We Like:

- Minimum deposit of $1

- Meager spreads starting from 0.0 pips

- A renowned broker with over ten years of experience

- A spectrum of payment options

- Cushions against negative balance

- Has no hidden fees

- Holds an international license from the IFSC of Belize

- Offers nonstop customer support

- No inactivity fees

- Exceptional educational resources

- Availability of social/ copy trading for investors

- Reliable trading tools, e.g., FX calculators

We Don’t Like:

- FBS does not accept traders from the USA, UK, and other regions

- Trading conditions depend on the account type, and some clients may miss out as the minimum deposit is capped a bit higher on those accounts

- A couple of payment options may charge a transaction fee

- Not regulated by elite agencies such as FCA

The Verdict:

FBS is an online forex and CFDs brokerage company that made its debut in the financial space a decade-plus ago. It boasts serving millions of traders from 150+ countries across the globe with razor-sharp spreads, lightning-fast executions, and wide leverage on its asset classes.

The broker offers variable and fixed spreads as depicted through the account types and confirms that the floating spreads start from as low as 0.0 pips. In addition, the leverage extends up to 1:3000, but it also depends on the account type. As some traders only access leverage of up to 1:1000 to curb them from major risks.

The broker also discloses to leverage ECN and STP technologies that give it the tools needed to provide speedy and market executions. The broker claims that 95% of its orders execute in under 0.4 seconds. Moreover, FBS asserts to operate under a legit regulatory framework bolstered by agencies such as the ASIC, CySEC, and the IFSC of Belize.

Company details

Internationally legalized brokerage company FBS launched in 2009 to transform the financial industry landscape with a state-of-the-art online liquidity provider platform. It focused on implementing ECN and STP technologies to provide market order executions and meager spreads. The forex and CFDs provider expanded and diversified its products and services to catch this goal with time.

Currently, it discloses to run an array of offices across the world and holds multiple awards in its trophy cabinet. It also serves over 17 million active clients from more than 150 countries and has inked a partnership deal with 410K organizations. The meager floating spreads starting from 0.0 pips and low fixed spreads are key to the company’s colossal client network.

However, other features such as a $1 minimum deposit, no inactivity fees, negative balance protection, leverage of up to 1:3000 give traction to its milestones. In addition, clients have access to a wide range of markets and incentives like a $100 welcome bonus.

FBS range of markets include:

- Forex pairs

- Commodities products

- Indices

- Stocks

- Cryptocurrencies

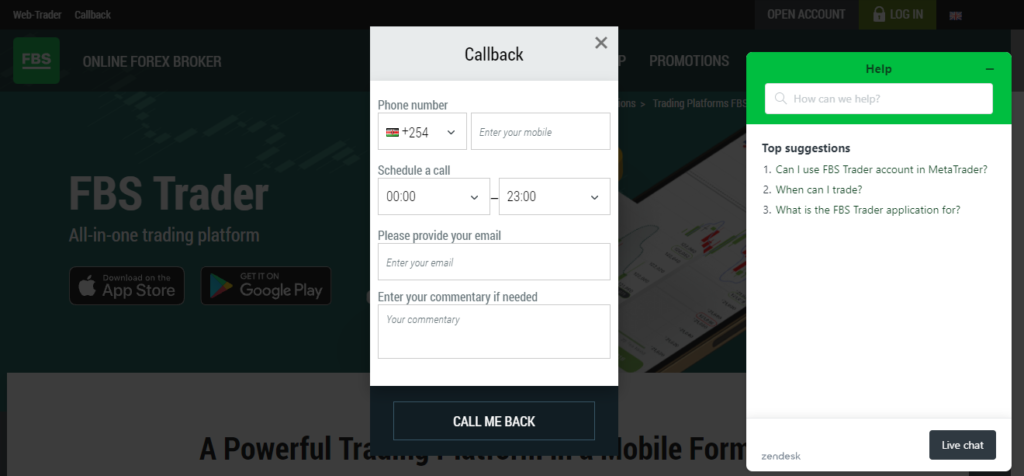

Trading is aided by 24/7 multilingual customer support that helps traders validate their transactions on top of solving their problems. The broker also claims that the traders have access to powerful trading platforms and can apply all strategies with no requotes. It provides the braced MetaQuote’s software platforms – MT4 and MT5 and its newly rolled out trading app, FBS trader. The trading platforms integrate with powerful tools and plugins making it easy to speculate FBS assets. Nonetheless, clients can copy-trade using embedded copy trading software as signal providers or followers.

