difference translates to larger profits and vice versa. For example, forex charting tools are invaluable in technical analysis. They help the trader to identify optimal price targets for optimal profits.

When devising a winning entry strategy, you should consider the following things:

Market trends

Foreign exchange markets follow a certain pattern over time. At any given time, a market could be in a bull trend or a bear trend. All you need to do is to analyze chart patterns as well as conducting fundamental and technical analyses. However, traders are specializing in just one type of market analysis, usually technical analysis.

In trending markets, it is possible to identify the ideal entry point in two ways. First, when there is a short counter-trend move. For example, the market may be in a strong uptrend, but it happens to pull back momentarily. You can use some of the best forex indicators, like moving averages to identify the trend. Complex indicators like Ichimoku charts not only identify the trend but also establish the strength of the trend. Once you establish the short counter-trend move, it is the right time to enter the market.

Secondly, trend trading after a consolidation period. Besides uptrend and downtrend, markets consolidate. Notably, a consolidation period is that which the market moves sideways. During such a period, the market does not take a solid direction.

After careful and in-depth market research, either fundamental or technical, you should be able to anticipate the direction of the market after consolidation. Typically, a period of consolidation is a harbinger of a further deepening of the previous trend.

Range bound markets

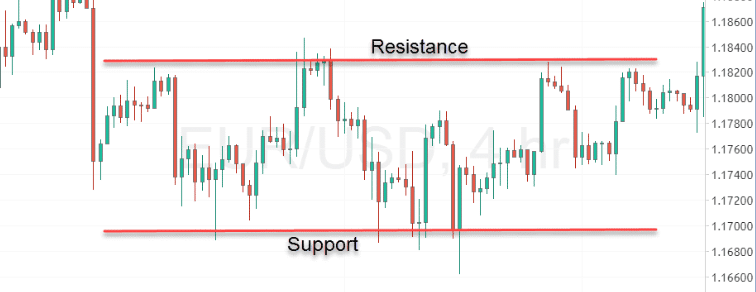

With time, the market might exhibit a certain pattern that is helpful when looking for entry or exit points. For example, a pair of straight lines might join the tops and the troughs of candlestick patterns. That is, the majority of the tops may align to form a resistance level while a majority of the troughs may align to form a support level.

In this case, the ideal entry point for a buy trade will be closer to the support level. It is by the rule of thumb of forex trading; buy low sell high. In a sell trade, the ideal entry point is closer to the resistance level and then exits more intimate to the support level. The idea is to maximize the difference in pips between the entry point and the exit point.

Final thoughts

Successful forex trading depends on the strategy. It is imperative to ensure that the entry point is optimum to increase the chances of a successful trade. Usually, an appropriate entry point leads to bigger pips in return. You will be able to increase the number of pips you earn if the entry price is as far away from the exit price as possible.