- The Euro area’s annual inflation (CPI) rose 2.0% in May 2021.

- The ECB (ECB) cut the long-term refinancing operation (LTRO) by 66.78%, from €330.5 billion to €109.8 billion.

- Japan is set to terminate the emergency (SoE) state on June 20, 2021, one month ahead of the Olympics.

The EUR/JPY traded at a -1.12% price change on June 17, 2021, from the previous day’s close. It opened at 132.76 and hit a low of 131.06.

The euro fell against the Japanese yen after the euro zone’s construction output data for April 2021 (MoM) indicated that it contracted -2.17% against a previous record of 4.14%.

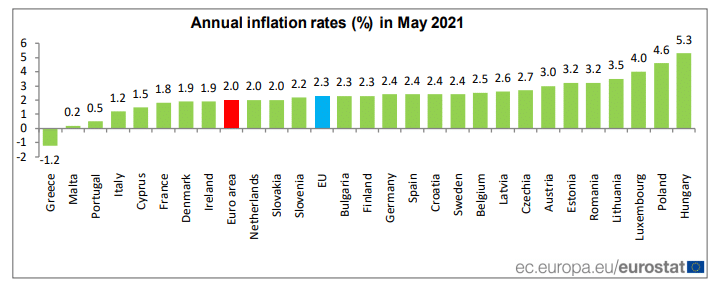

Inflation

May 2021 saw the euro area’s annual inflation (CPI) rose by 2.0% from a previous reading of 1.6%. In the European Union (EU), the yearly inflation gained 2.3% in May 2021 from an earlier reading of 2.0% recorded in April 2021.

EU countries with the lowest annual CPI rates included Greece (-1.2%), Malta (0.2%), while Hungary had the highest CPI at 5.3%.

EU nations annual inflation rates

Energy was the highest contributor to inflation, adding +1.19 % points while services came second at +0.45% points. Industrial products (in the non-energy category) added 0.19% points while food and alcohol contributed +0.15% points.

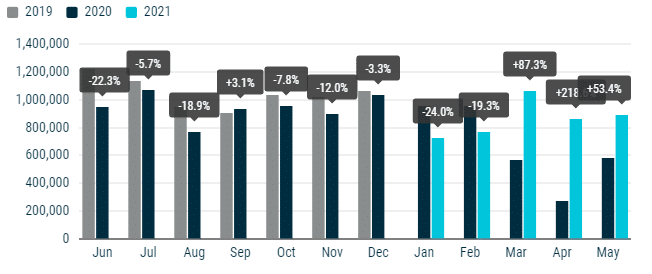

Car registrations

Data from the European Automobile Manufacturers Association (ACEA) showed that there was a 53.4% rise in the EU’s new passenger car registration in May 2021 (YoY).

However, with a total of 891,665 (car) units, it represents a decline of up to 1.2 million cars sold two years ago (pre-pandemic).

EU’s new passenger annual car registrations (2020-2021).

Spain had the largest increase in car registrations at +177.8%, France at +46.4%, while Germany increased by 37.2%.

However, Germany’s numbers represented an annual decline from 90% it registered in 2020. France saw a decline in registration from 568.8% to 46.4% in May 2021 (YoY). In terms of monthly data, Germany’s passenger registrations posted a +0.4% growth from a -21.4% decline in April 2021, while France saw a +0.4% growth from a -23.2% decline in April 2021.

The European Central Bank (ECB) cut the long-term refinancing operation (LTRO) by 66.78% from €330.5 billion to €109.8 billion. This refinancing program matures on June 26, 2024, with the settlement set for June 24, 2021.