Integrated trading tools and features

- Economic calendar

- Forex calculators

- Currency converters

- Forex news

- Daily market analysis

- VIP analytics

Although, before putting the tools into action, traders must fund their selected account type with the required monetary size. FBS covers deposit and withdrawal fees for clients, but it also depends on the payment option used. Some funding and withdrawal methods charge a transaction fee outside the broker’s fees and commissions bracket. The account types come with varying trading conditions tailored to the criteria of clients. As a result, the minimum deposit is capped at $1 for some accounts and increased to $1000 on other accounts.

The payment options include:

- E-wallets like Skrill and Neteller

- Bank cards like Visa

- Wire transfers

- Perfect Money

- Local exchanges

Regulations

- FBS Markets Inc. is internationally registered and regulated by the IFSC of Belize. License No. IFSC/000102/198.

- The broker also holds regulatory licenses from the ASIC and CySEC.

Trading platforms

Trade with powerful platforms at FBS fueled with cutting-edge tools to provide low latency and meager floating spreads. As briefly introduced, the broker offers two leading trading platforms coupled with its recently launched trading app.

They include:

- MetaTrader 4 (all terminals including on the Web and desktop)

- MetaTrader 5 (all terminals including on the Web and desktop)

- The FBS trader (via the Android and IOS terminals)

Analysis of the platforms

MT4

- Possibility to create, buy, and use expert advisors (EA) and scripts

- One-click trading and embedded news

- Four types of pending orders

- VPS service support

- Hedging positions

- Technical analysis tools: 50 indicators and charting tools

- Encryption of data exchange between the client terminal and the platform servers

MT5

- Expanded options to create technical indicators, trading robots, and utility applications

- Technical analysis tools: 90 indicators and charting tools

- One-click trading and embedded news

- Six types of pending orders

- Economic calendar

- Hedging positions

- 21 time frames

- VPS service support

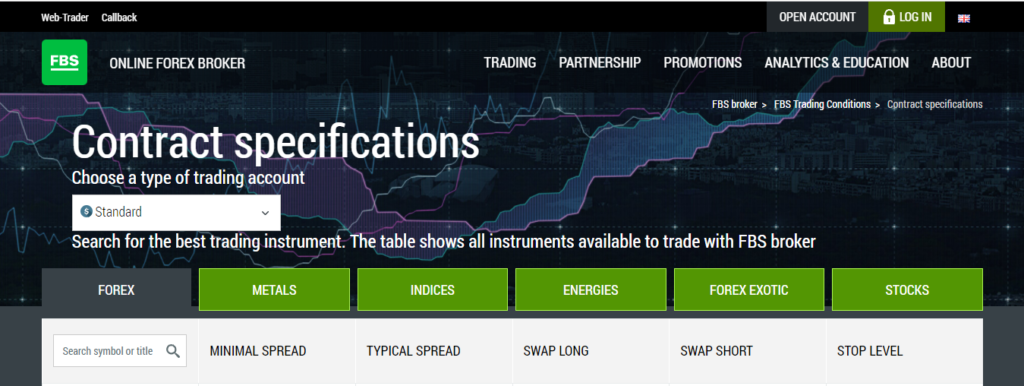

Range of markets

The broker offers traders a wide range of markets that yield multiple instruments. They speculate the instruments as forex and CFDs, giving them the ability to diversify their portfolios. The broker allows traders to swap long and short on CFD products. As a result, clients have the hedge even when the markets slump. A spectrum of its assets includes FX crosses, cryptocurrencies, commodities, among other asset classes.

Forex

The foreign exchange market supports a spectrum of currency pairs encompassing majors, minors, and exotics. It trades 24/5 with ultra-fast executions, low latency, and floating spreads starting from 0.0 pips.

The fixed spread is capped low, although the account type or the currency determines the typical spread of the currency pair. About seven base currencies across the FBS FX pairs trade, and the leverage goes up to 1:3000.

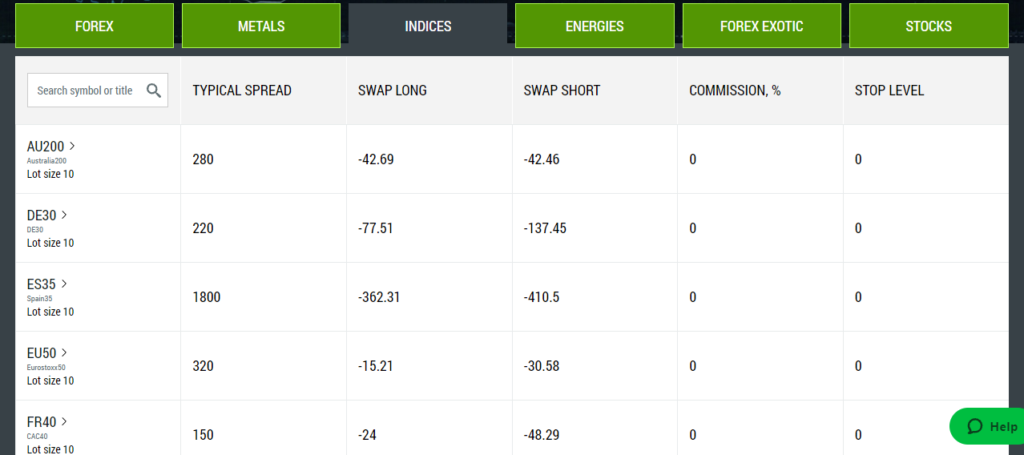

Indices

The broker deals with various indices such as US100, US500, and AU200 that clients speculate as CFDs by swapping long as short. These instruments trade with zero commission and a lot size of up to ten. The indices market is also backed by customer support that operates in real-time.

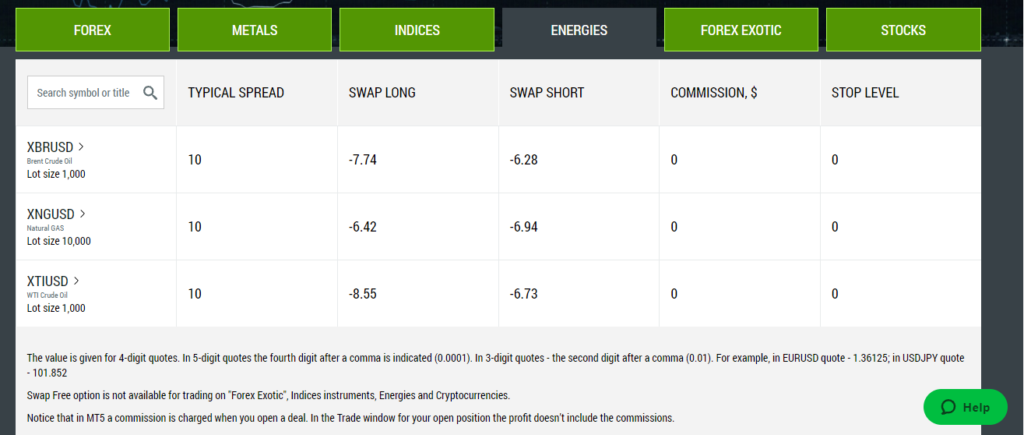

Energies

FBS energies include products like natural gas, brent crude oil, and WTI crude oil. These instruments trade 24/5 as CFDs. Meaning traders only swap long and short and do not own the underlying asset. They also trade with ultra-fast executions and zero commissions. Natural gas trades with a lot size of up to 10,000 while the other assets’ lot size is only up to 1000.