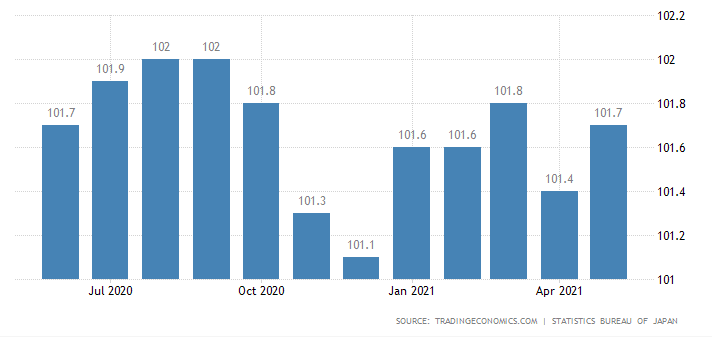

Japan’s CPI

May 2021 saw the Consumer Price Index (CPI) for Japan rise to 101.7 (+0.3 points) from April 2021, where it stood at 101.4.

Japan’s CPI

Food prices increased 0.4% (MoM) but fell -0.9% YoY at 104.9. Housing prices surged 0.6% YoY but stagnated at 0.0 MoM. Prices of furniture and household accessories recorded the highest annual growth at 2.1%, with the monthly change at 0.1%.

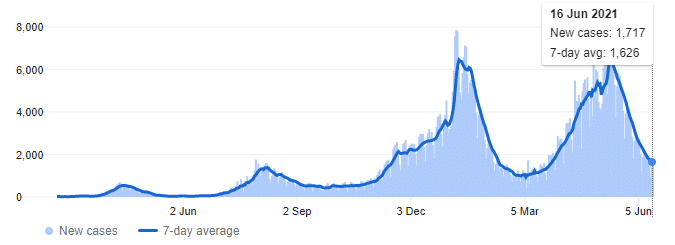

Ending the state of emergency

The Japanese yen has also reacted positively to the announcement that the government will terminate the emergency (SoE) state on June 20, 2021, ahead of the Olympics. The SoE had affected significant states such as Tokyo and Osaka, which are integral in hosting the summer games.

Japan’s Covid-19 cases

Out of the 27.7 million doses issued, about 7.63 million people are fully vaccinated (representing a population of 6.0%). Thus, at least 15.9% of the Japanese people had received the Covid-19 jab as of June 16, 2021.

New infections/cases had declined 73.03% from May 13, 2021 at 6,367 to 1,717 cases on June 16, 2021. The 7-day average has also dropped 74.69% over the same period.

Technical analysis

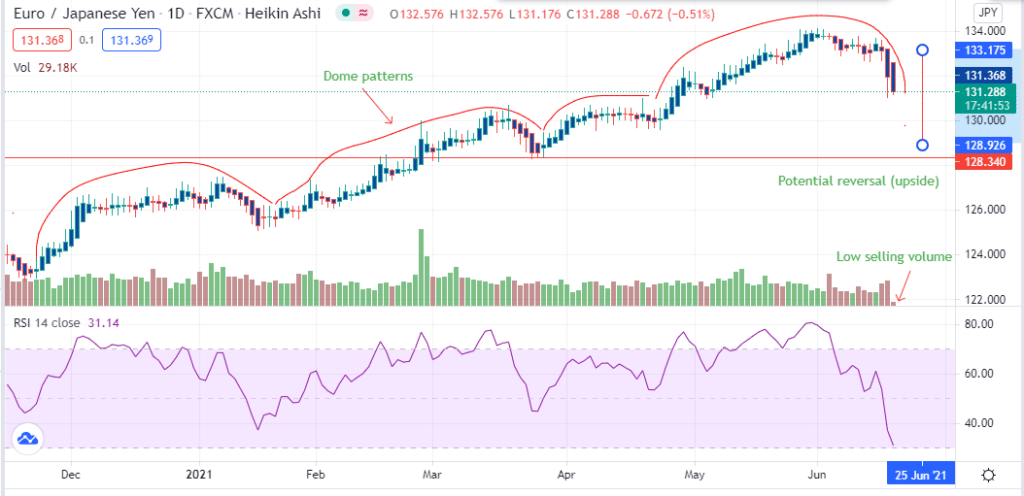

The EUR/JPY, while currently declining, is likely to rebound up due to the low volume among sellers.

EUR/JPY trading chart

In response to the dome pattern movements, the EUR/JPY may seek an upward move towards the 133.175 level before it crosses 134.000. However, we may still see a decrease to 128.926 if the potential bullish reversal fails.