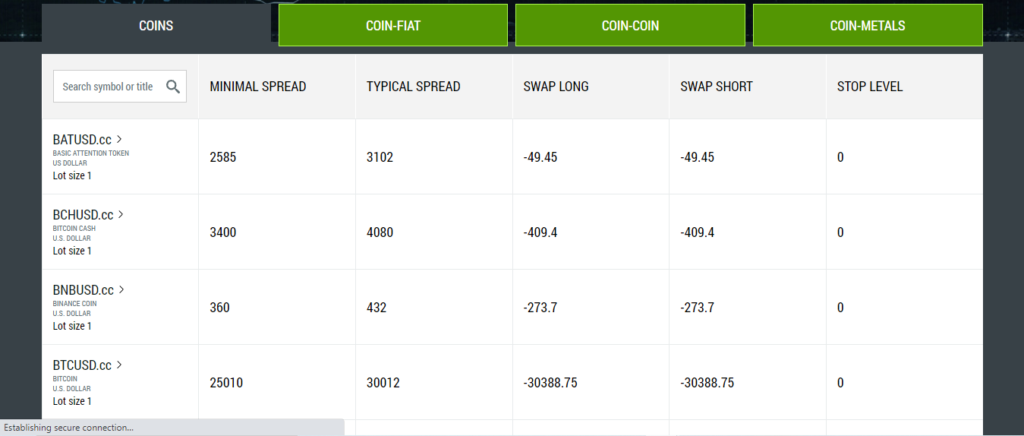

Cryptocurrencies

Many currencies, including BTC, Ethereum, Litecoin, Dash, and EOS, are available for customers to explore in the crypto marketplace. These currencies are highly volatile. Thus, clients speculate on their prices 24/7.

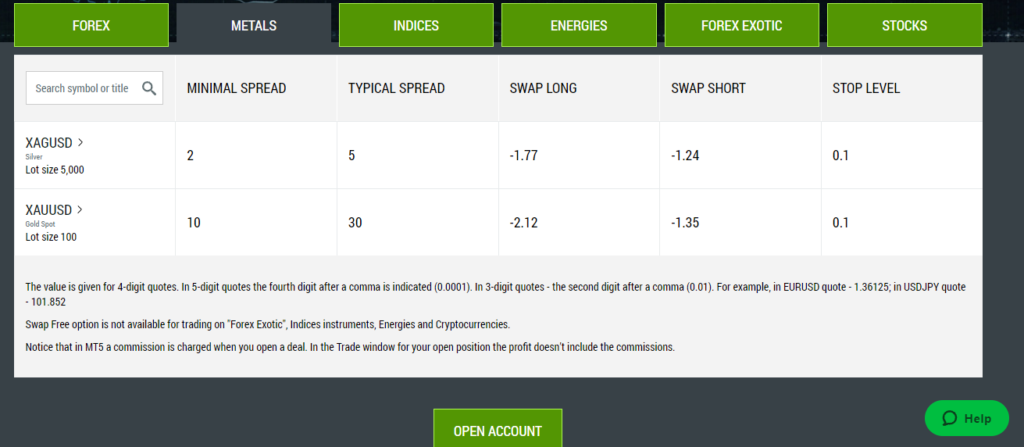

Precious metals

The broker provides a platform where clients can explore some of the most valuable metals globally, like gold and silver. Traders speculate these assets as CFDs throughout weekdays with a spread starting from two pips for silver and ten pips for gold.

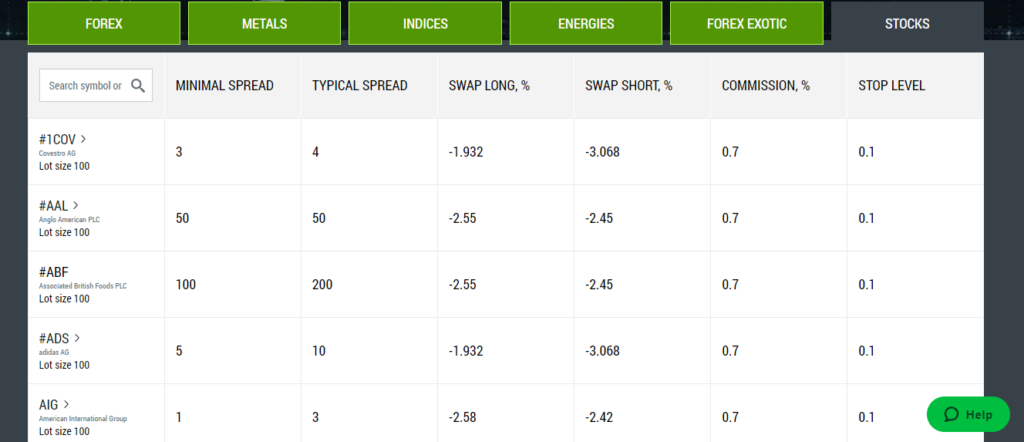

Stock

The FBS stock market also trades all through the weekdays, and it holds stocks from major worldwide companies such as Apple, Amazon, Alibaba, and many more. Customers are given a 0.7% commission on all stock instruments, and they can also swap log and short.

Main features

After unpacking most of the broker’s information, it’s correct to say that we have some knowledge about FBS products and services. FBS currently confirms to have about 17 million active traders from more than 150 countries. But what fuels its milestones? So what are its main features?

- Market order executions — FBS leverages ECN and STP technology for market order executions with no requotes.

- 24/7 Multilingual customer support — traders interact with qualified customer support in real-time.

- Legalized internationally — the broker holds an international regulatory license from the IFSC of Belize and also holds other regulatory licenses from ASIC and CySEC.

- Offers meager floating and fixed spreads — FBS floating spreads start from 0.0 pips, and fixed spreads capped at three pips.

- Powerful trading tools — traders have access to cutting-edge trading tools integrated with the broker’s trading platforms. Such tools include FX calculators, currency converters, and many others.

- Multiple payment options — due to its international status, FBS provides diverse payment options to suit its worldwide client base.

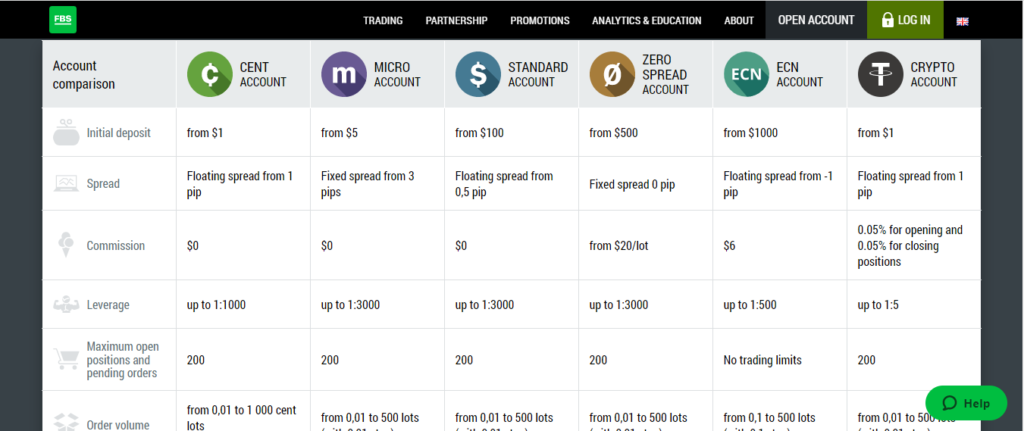

Types of trading accounts

The company has several account types that have been put in place to serve specific customers. The account types include:

- Standard account

- Cent account

- Micro account

- Zero spread account

- ECN account

- Crypto account

Account type analysis

The standard account

- The min. deposit allowed for this account is usually $100

- Spread starts from 0.5 pips

- Leverage of up to 1:3000

- The min. trade size is 0.01 lot

- Allows zero commission

- The maximum number of pending orders and opening positions is 200

- Offers ultra-fast market execution of 0.3 seconds, STP

The cent account

- The min. deposit is $1

- The least trade size lot is 0.01

- Zero commission

- Offers a leverage of up to 1:1000

- The spreads start from 1 pip

- The maximum number of open positions and pending orders allowed is 200

- 0.3 seconds, STP fast market execution

- The order volume ranges from 0.01-1000 cents lots with step 0.01

Micro account

- $5 min. deposit

- Offers a leverage of up to 1:3000

- The min. trade lot size is 0.01

- Spreads start from three pips

- Commission allowable is usually $0

- The order volume ranges from 0.01-500 slots with step 0.01

- The market execution speed starts from 0.3 seconds, STP

Zero spread account

- It allows a min. trade account deposit of $500

- The spreads are fixed from 0.0 pips

- 0.01 is the min. trade size

- The leverage level is up to 1:3000

- The maximum pending orders and opening positions allowed are 200

- The market execution is 0.3 seconds STP

- With step 0.01, the order volume ranges from 0.01 to 500 lots

- Face a commission of $20 per lot

ECN account

- The min. amount that you can deposit is $1000

- A min. trade lot size of 0.01 lot

- Leverage — up to 1:3000

- Floating spreads from — 1 pip

- Offers a commission of $6

- No trading limits are given; thus the number of open positions and pending orders are not fixed

- Gives an order volume from — 0.1 to 500 lots (with a 0.1 step)

- Market execution — ECN

Crypto account

- The min. deposit required for this account is $1

- The min. trade size is 0.01 lot

- Offers a leverage of up to 1:5

- Starting spread — 1 pip

- Gives a commission of 0.05% for pending and 0.5% for closing positions

- An order volume that starts from 0.01-500 slots with 0.01 step

- The maximum number of pending orders and open positions allowed is 200

Opening an account at FBS

The account opening process is a relatively fast and easy one, and the steps involved include:

Step 1. Ensure that you log into the broker’s official website and press the “open account button.”

Step 2. Key in your details on the form that will pop up on your display screen.

Step 3. Select the desired account type.

Step 4. Make sure that you verify your email and the documents required.

Step 5. Make the required deposit.

Step 6. Start trading.

Commissions and spreads

Commissions and spreads applicable to traders depend on the account type. A client might select the zero spread account looking to evade feed added on the market spread but pay a $20 commission per lot. The ECN account traders also benefit from meager spreads but incur $6. At the same time, other clients incur fees added to the market spread with the fixed spreads starting from one pip and three pips.

Customer service

FBS clients benefit from real-time customer support as the broker claims to provide a 24/7 multilingual qualified support team. Clients can contact the team via the live chat button, email, and phone number. In addition, customers have access to a sophisticated educational platform that comes in handy to novice traders. The platforms hold educational materials like webinars, video lessons, and a lot more.

FBS Review

What we liked

- An array of payment options that customers can choose from

- Reputable and well-regulated broker with experience in the financial trading arena

- Absence of any hidden fees

- Powerful trading platforms integrated with plugins

- Around the clock customer support

- Tight spreads starting from as low as 0 pip

- Negative balance protection

- Educational resources

- Easy account opening process

What we disliked

- High trading commissions

- Some conditions only favor a spectrum of clients

- Top-tier brokers like the FCA do not regulate it

- Does not offer services in the UK and USA

The bottom line

Forex and CFDs liquidity provider FBS proves to be a legit broker to all sorts of traders. The brokerage company offers a wide range of assets that traders speculate with meager spreads starting from 0.0 pips, ultra-fast executions, and leverage of up to 1:3000.

Moreover, the minimum spread is capped at $1. As a result, FBS suits all levels of traders. However, its drawback comes when trading using the No Dealing Desk account types, as clients incur commissions up to $20. In addition, some of its payment options hike a transaction fee, which may be daunting to some traders.